Try our self-guided dashboard and reporting demo!

Streamline reporting with AR Analytics

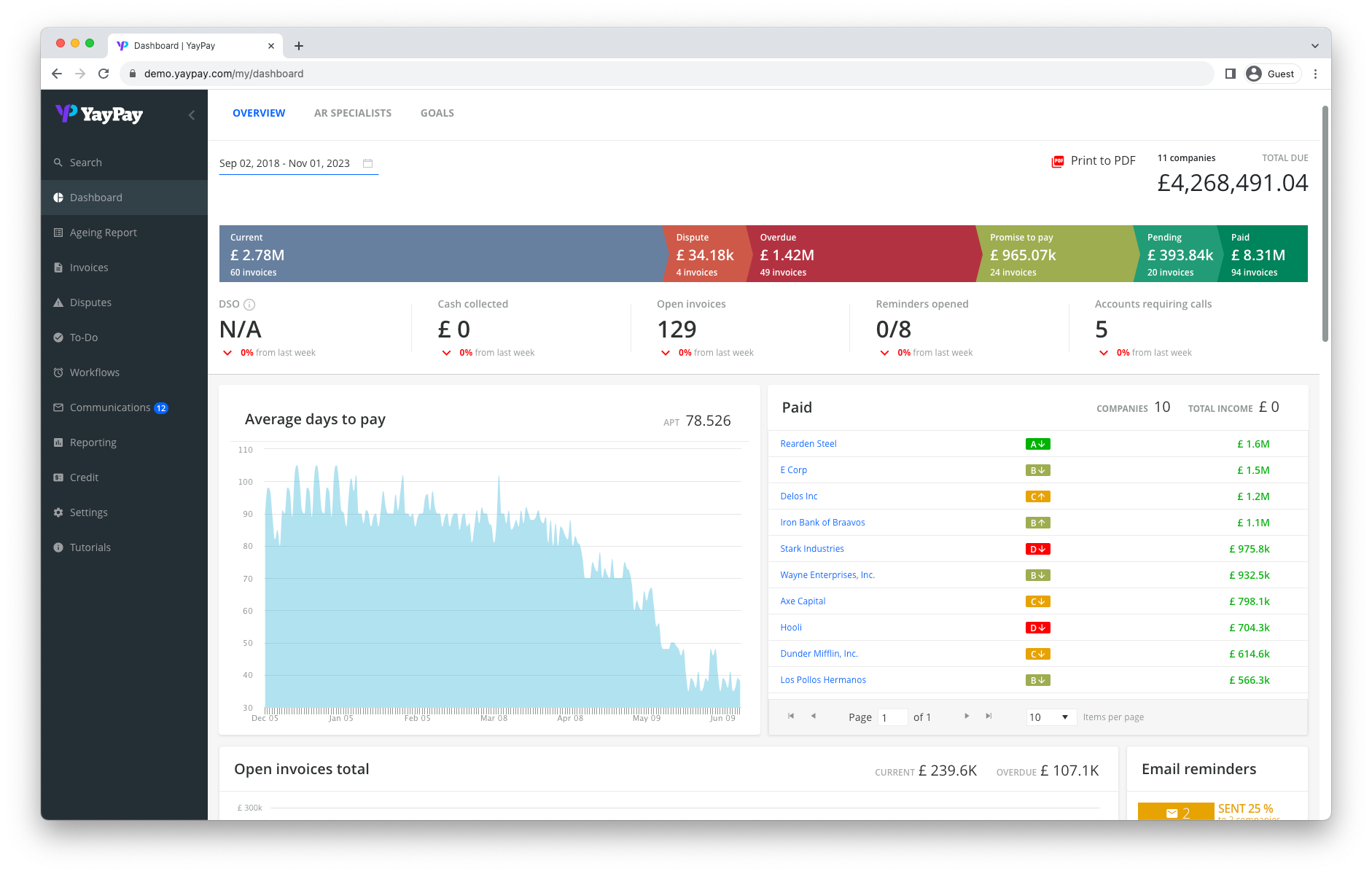

Gain full visibility into your receivable processes through our robust dashboard. Real-time aging reports, live Days Sales Outstanding (DSO) tracking, and customizable views offer valuable insights into key metrics like outstanding invoices, overdue accounts, and collection workflows and effectiveness. With this level of clarity, your team can reduce bad debt, improve collection rates, and maintain a healthy cash flow.

AI-powered insights

- AR Managers: Prioritize collection strategy by predicting payer behavior and reducing overdue payments over time.

