Here are 20 key statistics that show how accounts payable (AP) is changing in 2025. They highlight how companies are using automation to handle invoices faster and are able to reduce manual tasks and prevent errors. AP automation platforms are also allowing businesses to pay their suppliers on time which improves relationships. With AI and modern payment technologies, AP is becoming a more strategic part of finance.

AP automation market overview

AP automation keeps growing. Businesses want faster, easier ways to handle invoices. They also want safer and more reliable payments.

1. The global AP automation market is estimated to represent USD 6.17 billion in 2025 and is expected to reach about USD 11.17 billion by 2030.

2. Banking, financial services, and insurance (BFSI) accounts for 24% of global AP automation spending in 2025, representing the largest share of any industry.

3. More than 80% of finance leaders say accelerating AP automation is a key part of their digital transformation plans for 2025, speed is a clear priority.

AP efficiency and process performance

As invoice volumes go up, companies care more about speed and accuracy.They also want fewer errors and lower costs.

4. The average AP department takes about 9.2 days to process a single invoice from receipt to payment, close to two weeks.

5. It costs around USD 9.40 to process one invoice manually.

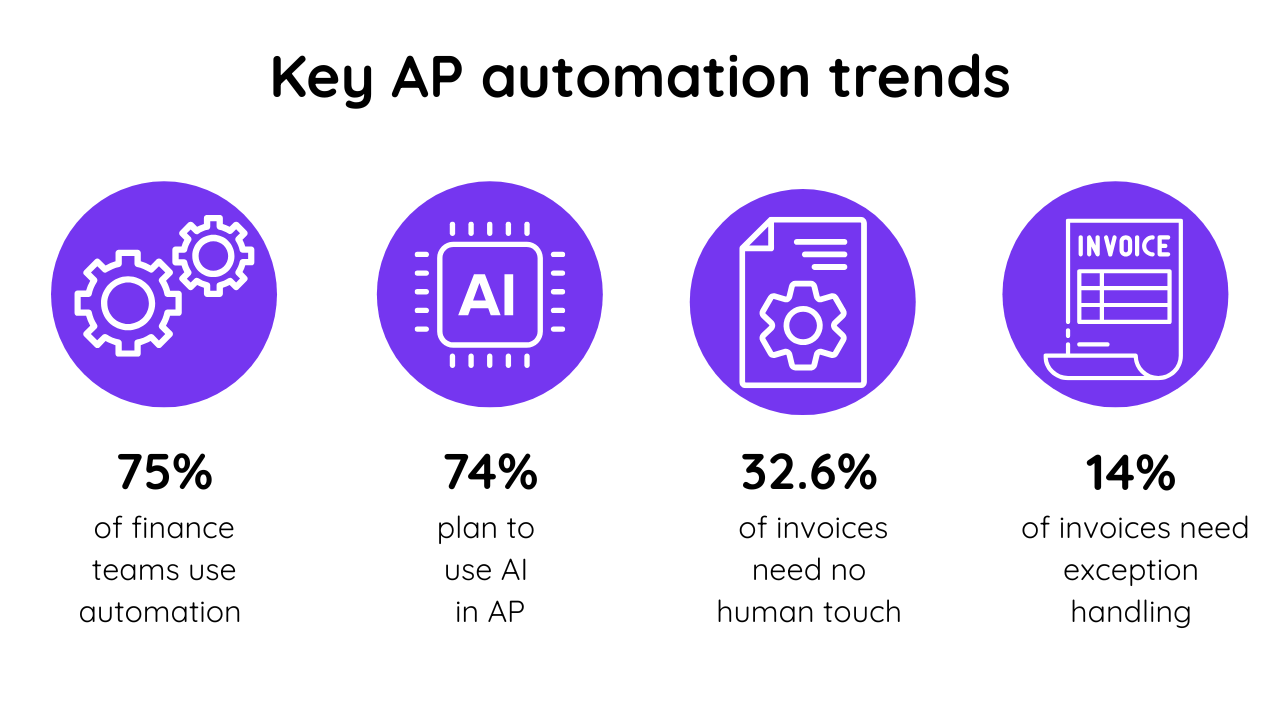

6. 14% of invoices require exception handling because of errors or missing data.

7. Only 32.6% of invoices are processed without any human intervention.

8. AP teams spend 21.8% of their time responding to supplier questions about invoices and payments.

Technology, automation, and AI in AP

AI and automation are becoming important tools for modern AP departments.

