The arrival of the digital age has created higher customer expectations. Today’s customer expects whatever organization they’re interacting with, no matter what the industry, to provide a seamless, efficient, omni-channel experience.

The majority of large retail and investment banks were early adopters of digital strategies which allowed them to be some of the first organizations to digitally transform themselves and keep pace with customer expectations.

The same can’t be said for the insurance industry.

Source: Forbes

The rate of digital adoption in the world of insurance is decidedly mixed.

At some insurers the process of digital transformation is underway, but their programs aren’t delivering as well as they need to, while other insurance organizations are still at the infancy of their digital journey trying to nail down what their transformation approach will be.

Without question insurers must evolve and reinvent themselves to remain competitive, but they better hurry. Today’s digitally-empowered customer isn’t patient enough to wait for their current insurance company to play catch up…especially when it comes to the claims process.

Disruption is real: insurers who refuse to change, risk being left behind

As any insurance professional knows the claims process can be the make it or break it moment in the relationship a customer has with your insurance organization.

According to a survey conducted by Accenture, 83% of customers who were not satisfied with the way their insurance claim was handled said they had switched or planned to switch to another insurer.

Source: Forbes

The adoption of an organization-wide digital approach will allow insurers to do both. Their customers will be able to submit and follow up on their claims more quickly and conveniently through digital channels, something 61% of customers surveyed by Accenture said they want to be able to do.

Cloud-based solutions allow even small- to mid-sized insurers to go digital

At one time, lack of resources to invest in new technologies might have been a reason to delay or ignore the need to embrace a company-wide digital transformation, but times have changed.

Cloud-based, end-to-end customer communications management (CCM) solutions have made it possible for even small- to mid-sized insurance organizations to make the transition to digital while still respecting their budgetary requirements.

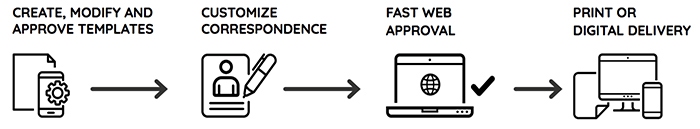

By managing their claims and claims follow up in the cloud, insurers of any size can create, approve and deliver regulatory-compliant, accurate and personalized claim correspondence to customers, across whatever channel they wish, with less reliance upon IT.

The leading CCMs are designed for simple implementation. The best ones are plug-and-play solutions that integrate seamlessly with your cloud-based or on-premise claims system, enabling you to get started right away.

Source: Quadient Correspondence “Manage Claims Correspondence, in the Cloud” brochure.

Another customary feature of most CCMs is that they include a selection of the most commonly used claims correspondence templates. Of course, you can also create your own templates, usually in less than an hour.

Your IT department will appreciate a CCM solution as well, since they won’t have to worry about ongoing IT maintenance. All software upgrades are performed by the solution provider and executed seamlessly in the cloud.

Claims is the most expensive and important customer interaction opportunity you have as an insurer. With a CCM in place, you will have the solution you need to deliver an efficient, consistent, convenient claims correspondence that will inspire customer appreciation, loyalty and referrals.