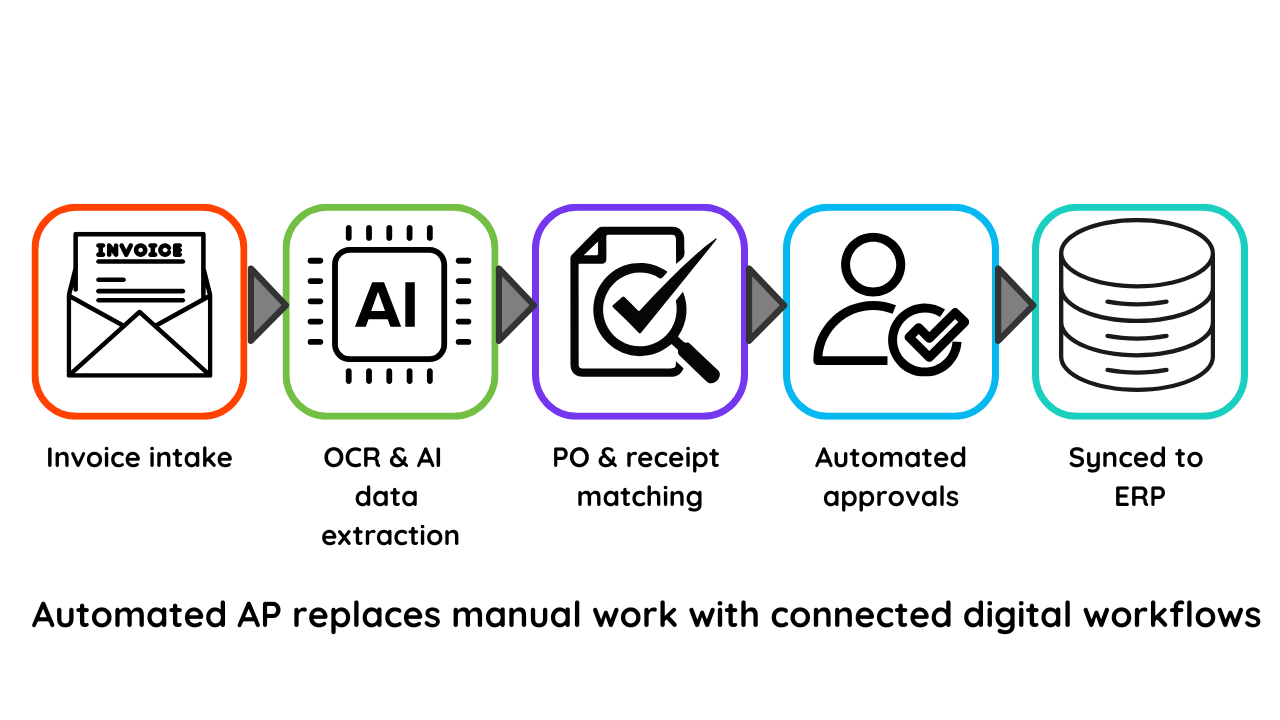

Short answer: You can automate accounts payable (AP) by digitizing invoices, extracting data with optical character recognition (OCR) technology and artificial intelligence (AI), matching invoices to purchase orders (POs) or receipts, routing approvals (and reminders) automatically, and syncing approved invoices to your ERP.

What is AP automation?

Accounts Payable automation covers the use of software to capture, validate, route, match, and store invoices in an electronic way. It speeds up processing, reduces manual tasks for financial teams, all while improving accuracy.

Automating accounts payable (AP) replaces manual, paper-based invoice management with faster, connected, digital workflows. AP automation software, such as Quadient Accounts Payable Automation, captures invoices electronically, extracts key data, matches documents, routes approvals, and provides greater visibility across the entire invoice cycle.

What AP automation actually does

AP automation gets rid of repetitive tasks that slow down finance teams. Instead of keying invoices by hand or chasing approvals, automation tools:

- Capture invoices from email, portals, scanners, or EDI.

- Read invoice data with the use of OCR technology and/or AI.

- Validate invoice details like amounts, vendor information, as well as tax, then automatically match invoices to purchase orders or goods receipts.

- Automatically routes invoices to the right approvers.

- Sync approved invoices with your ERP for payment.

- Provide dashboards to track processing time, exceptions, and bottlenecks.

