Your sales team landed an order. The customer has even submitted payment on their invoice. But it’s not time to celebrate yet. There’s still one step left in the order-to-cash (O2C) process, and without it, the money in that payment might as well not exist.

Cash application is the final step of O2C. It’s when your accounts receivable team matches the payment you’ve received to the appropriate invoice and applies it back to your enterprise resource planning (ERP) software. It sounds like a small task, but until it’s done you haven’t documented that your organization has a right to the funds that have been submitted.

And it doesn’t just impact your cash flow. If you have credit limits in place for customers, unapplied cash means that their line of credit won’t reflect the fact that they’ve submitted the payment. That means they may not be able to place critical orders, and you’ll potentially lose business. If it happens enough, you might even lose the customer. In a crowded marketplace, it doesn’t take much.

96% of customers say they will leave a business based on a single negative experience.

At a time when every penny counts, you simply can’t afford to leave cash application to inefficient and error-prone manual processes.

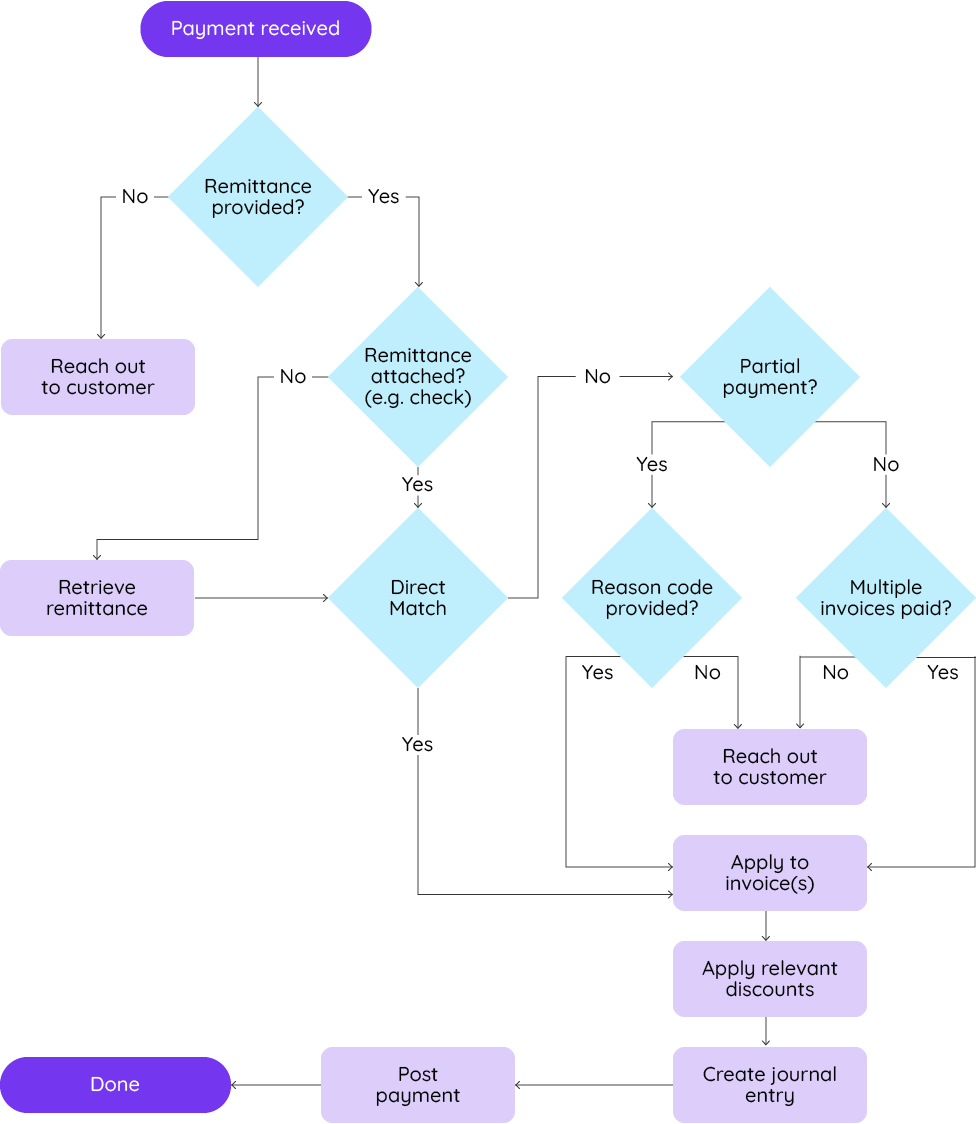

The Typical Cash Application Process

Before diving into the perils of manual cash application, it is important to understand the basic steps in the process.

- Payment and remittance are received, though not always at the same time.

- Payment is matched to the appropriate invoice

- Payment is then applied to your ERP

It sounds fairly straightforward, but a number of factors can complicate it, and they aren’t that uncommon. Here’s what the process is more likely to look like.

How Manual Processes Complicate Things

When working manually, each of the steps above requires labor-intensive work on the part of your accounts receivable team. Especially when you consider that it must be done for every order and every payment you receive.

Whether teams are attempting to match remittance advice to an invoice or verify claimed discounts, they must spend time hunting down records that typically exist on disparate systems. It’s more than a simple inconvenience. The longer it takes your receivables team to find the resolution, the longer it takes to apply that money back to your ERP. The result? An increase in days sales outstanding (DSO) and a decrease in cash flow.

Equally problematic is the fact that it leaves your financial leadership in the dark about the organization’s financial situation. As the application process drags on, it makes it hard to assess the true state of your outstanding receivables, making it hard to determine which accounts are delinquent. As a result, your AR team cannot make truly informed decisions when it comes to strategically approaching the collections process. Time and effort can even end up being wasted on chasing down customers who have already submitted payment but are waiting for the payment to be applied.

That can generate an additional problem. As noted previously, slow cash application can impact a customer’s credit limit and ability to place orders. But it can also create other frustrating experiences for them, such as receiving repeated communications and requests for payment after it has already been submitted.

Not only will 96% of customers leave because of a single bad customer experience, but 60% say they are extremely willing to switch companies to receive better service.

Imagining the impact of losing over half of your customers is a sobering thought and emphasizes the need to not only avoid negative customer interactions but improve existing experiences.

Data entry errors are another potential complication of manual cash application. Even the most careful of AR employees are susceptible to them because all it takes is a simple keystroke error. Customer experience is again one of the biggest victims when these circumstances occur. A single instance of mistyping can make it appear as though a customer has not submitted a payment even if they have, and as a result, they will continue to receive follow-up from your team.

These issues explain why 22.6% of businesses cite manual cash application and reconciliation as a problem area in their receivables process.

The Benefits of Automation

By contrast, automating the cash application process eliminates the need for manual data entry, as data is immediately extracted from remittance papers and matched to invoices. In addition, because the software integrates with your ERP application, payments are automatically connected to the correct invoice and then the cash is transferred back to the ERP in real time.

These benefits not only decrease the amount of time that your AR team spends on the cash application process but ensure a smooth and positive experience for your customers. That creates loyalty and long-term value in your accounts.

Got 90 seconds to spare? Watch how it works!

To learn more about the benefits of automating the cash application process, download our Quadient AR Advanced Cash Application datasheet.