Most modern finance teams are being asked to do more with less as economic uncertainty lingers. Teams try to move faster, follow the rules, and keep costs under control, all at the same time.

Financial automation can help. New platforms allow teams to delegate a lot of the repetitive work. Adoption means cutting down on mistakes and making the entire finance function run in a steadier and more predictable way.

When we talk about finance automation, we mean using software to handle everyday tasks such as invoicing, accounts payable (AP), accounts receivable (AR), and payments, so teams stay organized, save time, and keep money moving in and out of the business. But finance automation can go much further, with predictive tracking, analysis of customer payment behavior, and proactive insights that guide smarter decisions throughout the finance cycle.

The statistics in this article show how automation is changing areas such as AP, AR, invoice processing, and expenses, and that more finance teams are turning to these tools to simplify their work and improve their results.

Financial automation market and adoption trends

Financial automation is growing as companies move away from paper, spreadsheets, and email attachments and invest in tools that make AP, AR, and invoicing easier to manage.

3. The broader CFO technology stack market has grown from roughly 12 billion dollars in 2020 to an estimated 89 billion dollars in 2025.

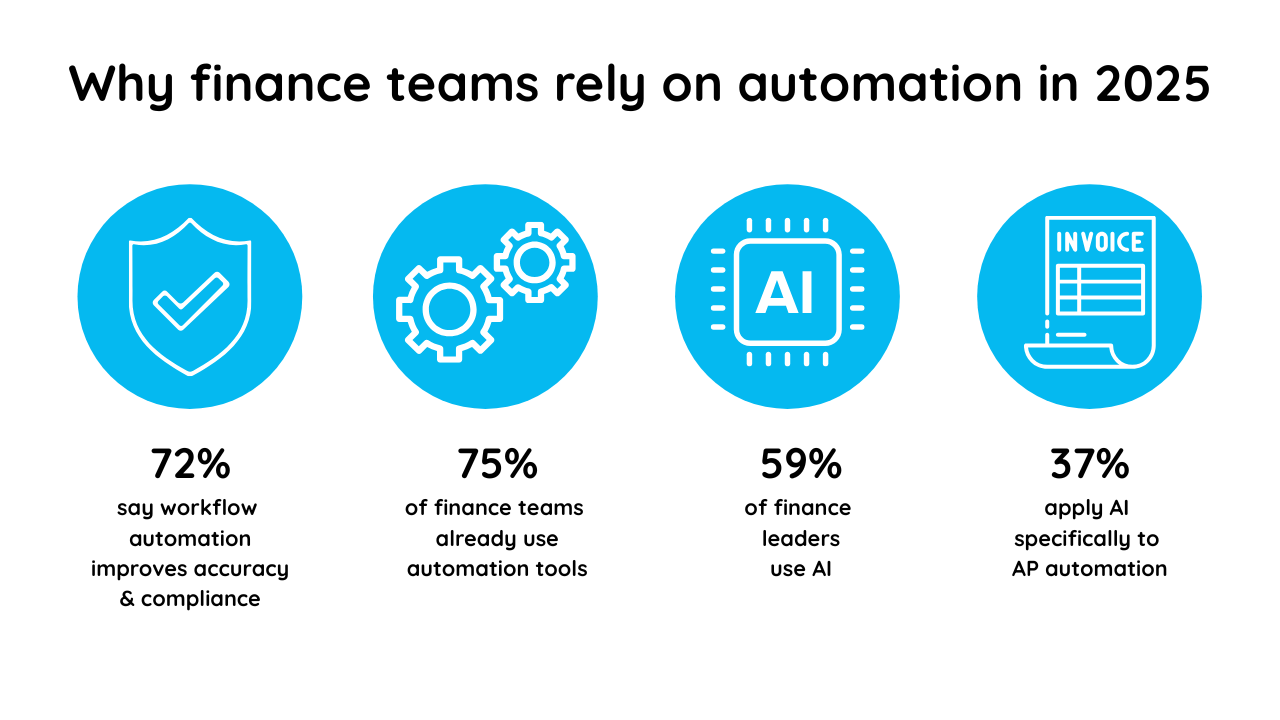

4. 72% of finance departments say workflow automation improves accuracy and compliance.

5. Finance and accounting have one of the highest automation adoption rates, with about 75% of teams using automation tools.

Accounts payable and invoice automation

Many AP processes are still manual, but automation makes them faster, cheaper, and easier to manage.

7. 78% of CFOs say improving finance operations is a major focus of their tech spending for 2025.

8. 75% of AP teams already use AI, and 61% believe it will have a big impact on AP in 2025.

9. The average time to process an invoice is still more than nine days (9.2 days).

10. Automation brings the cost to process an invoice down from about $9.40 to around $2.78 for top-performing teams.

11. Only about 32.6% of invoices are processed without any human touch, while best-in-class AP teams reach 49.2% touchless processing.

