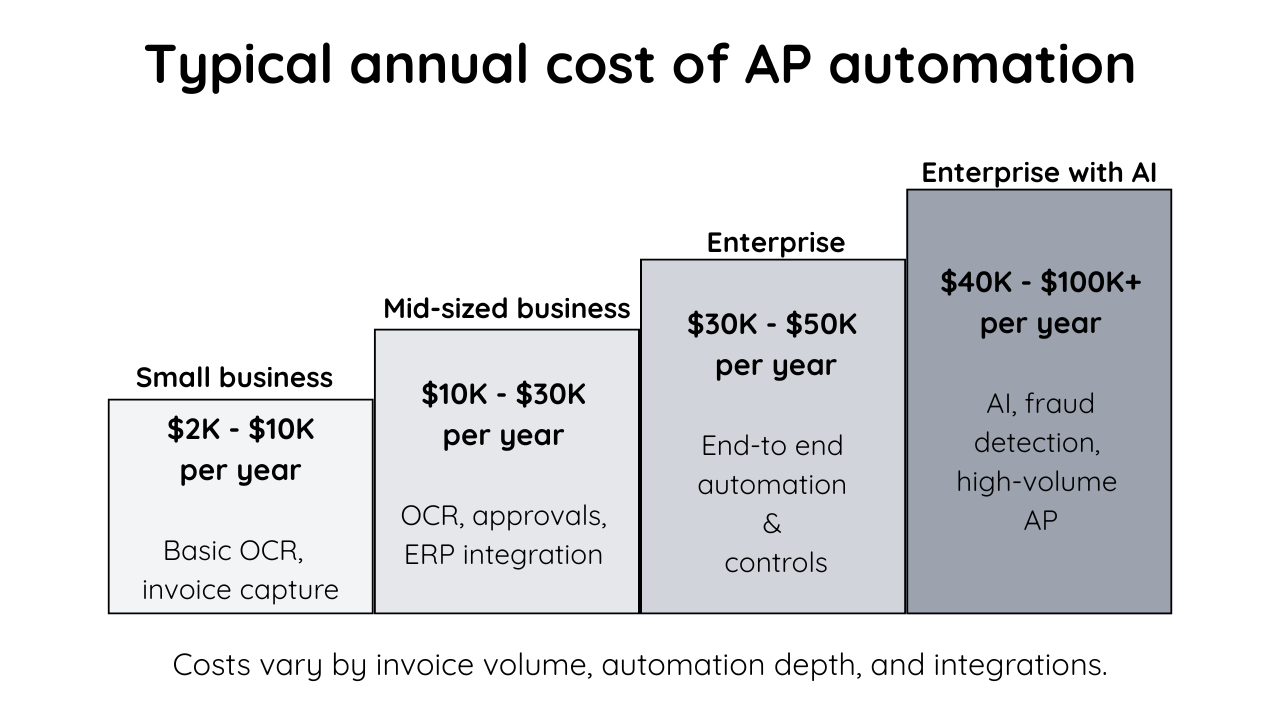

Short answer: For many organizations, accounts payable (AP) automation costs fall in the $2,000 to $50,000+ range, annually, while large enterprises, especially those using AI at scale and requiring complex ERP integrations, can exceed $100,000+. Pricing varies based on invoice volume, automation depth, deployment model, and integrations.

There is no single price for accounts payable automation because finance teams automate AP for different reasons.

Some AP departments focus on eliminating manual AP processes, such as invoice receipt and data entry. Others need real-time visibility, approval routing, audit trails, and fraud prevention. Larger finance departments often require end-to-end automation that integrates with accounting systems.

The more of the invoice lifecycle you automate, the higher the cost, but also the greater the return.

What you are actually paying for

AP automation pricing is usually driven by a few factors:

- Invoice volume and usage: Some vendors price by invoices processed, often alongside user counts or feature tiers.

- Automation depth: Basic capture and OCR costs less than end-to-end processing with approvals, two- and three-way matching, and GL coding.

- Deployment and rollout: Cloud subscriptions are typically simpler to launch, while on-premise models and large rollouts can raise implementation and ongoing support costs.