- Controllers: Improve cash flow management with up to 94% forecast accuracy and strengthen the balance sheet.

- Finance teams: Minimize outstanding payments and boost visibility into the receivables process.

What can you do with the AR analytics suite

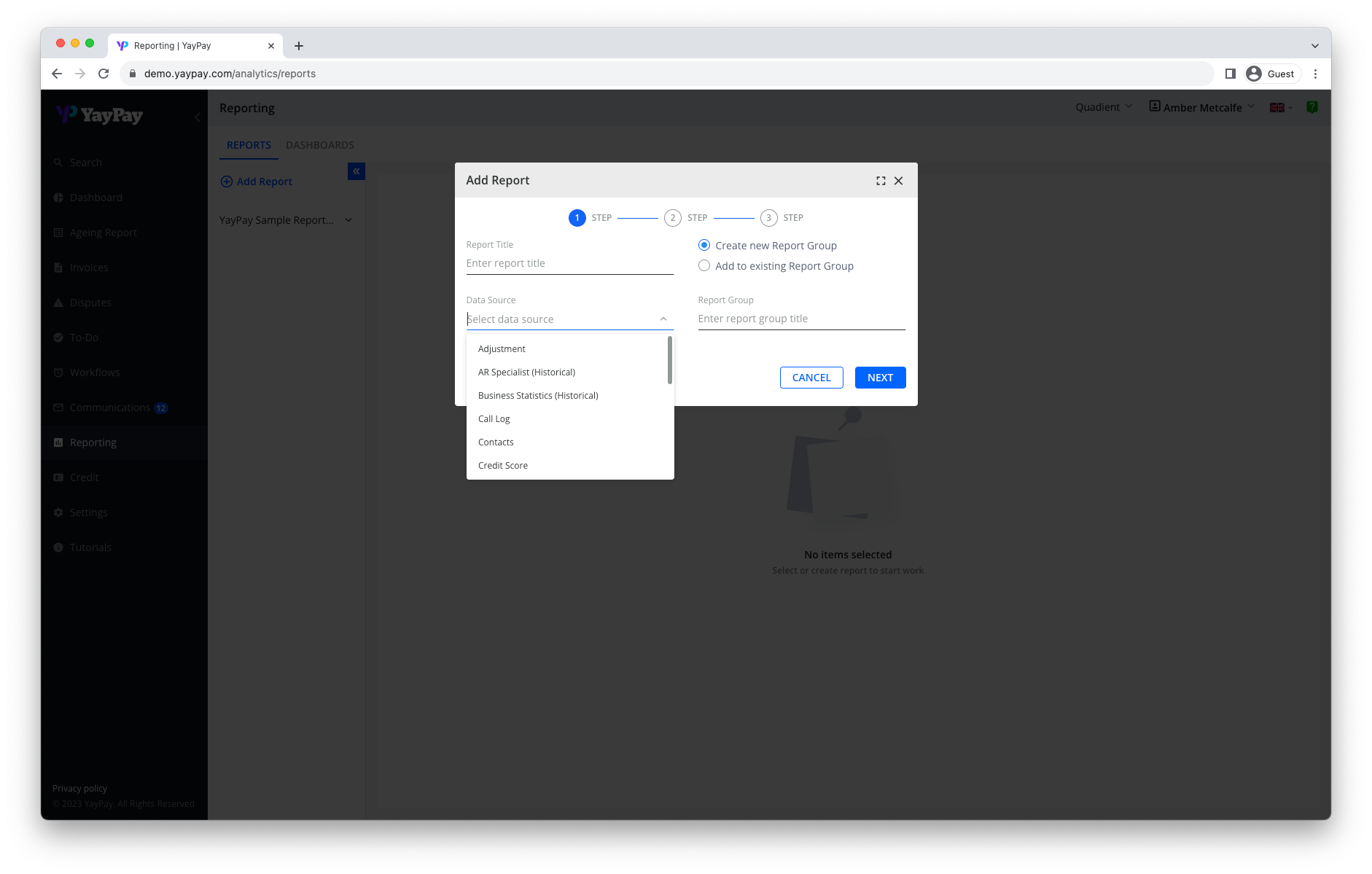

Report on any accounts receivable datapoint with seamless AR integrations for any ERP, accounting software, or financial system. Optimize and improve your receivable processes with AR automation designed for modern B2B finance teams.

What’s included in the AR analytics suite

Aging reports

Filter by aging buckets to analyze overdue payments and outstanding invoices.

