Cash flow remains a top concern for finance leaders in 2025. The cost of capital is still elevated, and many companies are holding large amounts of cash as working capital. Late payments remain common, and customer payment behavior continues to be shaped by economic uncertainty.

The following statistics reveal the challenges that accounts receivable (AR) teams are navigating this year. They also show why automation is becoming a practical way to accelerate collections, reduce risk, and strengthen working capital.

Working capital and cash flow trends

Companies are handling longer payment cycles and higher cash demands in 2025.

1. US companies are carrying 1.7 trillion dollars in excess working capital, keeping critical cash trapped in the business.

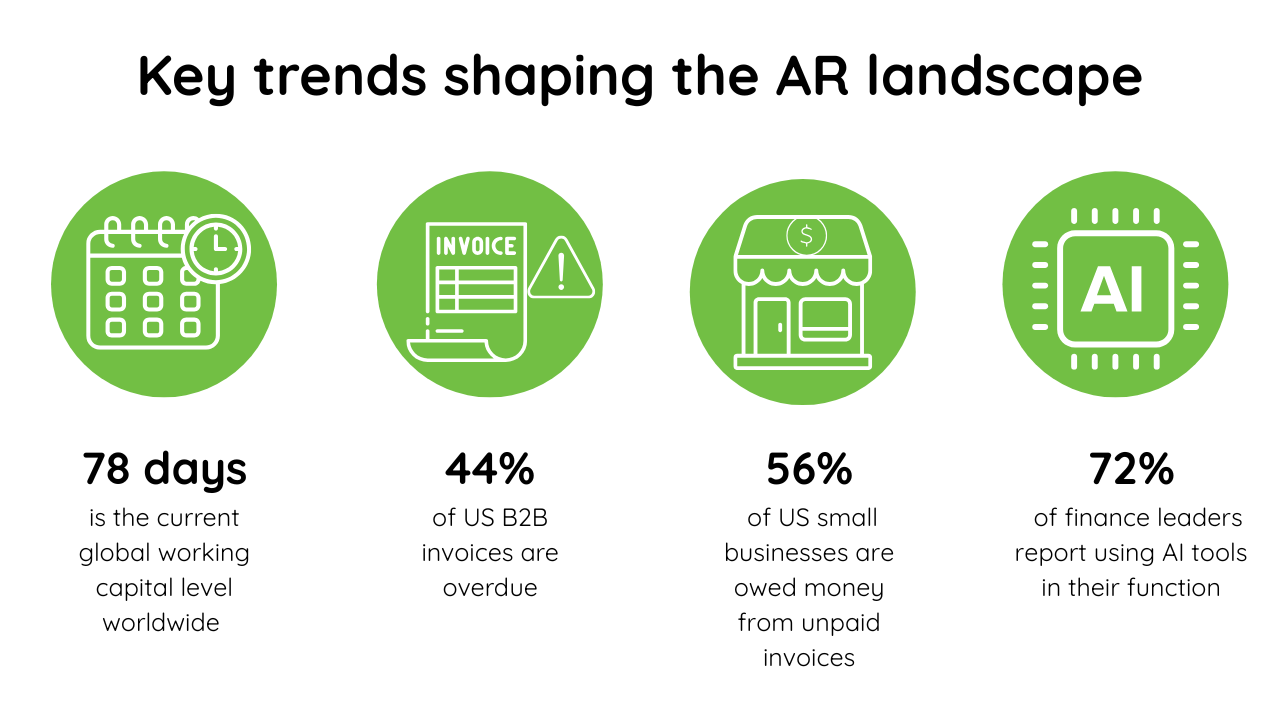

2. Global working capital reached its highest level since 2008 in early 2025, rising to 78 days and intensifying cash flow pressure worldwide.

3. The average cash conversion cycle for more than 2,700 US public companies remains at 89 days, indicating a slight improvement despite ongoing efforts to accelerate cash flow.

4. Among the 1,000 largest US public companies, the cash conversion cycle now stands at 37 days, with most gains driven by stretching payables rather than speeding up collections.

Late payments and AR risk

Late payments remain widespread, increasing risk and extending collection cycles.

5. In the United States, 44% of B2B invoices are now overdue, and 3% are written off as bad debts, putting sustained pressure on cash flow.

6. Over the past year, 34% of US businesses say the average time it takes to get paid has increased.

7. When customers pay late, 42% of US companies struggle to meet their own financial obligations, and 40% slow payments to their suppliers in response.

9. Across North America in 2025, nearly half of B2B invoices remain overdue, and bad debts account for roughly 6% of credit sales.

Industry-level delinquency and AR performance

Some industries are dealing with exceptionally high levels of severely overdue receivables.

10. In Q1 2025, 17 of 209 US industry segments reported that at least 10% of their receivables were 91 days or more past due.

11. In Q2 2025, 15 of 203 US industry segments still had at least 10% of their receivables aged 91 days or more.

12. 56% of US small businesses report being owed money from unpaid customer invoices, with an average outstanding amount of about $17,500 per business.

Small business cash flow and late payment

Late payments pose a structural issue for US small businesses and their cash flow.

13. 47% of US small businesses say at least some of their invoices are more than 30 days overdue, with nearly one in ten invoices falling into this category.

14. Half of small businesses with frequent late payments report cash flow problems, compared with just 34% of those less affected.

15. Small businesses more affected by late payments are 1.7 times more likely to rely on credit cards and carry average balances 1.5 times higher than their peers.

AR automation and finance leadership

Automation is becoming a vital tool for finance leaders as they work to improve performance and reduce manual effort.

16. North America accounts for 44.9% of the global AR automation market in 2025, making it the largest regional adopter of AR technology.

17. Globally, the AR automation market is valued at 3.40 billion dollars in 2025 and projected to grow to 5.95 billion dollars by 2030.

18. 72% of finance leaders report using AI tools in their function, up from 34% the year before.

19. 58% of finance leaders say they are using automation and AI to boost performance, focusing on streamlining manual processes.

20. More than 60% of CFOs plan to increase investment in finance automation in 2025, with AR among the highest-impact areas.

Wrap up

These statistics paint a clear picture. Working capital is tightening. Late payments continue to rise. Many industries are dealing with bottomless aging buckets. Small businesses face an ongoing cash strain. And finance leaders are increasing their investment in automation and AI in response.

Automating AR is one of the fastest ways to improve cash flow, reduce risk, and strengthen working capital.

If you’re ready to simplify invoicing, accelerate collections, and give customers a smoother payment experience, explore how Quadient AR Automation can help.

Request a free demo, read verified customer reviews, and discover why analysts consistently recognize Quadient AR as a leader in AR automation.

Frequently Asked Questions

What is AR automation?

AR automation uses software to streamline invoicing, reminders, payment processing, dispute management, and cash application. It reduces manual work and helps teams get paid faster in 2025.

Why is AR automation important in 2025?

High interest rates, economic uncertainty, growing working capital pressures, and widespread late payments are pushing teams to accomplish more with fewer resources. Automation helps bridge the gap between booked revenue and cash collected.

What KPIs are improved by AR automation?

Key improvements include lower days sales outstanding (DSO), fewer overdue invoices, reduced bad debt, faster dispute resolution, and more predictable cash flow.

Does AR automation improve customer experience?

Yes. Automation supports clearer communication, online payment options, and self-service access to invoices and statements, reducing confusion and speeding up payments.

Where should teams begin with AR automation?

Most teams start with invoice delivery and automated reminders. From there, they expand into dispute workflows, online payments, and AI-driven risk scoring.