Apple has its intuitive design and the Genius Bar. Amazon lets customers have exactly what they want when they want it—in just one click. Starbucks’ personalized app and generous rewards program keep customers coming back daily. One thing’s for sure: The world’s biggest brands share an obsessive focus on the costumer experience—and it pays off.

It makes sense. Happy customers are loyal. They keep coming back. They spend more. And they’re more likely to pay you on time. Their experiences show up in your bottom line—and take shape within accounts receivable.

AR is often the main—or only—point of contact once a sale is complete. When an invoice is lost, there’s a dispute, or a payment is late, interactions can become rocky. If you’re too heavy-handed, it could damage your relationship. But you need to be assertive because on-time payments fuel your cash flow.

How you follow up on payments matters. Manual collections processes cause delays, errors, and miscommunications that can frustrate your customer and your AR team alike. Automation eliminates these risks. By keeping your customers happy and your cash flow healthy, you can shift collections from a pain point to a business building block.

The problem with manual follow-ups

Too many businesses still rely on manual invoice tracking, complex spreadsheets, and repetitive, ineffective follow-up communications to manage the collections process. Chasing down payments this way leads to:

- Unpaid invoices

- Open disputes

- Strained relationships

- Stressed AR teams

- Unpredictable cash flow

Automation changes the dynamic. Instead of chasing payments, you're delivering proactive updates with the opportunity for open communication. Automated reminders, structured workflows, and well-timed follow-ups create a frictionless experience that strengthens relationships and accelerates payments.

Beyond the customer experience, automation benefits your business in the following ways:

Accelerated cash flow. Automated reminders reduce overdue invoices and speed up payments, ensuring a steady cash flow.

Better visibility. Real-time insights help AR teams track invoices, prioritize tasks, and manage risk. Automated reporting provides clarity on risks, opportunities, and overall business performance.

AR as a strategic asset. Automation shifts AR from a routine task to a growth driver. It frees teams to focus on relationship management, credit risk analysis, and other strategic tasks, improving overall business operations.

Automation ensures invoices aren’t missed, and follow-ups are timely. In fact, 70% of companies report that it’s made collections faster, easier, and more efficient.

The right message. The right way. The right time.

