The last few years have forced finance teams to do more with less. While resignations have eased from their peak 3-4 years ago, roughly 43% of companies still say they are facing talent shortages in finance.

Five key reasons have been identified for this:

- Retirements and high turnover: A significant number of experienced professionals, including 300,000 accountants and auditors in the U.S. over the last few years, have left their jobs across all age groups, not just those nearing retirement.

- Declining pipeline: There has been a significant drop in qualified individuals entering the field.

- Underestimating work realities: Many students underestimate the demanding nature of finance careers, including long hours and burnout, which can deter them from entering the profession.

- Evolving skill requirements: The increasing complexity of roles, driven by technology like AI, requires new skills that current professionals may lack, and the younger generation isn't yet fully prepared for these changes.

"…talent scarcity continues and the need for skilled talent is growing."

-Sander van't Noordende, CEO of the world's largest talent company, Randstad

Focusing on Finance

This has been acutely felt in the finance function. Battling with a wide range of challenges, ranging from increased late payments, rising inflation, and geopolitical challenges, the pressure on accounts receivable (AR) teams has been immense.

A recent study found that 77% of finance leaders said they have invested in AI and automation to address staff concerns in their AR process. In the same study, 55% said that automating workflows in the finance department is a top priority for their organization.

The B2B space has been slow to embrace automation, but the undeniable benefits of using technology to "do more with less" make it difficult for AR teams to postpone much longer.

Optimizing the entire AR process is key to achieving this, but in this article, we're going to focus on cash application. After all, if that step isn't completed, the money your customers pay you may as well not exist.

The AI advantage in cash application

Cash application is the final step in the credit-to-cash process, where you apply a payment to a customer's outstanding balance. As Dun & Bradstreet notes, it also, "can be one of the most manual, time-intensive, and error-prone processes in accounts receivable management." This makes it ripe for automation.

For companies that deal with a high volume of monthly invoices, this challenge is even greater. The largest organizations even have cash application specialists who spend their entire day on nothing else. For most businesses, this isn't possible, especially with the skills and labor shortage, as well as budget constraints.

