As a transportation and logistics company, you are a high-volume business. If you are like most companies in the industry, you likely work with tight margins, and carry a high accounts receivable (AR) and accounts payable (AP) balance. Managing the two can be tricky. Late customer payments can hurt your cash flow, affecting your ability to keep AP current.

Unfortunately, an uncertain economic outlook is leading many buyers to delay payment for as long as possible. Some are formally changing negotiated terms, while others may simply withhold payment without notice. Either way, it puts the squeeze on carriers, leaving their cash flow in limbo. The issue can be worsened by other issues, such as damaged shipments or missing documentation, which can create further collection delays.

Because of this, it is vital for transportation and logistics companies to maintain an efficient AR process to keep cash flow at an optimal level.

Accelerate Your Collections

One of the most common hindrances to a healthy cash flow is a lengthy collections process. The failure to deliver invoices promptly, as well as a lack of rigor and consistency in follow-up, can lead to customers putting payment on the back burner. This is particularly a problem for accounts receivable teams that rely on a manual AR process.

Using accounts receivable automation software eliminates this concern by automatically delivering invoices to customers, as well as sending out regular follow-up messages until payment is received. The system also allows your team to set conditions, such as sending out a follow up if the customer did not open the previous communication.

Just as importantly, you can tailor the invoice delivery to your customers' preferred method of communication, whether that be digital, physical, or both. For customers who desire physical mail, the software allows you to set up a global rule that automatically transfers buyers to a postal workflow.

While this may seem like a fringe benefit, the ability to deliver messages and invoices in a method that meets your customers’ needs increases the likelihood of an invoice being resolved on time.

According to Deloitte, customer-centric companies are 60% more profitable than their competitors.

Anticipate Bumps in the Road

Another key step in maximizing cash flow is recognizing and anticipating problems before they occur. That’s virtually impossible to do if you’re still working with a manual accounts receivable process with data spread out between systems that don’t communicate.