- Integrations: Connecting to ERPs like Sage Intacct, QuickBooks, or NetSuite can increase cost based on integration complexity and testing.

- Advanced features: AI-assisted extraction and validation, exception handling, fraud or duplicate detection, and payment options can add value and cost.

Accounts payable automation cost breakdown

The table below shows typical annual cost ranges based on company size and automation depth. Enterprise with AI can exceed $100,000+ per year when invoice volumes are very high, and requirements include advanced AI, strong controls, and complex ERP integrations across multiple entities.

Organization type | Typical annual cost | What’s included | Best use case |

|---|---|---|---|

Small business | $2,000–$10,000 | Invoice digitization, Invoice capture and OCR, basic payment approvals | Reducing manual data entry |

Mid-sized business | $10,000–$30,000 | OCR technology, AI-powered data extraction, approval routing, ERP integration | Scaling AP efficiently |

Enterprise | $30,000–$50,000+ | End-to-end automation, two- and three-way matching, audit trail, real-time reporting | High-volume, multi-entity AP |

Enterprise with AI | $40,000–$100,000+ | AI-driven capture, exception handling, fraud and duplicate payment detection, analytics and reporting | Touchless AP at scale across high volume and multi-entity environments |

These figures reflect typical annual software costs. Implementation, integration, and change management services may be additional depending on scope.

What AP automation replaces (and saves)

Manual accounts payable creates costs beyond data entry. Common cost drivers include rework from errors, duplicate payments, late fees, missed early-payment discounts, audit effort, and fraud risk.

Benchmarks commonly cited by AP research firms put manual invoice processing at around $10 to $15 per invoice, while best-in-class automation can reduce it to roughly $2 to $4 per invoice. Actual results vary based on invoice volume, exception rates, and how costs are calculated.

For high-volume AP departments, savings can often outweigh the subscription cost.

How AI affects the cost (and value)

Modern AP automation platforms increasingly rely on AI. This impacts cost in two ways:

1. Slightly higher subscription cost

AI-powered systems cost more than basic OCR tools.

2. Significantly higher ROI

AI improves invoice data accuracy, reduces exceptions, supports fraud prevention, and increases straight-through processing.

Common AI features include:

- Intelligent invoice capture

- AI-powered verification of invoice numbers and amounts

- Duplicate payment detection

- Fraud detection capabilities

- Workflow reengineering and approval automation

For many organizations, AI pays for itself quickly.

Is accounts payable automation worth the cost?

For most organizations, yes. AP automation can improve processing speed, visibility into supplier transactions, controls, and audit trails, payment accuracy, and staff productivity. The payback period often improves as invoice volume increases and exceptions decline.

How to estimate your AP automation cost

To build a realistic estimate, start with:

- How many invoices you process per month

- How many people touch each invoice

- Your exception rate (missing PO, price mismatches, incomplete data)

- How often you see duplicate payments or late payments

- Your labor costs for AP processing

Many vendors offer ROI or savings calculators, but the most reliable estimate comes from modeling your current cost per invoice and comparing it with your target automation level.

Final verdict

Accounts payable automation costs vary widely, but many organizations spend between $2,000 and $50,000+ per year, depending on scale, automation depth, and integration needs. Large enterprises using AI at scale can exceed $100,000+ per year, especially when invoice volumes are high, and ERP integrations and governance requirements are complex.

The real question is not only what AP automation costs, but what manual AP is already costing your business.

Learn more about Quadient Accounts Payable Automation.

Frequently Asked Questions

How much does accounts payable automation cost per invoice?

Costs often range from $2 to $5 per invoice with automation, depending on invoice volume and exception rates, compared with the commonly cited $10 to $15 per invoice for manual processing.

Is AP automation expensive to implement?

Cloud-based AP automation usually has lower implementation costs and faster deployment than on-premise systems.

Does AP automation reduce headcount?

Not usually. Most finance departments redeploy staff to higher-value tasks rather than eliminate roles.

Is AI-based AP automation more expensive?

AI-based platforms may cost more upfront but deliver greater savings through lower error rates, fraud prevention, and automation efficiency.

What size company benefits most from AP automation?

Any company processing more than a few hundred invoices per month can benefit. The higher the volume, the faster the ROI.