- Create an audit trail for compliance.

Discover how Quadient AP Automation works and book a free demo to see the platform in action.

The steps to automate accounts payable

1. Start by digitizing invoice capture

The first step is to collect all invoices, PDFs, emails, scans, and XML into a centralized system instead of inboxes or paper folders.

2. Extract and validate invoice data

OCR and AI can extract key fields, including vendor name, invoice number, currency, tax, PO number, and line items.

Thorough checks verify:

- Missing or incorrect fields

- Duplicate invoices

- Formatting errors

- Amount or tax discrepancies

3. Match invoices automatically

Quadient AP Automation supports both:

- 2-way matching: invoice ↔ PO

- 3-way matching: invoice ↔ PO ↔ goods receipt

This ensures accuracy, prevents overbilling, and routes exceptions directly to procurement or AP.

4. Automate approval workflows

Manual approvals slow everything down. Automation fixes this with:

- Configurable routing based on cost center or amount

- Mobile approvals

- Automatic reminders and escalations

This reduces delays and stops invoices from sitting unnoticed in inboxes.

5. Sync payment-ready invoices to your ERP

Approved invoices sync directly to ERP systems such as NetSuite, Sage Intacct, Microsoft Dynamics, or QuickBooks. This drasically reduces data entry and ensures clean payment runs.

6. Track performance in real time

Dashboards show:

- Pending approvals

- Processing time by user

- Exceptions

- Duplicate or risky invoices

- Spend by vendor

This improves forecasting and decision-making.

What you need to automate AP

Requirement | What it means | How AP automation helps |

Central invoice intake | All invoices are collected in one place | Quadient AP offers email, portal, scanned, and digital capture |

Data extraction | Converting PDFs to usable fields | OCR and AI reduce manual data entry |

Validation rules | Ensuring accuracy | Duplicate checks, PO matching, and tax validation |

Approval workflows | Routing invoices for sign-off | Custom workflows, mobile approvals, and reminders |

ERP integration | Syncing invoices into financial systems | Prebuilt integrations reduce IT effort |

Security and compliance | Audit trails and permissions | Tracks every action for governance |

Why automate accounts payable?

1. Reduce invoice processing costs

Manual invoice processing can typically cost $15-$20 per invoice. With AP automation, organizations often lower that to $5 or less—a 60–80% reduction—by eliminating manual data entry and paper handling.

2. Improve speed and cash flow visibility

Quadient AP can speed invoice processing up to 9× faster, cutting approval cycles from days to minutes. This helps capture early payment discounts and improves cash flow forecasting.

3. Reduce errors and fraud risk

AI validation catches:

- Duplicate invoices

- Invalid vendor details

- Suspicious or unusual amounts

- Incorrect or missing coding

This strengthens financial controls and reduces the risk of overpayments and fraud.

4. Strengthen supplier relationships

Faster, more predictable processing reduces supplier queries, prevents late payments, and improves communication. Vendors get clearer visibility into invoice status, which builds trust.

5. Free your AP team for higher-value work

Automation removes repetitive tasks, allowing teams to focus on vendor management, analytics, and compliance instead of typing invoices or sending reminders.

Conclusion

Automating accounts payable is one of the quickest ways to cut processing costs, reduce errors, and speed up approvals. With Quadient AP Automation, businesses shift from manual tasks to streamlined digital workflows that are accurate, transparent, and easy to manage.

Explore Quadient AP Automation and book a free demo to see it in action.

Frequently Asked Questions

Does AP automation work with my ERP?

Yes. Quadient AP Automation integrates with major ERPs, including NetSuite, Microsoft Dynamics, Sage Intacct, QuickBooks, and others.

Do I need IT resources to deploy AP automation?

Cloud-based AP automation typically requires reduced IT involvement, although ERP integrations, user access, and workflow setup may involve light IT or admin support.

Can AP automation handle PO and non-PO invoices?

Yes. PO invoices use matching rules (2-way or 3-way), while non-PO invoices route directly for coding and approval.

What about compliance and audits?

AP automation creates a digital audit trail, enforces approval rules, and provides secure document storage, making audits faster and more accurate.

How long does it take to automate an AP process?

Most organizations have AP automation running within weeks, especially with cloud tools and prebuilt ERP integrations.