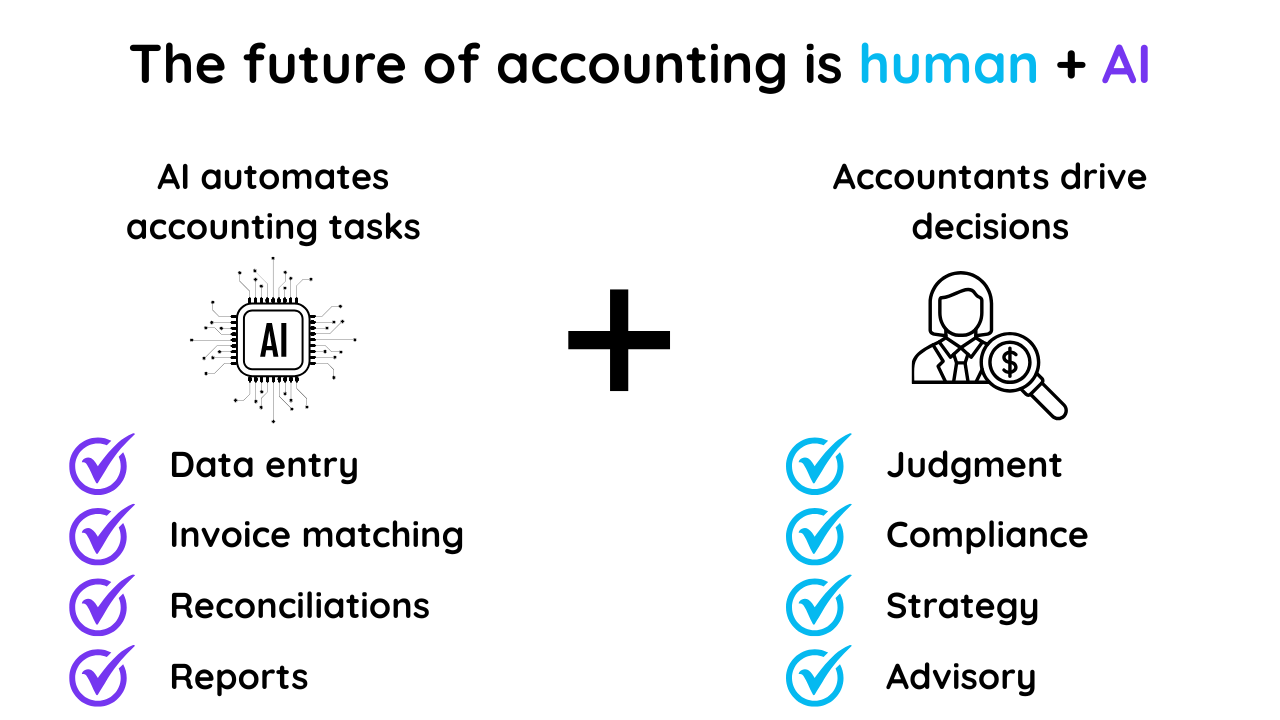

Short answer: AI will not replace accountants. It will automate many repetitive accounting tasks, like data entry, invoice processing, reconciliations, and reporting, but accountants will still be needed for work that requires judgment, compliance expertise, interpretation, and/or strategic decision-making. In the long run, AI will increase the value of accounting professionals, not eliminate them.

AI replaces tasks, not roles. The more routine the task, the more likely AI can automate it. The more judgment-driven the task, the more accountants remain essential.

What AI can automate in accounting

AI already streamlines many manual accounting activities:

- Extracting and categorizing invoice or payment data

- Matching transactions and reconciling accounts

- Detecting potential fraud or anomalies

- Drafting financial reports

- Predicting cash flow trends

- Flagging late payments or unusual activity

- Processing sales orders, statements, and remittances

Software like Quadient Accounts Receivable Automation uses AI and intelligent automation to interpret remittances, reconcile payments, match them to invoices, and identify exceptions. This helps to cut down manual work and speed up cash application.

What AI cannot replace

AI has limits, especially in tasks requiring human expertise:

- Judgment: Handling nuanced or unusual transactions

- Regulatory interpretation: IRS rules, GAAP, SEC requirements, state tax

- Ethical oversight: Evaluating financial controls and risks

- Strategic thinking: Building budgets, forecasts, and scenario plans

- Human communication: Advising executives, auditors, customers, and clients

AI supports accountants. It doesn’t replace the experience required for these tasks.