DSO/Average days to pay

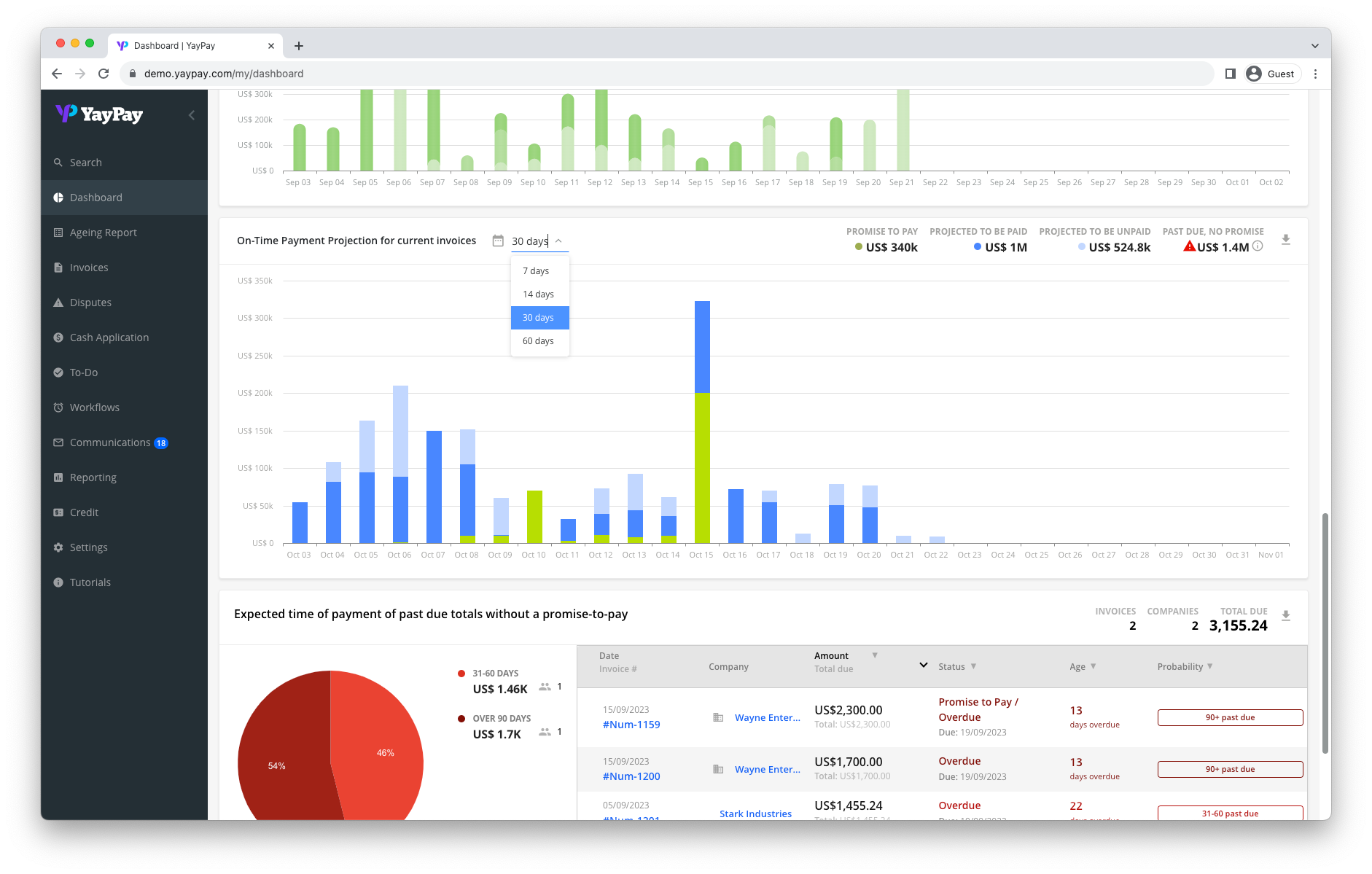

Cash flow forecasting

Forecast with 94% accuracy to support proactive cash flow management.

Payer behavior analytics

Use customer grading to gain insights into which customers are likely to pay on time or make late payments.

Credit scorecards

Build detailed profiles to support smarter credit decisions and limit setting.

Anything else you can imagine

Report on any other AR data point you can possibly think of to create valuable insights.

Quadient AR's reporting and customer communication capabilities have made a big difference. Our AR has become more transparent, making it easier for me and my team to understand the exact state of our accounts.

Accounts Receivable Analytics Frequently Asked Questions

Featured resources

Trusted by finance teams across manufacturing, SaaS, logistics, and more.