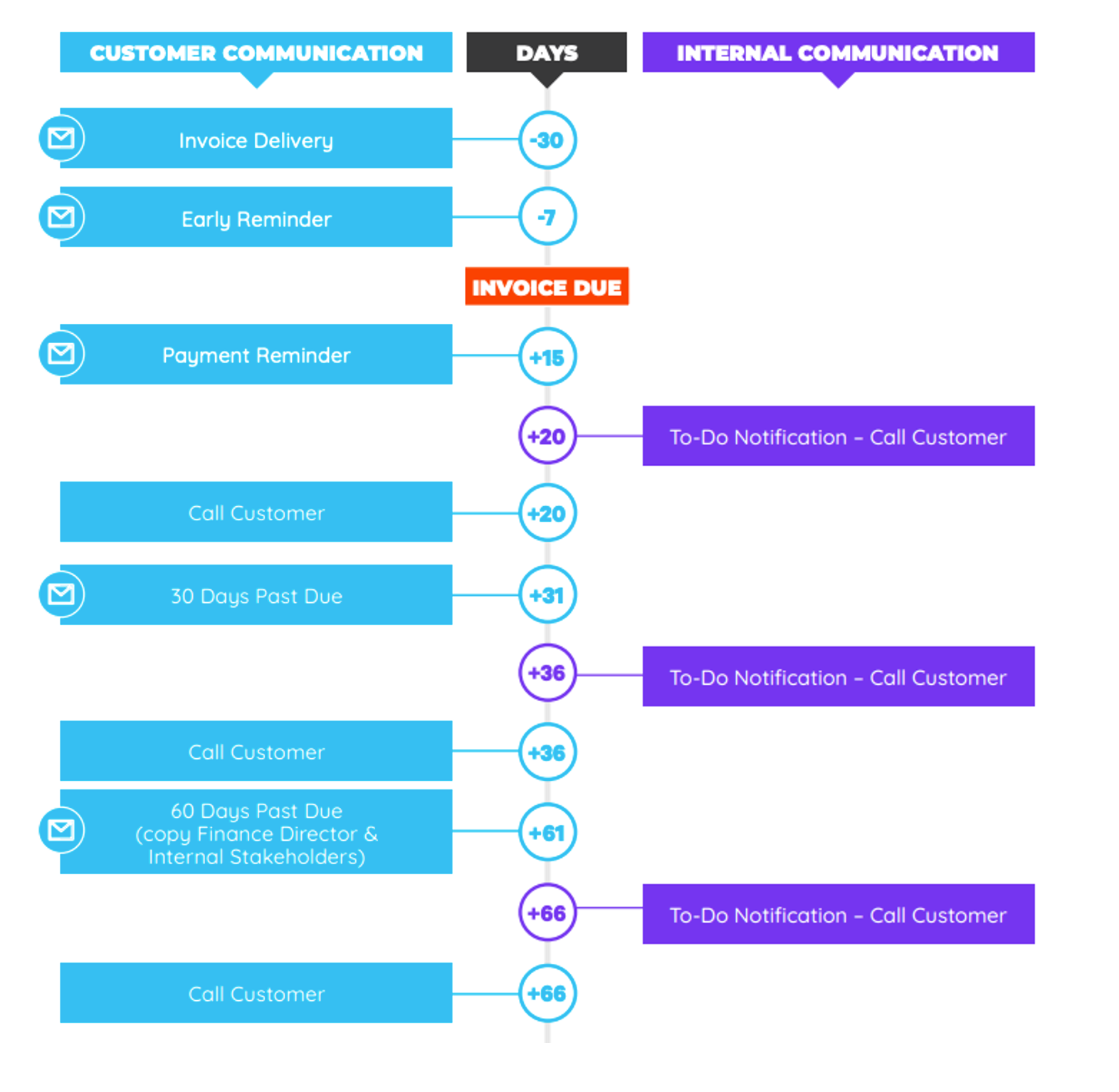

AR automation helps structure your customer communication strategy so messaging is frequent, informative, and well-timed. Invoices can be sent automatically based on terms, dunning letters follow a scheduled cadence, and escalation triggers ensure that accounts are managed effectively. Customers receive clear, structured messages. So there are fewer disputes and more trust.

With automation, you can:

- Include the sales team in correspondences

- Receive notifications when emails have not been opened

- Alert collections team when to call specific customers

- Include a PDF of all open invoices via email to customers

A smarter approach to follow-ups

Chasing overdue accounts doesn’t have to take a toll on your relationship with a customer. In fact, a predictable, well-timed collections experience reflects positively on the brand while accelerating outcomes.

Here are our tips:

Be proactive. Prevent forgotten or lost invoices from falling through the cracks. Early reminders and personalized outreach prevent overdue balances and build confidence in your AR team. Automated reminders and task assignments keep follow-ups on track without added manual effort.

Be consistent. Structured follow-ups set clear expectations and bring reliability to your conversations with your customers. They learn to expect to hear from you and even become reliant on your reminders and updates. That means payments come in faster, disputes are less frequent, and relationships stay strong.

Get the timing right. Pay attention to the timing of your messages to ensure that customers don’t feel overwhelmed or underserved. The frequency of your reminders, and the cadence of any follow-up messaging post-due date will depend on your payment terms, any expectations set with the customer, as well as your tolerance for late payments and risk. Tailoring communication cadences—such as frequent, structured billing reminders and periodic business updates—helps you strike the right balance between efficiency and customer care.

Not sure where to start when it comes to follow-up communciation? We’ve got more than 20 customer-friendly emails for every AR touchpoint. Download Email Template Kit.

AR workflows for every customer

A collections workflow is a communication tool that automatically sends correspondence to your customers based on where they are in the payment process (ex. current, soon to be due, overdue) and other factors like region, product line, risk or business size. It helps you create an experience for each customer that feels like it’s wholly designed for them. For example, high-value accounts could get a white-glove approach with a light-touch and friendly reminders. Like this:

Ready to strengthen customer relationships, take the heat off your AR teams, and accelerate cash flow for your business?

Take a self-guided demo and see how Quadient’s collection workflows can transform your AR strategy.