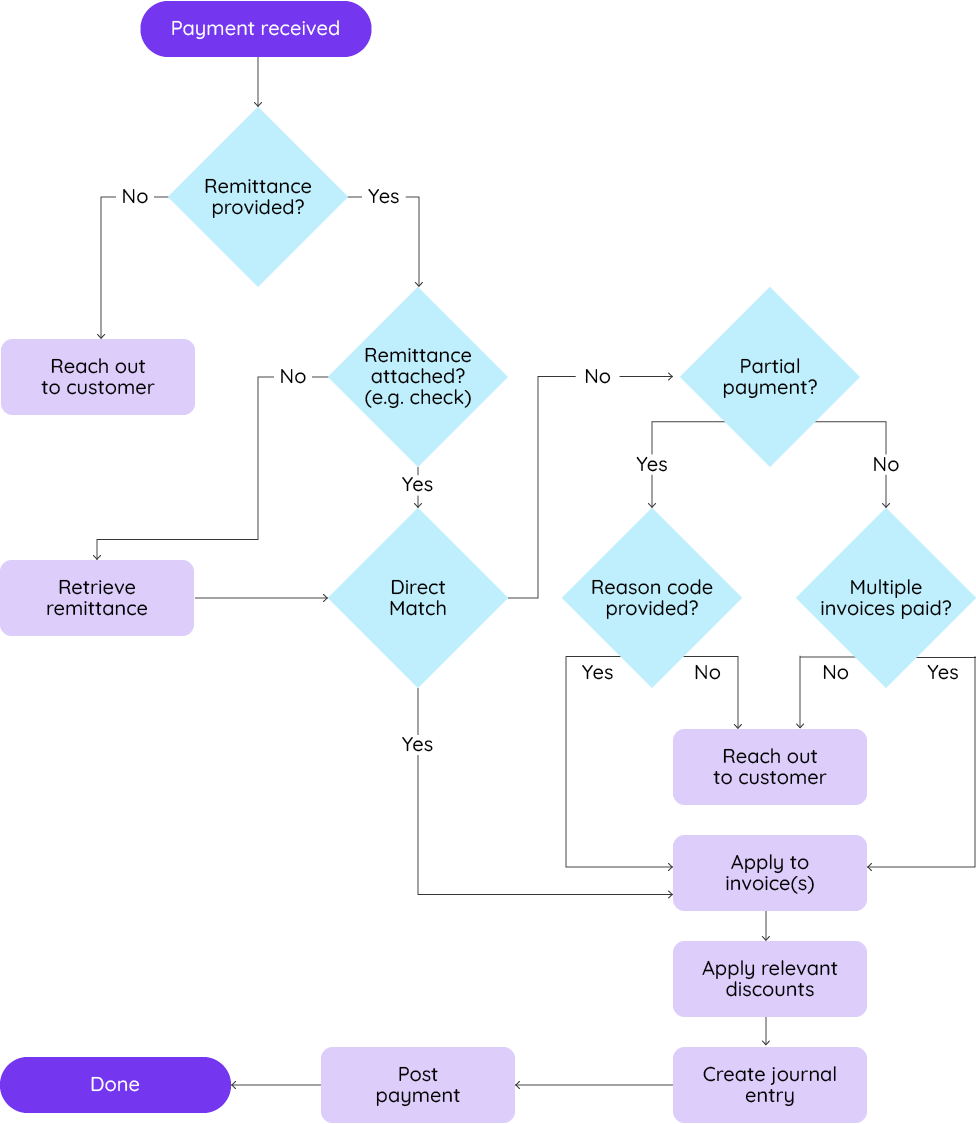

To understand why the process can be so complicated, let's look at the standard cash application workflow.

That's a lot of steps with a large number of variables!

It's not unusual for payment to be received with missing customer data, or in some cases, without any customer information. When it happens, your team must comb through customer records, hoping to match the payment to the appropriate account.

Rather than devoting manpower and extensive time to completing the task, artificial intelligence expedites the process. The software uses machine learning to analyze the payment and past customer transactions to make a recommendation about the account it likely belongs to.

Remittance advice extraction is another way AI enhances the cash application process. Customers frequently submit remittance data in different ways — be it PDF, in the body of an email, or even electronic data interchange — and AR teams must be able to quickly extract key information from the file to complete the process.

This can be complicated if the file contains missing characters, or if scanned images of paper documents show up blurry. An AR tool with remittance advice extraction uses Optical Character Recognition (OCR) to scan the document and collect the relevant information.

Optical Character Recognition - the electronic or mechanical conversion of images of typed, handwritten or printed text into machine-encoded text, whether from a scanned document, a photo of a document, a scene photo or from subtitle text superimposed on an image.

At its most basic, OCR stores templates full of font and text image patterns. When a document is received, an algorithm compares the text in the image to those stored in the templates. Once it finds a match, it recreates the figure digitally. As machine learning is involved, the software stores new images and incorporates them into future operations, essentially "learning" new characters with each use.

Want to learn more about how AI benefits the cash app process? Check out our datasheet!

AI features can be used to help resolve short or split payments, another issue that frequently plagues the cash application process. The most common cause of these incidents is an invoice dispute. Typically, when a customer disputes an invoice, a team member must review the claim and spend a lengthy amount of time interacting with the customer to come to a resolution.

With artificial intelligence as your assistant, customer disputes submitted digitally are scanned by the software and categorized according to severity. When the software detects a simple problem, such as a customer claiming they never received an invoice, it automatically sends them the document. For more complex problems, it directs the query to the appropriate team member for a speedy resolution. These features reduce the amount of time it takes to resolve an invoice dispute, ensuring you get paid faster.

Working smarter and faster

Tools like OCR and machine learning enable AR teams to complete cash application tasks more efficiently than ever. While the cash flow benefits are obvious, these features also drive other valuable outcomes. You can achieve more with a smaller team, avoiding the necessity to add headcount at a time when talent is scarce, and budgets are constricted.

Not only do these tools help members of the accounts receivable team work faster; they also enable staff to be more strategic in their work. Rather than spending countless hours on routine tasks, such as data entry, they can focus on activities that will help increase cash flow, such as proactively approaching high-risk accounts to avoid delinquency.

These types of strategies and tools will be key to companies thriving during a labor shortage and throughout the continued economic slowdown.