9. 62% of organizations adopt AP automation to reduce manual errors and improve processing speed.

10. 48% of AP leaders list automation as their top priority for 2025.

11. 74% of AP departments plan to use AI in their AP processes.

12. 70% of AP leaders expect 2025 to be one of the most challenging years for AP, driven by rapid change, uncertain economic times and higher expectations.

13. 68.3% of enterprise payments are now conducted through electronic methods (ACH, virtual cards, etc.) rather than paper checks.

14. Best-in-class teams spend only $2.78 to process an invoice, compared with $12.88 in average for other organizations.

15. Leading AP teams complete invoice cycles in 3.1 days, compared with 17.4 days in average for other organizations.

16. Best-in-class organizations attain 49.2% touchless invoice processing, nearly double the average rate.

Risk, fraud, and supplier relationships

Stronger controls and better supplier experiences are top priorities for finance leaders.

17. 53% of AP teams say invoice exceptions are their biggest challenge in AP operations.

18. 29% of AP leaders say fraud risk remains a major challenge in 2025.

19. 65% of AP teams now partner with their treasury department to guide cash flow and payment timing decisions.

20. Best-in-class AP teams spend 13.4% of their time on supplier inquiries, compared to 26.9% for others.

What this means for AP in 2025

Accounts payable is changing quickly, driven by digital payments, AI, technology advances and automation. Companies that invest in modern AP tools are reducing costs, removing manual processes, and improving supplier satisfaction, while strengthening their financial operations altogether.

As more organizations prioritize automation and more technologically-advanced workflows, AP is evolving from a back-office function into a strategic contributor. With a clear impact on cash flow management, compliance, as well as business resilience. The vision is clear: AP automation has become critical for finance teams aiming to excel in 2025 and beyond as technology has matured.

Frequently Asked Questions

What is accounts payable automation?

Accounts payable automation uses software to handle invoices and payments. It captures invoice data. It sends invoices to the right people for approval. It matches invoices to purchase orders. It then processes the payment.

How does AP automation save money?

Automation lowers invoice-processing costs by reducing labor-intensive work and errors. Fewer manual touches mean less time spent per invoice and fewer mistakes – which cuts down on rework, late fees, and missed discounts.

Why is AI becoming important in AP?

AI helps AP teams work smarter. For example, AI-based data capture can automatically read invoices, machine learning can predict and flag exceptions or fraud, and intelligent workflows can route invoices to the correct approver. These capabilities reduce manual effort and improve accuracy.

What is “touchless” invoice processing?

“Touchless” processing means an invoice goes from receipt to approval without any human intervention. Invoices are automatically captured, matched, approved, and even scheduled for payment by the system, unless an exception occurs.

How does AP automation improve supplier relationships?

It ensures suppliers are paid accurately and on time. Automation provides suppliers with greater visibility (for instance, through supplier portals that show invoice and payment status) and reduces errors that could lead to payment disputes. This transparency and reliability make suppliers happier and strengthen the relationship.

Which AP processes are usually automated first?

Most companies start by automating invoice data capture, approval workflows, and electronic payments. These areas tend to yield fast results: invoices get into the system quicker, approvals move faster electronically, and digital payments simplify the payout process.

Does AP automation reduce fraud?

Yes, it can. Automated AP systems include controls like duplicate invoice checks, verification of supplier bank details, and audit trails for approvals. These features help prevent typical fraud schemes and make it easier to catch irregularities. Automation also enforces the separation of duties and other compliance rules that mitigate fraud risk.

What size companies benefit from AP automation?

Mid-size and large organizations see the fastest ROI from AP automation because of their invoice volumes, but small companies also benefit as they grow. Automation scales with the business – the more invoices you process, the greater the time and cost savings automation delivers.

Will automation replace AP teams?

No, it changes their work rather than replacing them. Automation takes over the repetitive, low-value tasks (like data entry or chasing approvals). AP staff are still needed to handle exceptions, manage supplier relationships, ensure compliance, and analyze AP data. In fact, by freeing them from manual tasks, automation allows AP professionals to focus on higher-value activities that require judgment and experience.

Is AP automation hard to implement?

Modern AP automation solutions are increasingly user-friendly and integrate with common ERP systems. While there is a project involved in setup and training, many providers offer cloud-based platforms that minimize IT effort. Starting with a pilot or phased rollout (for example, automating one part of the process first) can help build confidence and demonstrate value, making full implementation easier.