Will AI reduce accounting jobs or replace accounting roles in the US?

No. Instead, accounting roles are shifting toward:

- Financial analysis and insights

- Advisory services

- Internal controls and compliance

- Audit readiness and risk management

- Technology-enabled decision support

Routine, process-heavy roles may shrink, but demand for skilled accountants remains strong. AI helps fill workflow gaps, particularly in accounts receivable (AR), where automation speeds cash application, reduces exceptions, and improves working capital.

Learn more about Quadient Accounts Receivable software and schedule a free demo to see it in action.

How AI is changing accounting roles

Accounting activity | Automated with AI? | Human responsibility |

Manual data entry | Yes | Oversight, exception handling |

Matching payments to invoices | Yes | Customer communication, dispute resolution |

Account reconciliations | Yes | Investigating discrepancies |

Fraud/anomaly detection | Partially | Validating alerts, assessing risk |

Report preparation | Partially | Reviewing results, interpreting insights |

Forecasting | Supported by AI | Strategic planning and decision-making |

Financial controls | No | Designing and maintaining governance |

This shift allows accountants to focus on insight-driven and advisory work, while AI handles more time-consuming tasks.

AI vs. human accountant strengths

AI strengths | Human strengths |

Speed and automation | Judgment and interpretation |

Pattern recognition | Regulatory expertise |

Error detection | Ethical oversight |

Processing large datasets | Strategic decision-making |

Drafting routine reports | Communication and advising |

Why businesses still need accountants

US financial regulations are complex: IRS rules, GAAP, SEC filings, and industry-specific requirements demand expertise that AI cannot replicate.

Businesses rely on human advisers: Leaders need accountants to interpret data, explain risk, and guide strategy.

AI is not always accurate: AI can miscategorize payments or misread documentation. AR automation tools can highlight anomalies, but humans must decide how to resolve them.

Oversight and ethics require human judgment: Financial decisions affect customers, investors, employees, and legal compliance.

Examples of accounting tasks that benefit from AI

Accounts receivable automation

AR automation software uses AI and automation to:

- Capture remittances across email, portals, and EDI

- Extract payment details using optical character recognition (OCR) and machine learning

- Match payments to invoices automatically

- Flag short-pays, deductions, or disputes

- Identify exceptions requiring review

- Provide real-time visibility into aging and cash flow

This reduces manual effort and accelerates cash application, helping teams manage collections more proactively.

Month-end close

AI supports reconciliations, identifies anomalies, and reduces time spent on manual matching.

Cash flow forecasting

Machine learning models highlight trends in payment timing, customer behavior, and outstanding balances.

How to prepare your accounting team for AI

- Build skills in automation tools and financial systems

- Shift toward advisory, analysis, and compliance-focused roles

- Strengthen understanding of GAAP, IRS rules, audits, and controls

- Use AI-generated outputs with proper review by a human

- Develop communication skills for guiding stakeholders

Accountants who embrace AI typically become more productive, efficient, and valuable.

Conclusion

In summary, AI is transforming accounting by:

Automating repetitive tasks

Improving accuracy and highlighting anomalies

Accelerating cash application and other workflows

Supporting better forecasting

Freeing accountants to focus on strategic, advisory work

AI will not replace accountants, but it will transform how they work. It’s taking over repetitive accounting tasks in accounts receivable, allowing professionals to focus on strategy, risk management, and high-value decision support. The future of accounting is human-plus-AI.

Explore Quadient AR solutions to eliminate manual matching, cut exceptions, and give your team more time for high-value work. Request a free demo.

Frequently Asked Questions

Will AI ever fully replace accountants?

No. AI automates tasks, but accountants are needed for judgment, compliance, and strategic decision-making.

Which accounting tasks are most likely to be automated?

Manual tasks such as data entry, payment matching, reconciliations, anomaly detection, and report drafting.

Will AI reduce accounting jobs?

Routine processing roles may shrink, but advisory, analysis, and compliance roles continue to expand.

Is AI accurate enough for accounting?

AI is dependable for structured tasks but needs human oversight to prevent compliance issues or misinterpretation.

How can accountants stay relevant?

Accountants can develop their advisory and analytical skills. They should also strengthen their regulatory knowledge, and use automation tools to eliminate manual tasks, forcing them to concentrate on more strategic tasks.