Accounts receivable and collections

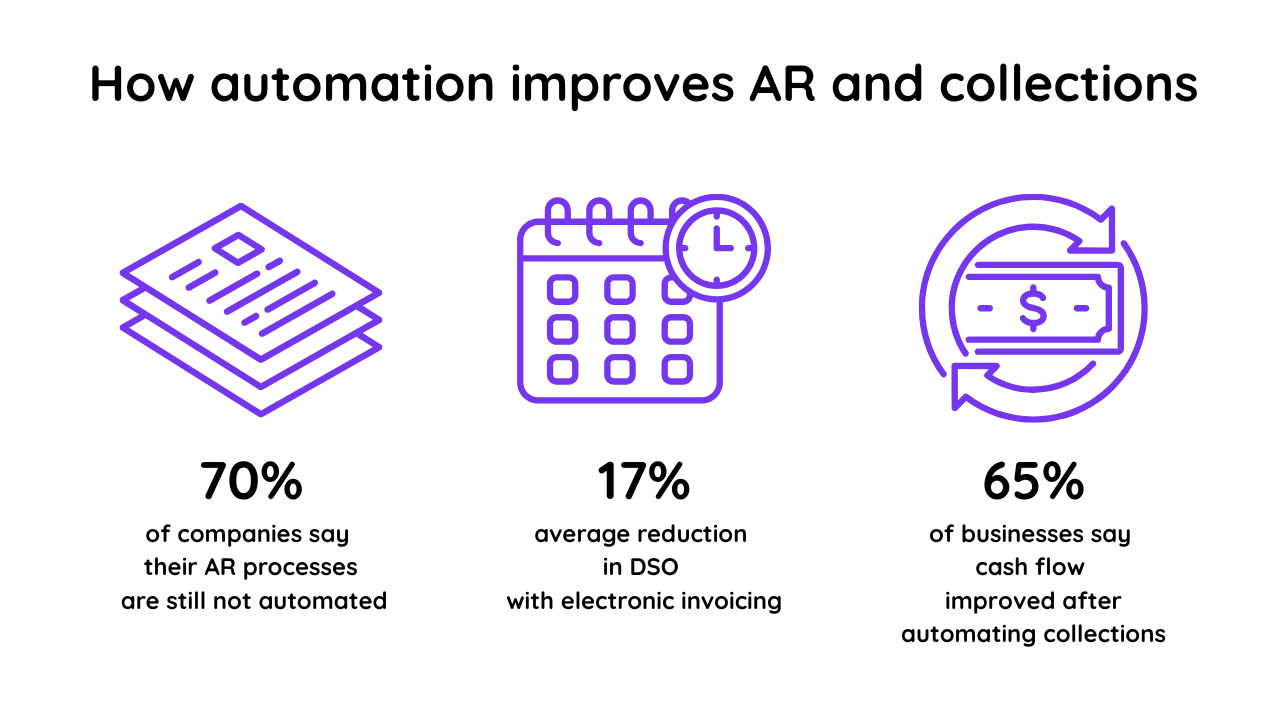

While many AR tasks are still handled manually, automation helps improve collections and cash flow.

12. 70% of companies say their AR processes are still not automated.

13. Companies that use electronic invoicing report a 17% average drop in days sales outstanding (DSO).

14. 65% of businesses say cash flow improved after automating collections.

15. As of mid-2025, 15 of 203 U.S. industries had 10% or more of their receivables 90 days or more past due.

Expense management and T&E automation

While manual expense reporting is slow, costly, and error-prone, automation helps save time, cut costs, and reduce errors.

16. The average expense report costs about $58 to process and takes roughly 20 minutes.

17. 19% of expense reports contain errors, and each error adds about $52 and 18 minutes of rework.

18. Switching from paper-based to electronic expense reporting cuts processing costs by 58%.

AP automation outcomes

AP automation drives measurable improvements in cash flow and cost reduction.

19. 60% of CFOs say automating AP processes improves cash flow management.

20. 70% of companies with automated AP report significant cost savings.

What this means for finance leaders

These numbers tell a clear story: finance teams lose time, money, and visibility when they rely on manual processes. Automation delivers faster cycles, fewer mistakes, lower costs, and better cash flow control.

As more organizations modernize their financial operations, automation is becoming the standard for teams that want to work smarter and stay competitive.

Are you ready to modernize your financial operations?

Give your finance teams the tools they need to automate AP, AR, and e-invoicing so they can work faster, cut manual tasks, and keep cash flowing. Quadient’s financial automation solutions help you reduce costs, speed up invoice and payment cycles, and improve the overall customer and supplier experience.

Join thousands of businesses that trust Quadient to support their financial operations. Request a free demo, check out verified customer reviews, and see how Quadient helps finance teams work smarter.

Frequently Asked Questions

What is financial process automation?

It refers to using technology to handle tasks such as invoice processing, e-invoicing, collections, payments, and expense management. Automation cuts down on manual work and helps teams move faster and with fewer errors.

Why are CFOs prioritizing automation in 2025?

CFOs are turning to automation because budgets are tight, teams are stretched, and they need better visibility into their numbers.

Which finance processes benefit most from automation?

The biggest gains show up in accounts payable, accounts receivable, collections, invoicing, e-invoicing, and employee expense processing.

How fast can finance teams see results?

Most organizations see improvements in efficiency, error rates, and process visibility within the first few months of adopting automation, especially in AP and AR, where cycle times and costs are easy to track.

Is automation expensive to implement?

Modern cloud solutions allow teams to start with a limited scope, such as invoice capture and approval workflows or e-invoicing, and scale over time, which makes automation accessible for mid-sized businesses as well as large enterprises.