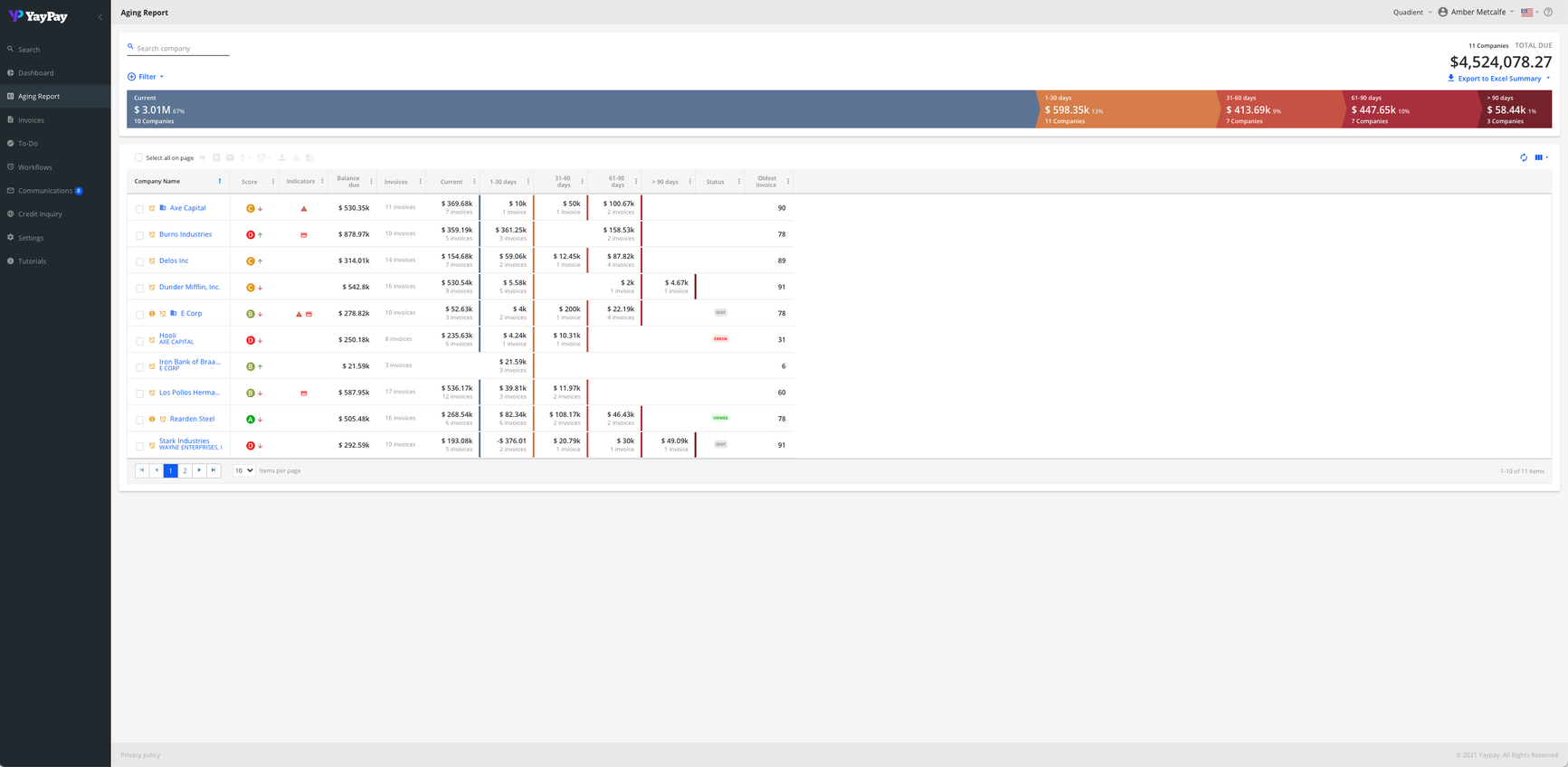

An automation solution like Quadient AR integrates with your tech stack so that you have all relevant customer data at your fingertips. Even better? That data can be easily formatted into charts and graphs that are easy to analyze, providing context for the information. But the solution doesn’t stop there.

Using proprietary algorithms, the software analyzes the data and provides an assessment of when accounts are likely to make their payments, with 94% accuracy. If the payments are anticipated to be late, it also provides a window into just how late they are likely to be. Because it uses real-time data, it recognizes any changes in payment behavior, so the estimates provided are reflective of the customer’s current situation.

With this information in hand, your AR team can proactively go after accounts that show a likelihood of late payment, prioritizing them over those accounts that are likely to pay on time or early. Using this strategic approach, you increase the odds of heading off problems before they can impact your cash flow.

In addition, the ability to recognize changes in payment behaviors allows you to see when customers may be struggling. It provides an opportunity to reach out to the customer, better understand their circumstances, and work with them to find a solution that benefits both sides. By doing so, you improve customer experience and increase the lifetime value of the account. This ensures that your cash flow is protected today, and into the future.

Jump Start Your Late Paying Accounts

Even with the most efficient accounts receivable team and the latest software, there are some customers who will pay late. And the longer it takes to get paid, the less likely it is that your organization will recover the full value of the invoice. That’s why it is important to have an effective dunning process in place. This is especially important in logistics when margins are already tight.

A 2022 report found that “late payments to suppliers are trending at almost double the rate we saw in the six months prior to the pandemic.”

While employing well-crafted dunning letters is key, how those communications are managed also plays a significant role in getting paid quickly. Quadient AR’s automation software can be customized to send out dunning letters on a pre-defined schedule. It can also be set to send out an immediate follow-up in the case that a customer does not open an e-mail.

While the automation of the process is key, it also helps to combine it with the human element, and often a follow-up by phone in conjunction with digital reminders will be key in getting a late invoice resolved. When AR representatives aren’t bogged down with manual busy work, it affords them more time to employ this nuanced approach that effectively resolves delinquent payments.

While the road ahead looks like it may contain many unavoidable bumps, these tips will help keep your cash flow steady.