How to calculate accounts payable days

Accurate accounts payable (AP) accounting is critical to any successful business. Knowing how to calculate accounts payable days and the AP turnover ratio can help you ensure that the money owed by your company is accounted for and paid in a timely manner. This article will explain both metrics, why they are important, how to calculate accounts payable days for your business, and how to interpret them.

What are accounts payable days/days payable outstanding (DPO)?

Accounts payable days, also known as days payable outstanding (DPO), is a financial ratio that indicates the average number of days it takes your company to pay its bills. DPO is typically calculated quarterly (90 days) or annually (365 days).

Generally, a higher accounts payable days number is better because it means you have more cash on hand for short-term investments and increasing your working capital. That said, a high number can also be a warning sign that the organization is unable to pay its bills on time. A lower number can indicate that your business is not taking full advantage of the payment terms offered by your suppliers. For example, if payment is due in 60 days, but you pay the invoice in 30 days, you could have been earning interest on the funds for the additional 30 days.

Ideally, DPO should maintain a balance between paying vendors on time and ensuring there’s sufficient cash flow.

Why is calculating accounts payable days/DPO important?

Accounts payable days/DPO is a valuable metric for evaluating efficiency and productivity in accounts payable. Calculating accounts payable days/DPO is important because it provides a detailed picture of a company's financial obligations to its suppliers. This information can help businesses effectively manage their cash flow and make strategic decisions about when to pay their bills to reduce the average time spent on budgeting. .

Businesses that accurately track their accounts payable days can avoid late fees and penalties, which can negatively impact their bottom line. Having a clear understanding of accounts payable can help businesses negotiate favorable payment terms with suppliers and maintain positive relationships with them. Calculating accounts payable is crucial for maintaining financial stability and ensuring the smooth operation of a business.

How to calculate accounts payable days/DPO

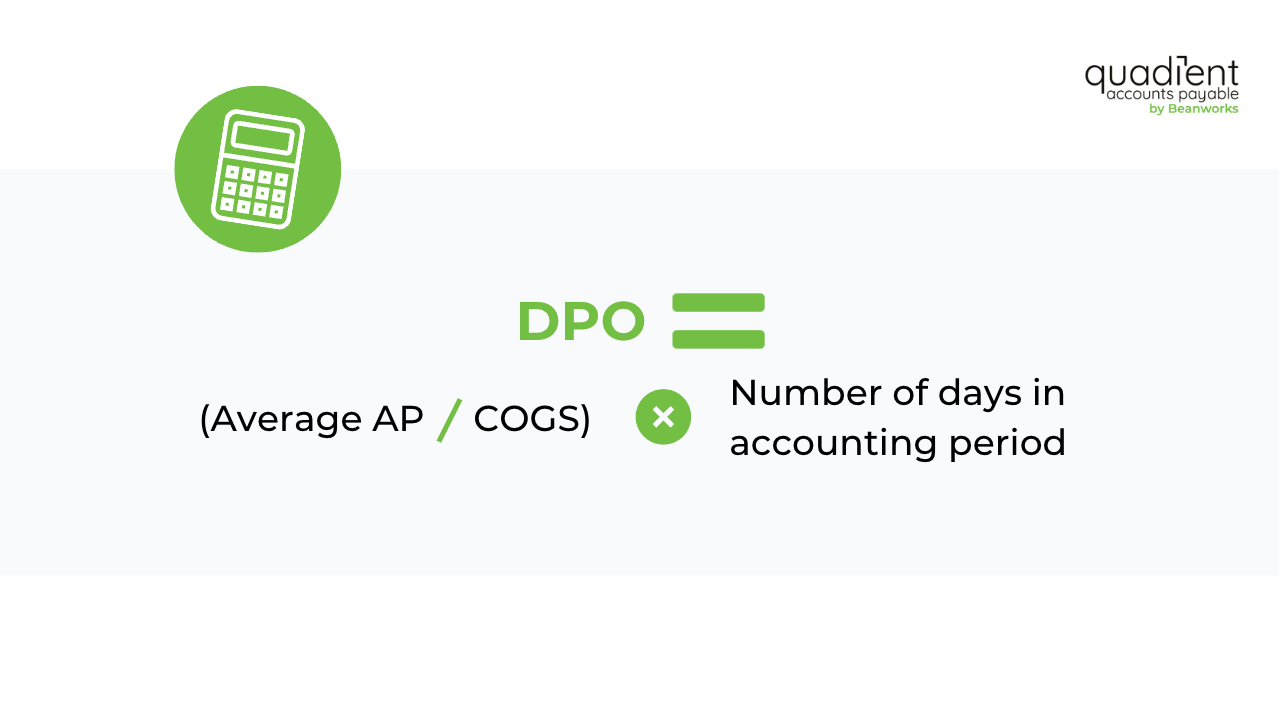

Accounts payable days/DPO is calculated by taking standard accounting figures over a defined period to calculate the average cycle time for outbound payments.

To calculate DPO, divide your average accounts payable by the cost of goods sold (COGS). Then multiply the result by the number of days in the accounting period, where COGS = beginning inventory + purchases – ending inventory.

Many AP automation solutions, like Quadient AP by Beanworks, feature financial dashboards that offer insights into critical AP statistics, including pending invoices and payments, the sum of all new invoices and payments, and total monthly and daily expenses. The software compares data to the last 30 days and computes the difference, giving businesses a comprehensive view of their financial health.

All information is automatically updated as the platform processes transactions and other financial data. It breaks down the total volume of invoices, purchase orders, payments, and expenses processed daily.

What is the AP turnover ratio?

The accounts payable turnover ratio, or payables turnover, quantifies the rate at which a company pays its suppliers during a given period. It indicates how efficiently a business is at paying its suppliers.

The AP turnover ratio is useful for identifying payment issues. Additionally, creditors can use it to evaluate a business’s historical payment patterns.

Why is the AP turnover ratio important?

The accounts payable (AP) turnover rate is an important financial metric used to analyze a company's ability to manage its cash flow effectively. This ratio can provide valuable insights into the company's financial health and efficiency. A higher AP turnover rate is generally seen as a positive sign, indicating that a company pays its bills quickly and efficiently.

An efficient AP turnover rate is important for several reasons:

- It helps to maintain good relationships with suppliers by demonstrating that a company is a reliable and timely payer. A good relationship with suppliers can help ensure a steady supply of goods and services and potentially favorable pricing and terms.

- An efficient AP turnover rate helps improve a company's cash flow and working capital. By paying suppliers quickly, a company can avoid late fees and penalties and maintain good credit ratings, which can lead to lower financing costs in the future. This can free up more cash to invest in growth opportunities, such as expanding the business or launching new products and services.

How to calculate the AP turnover ratio

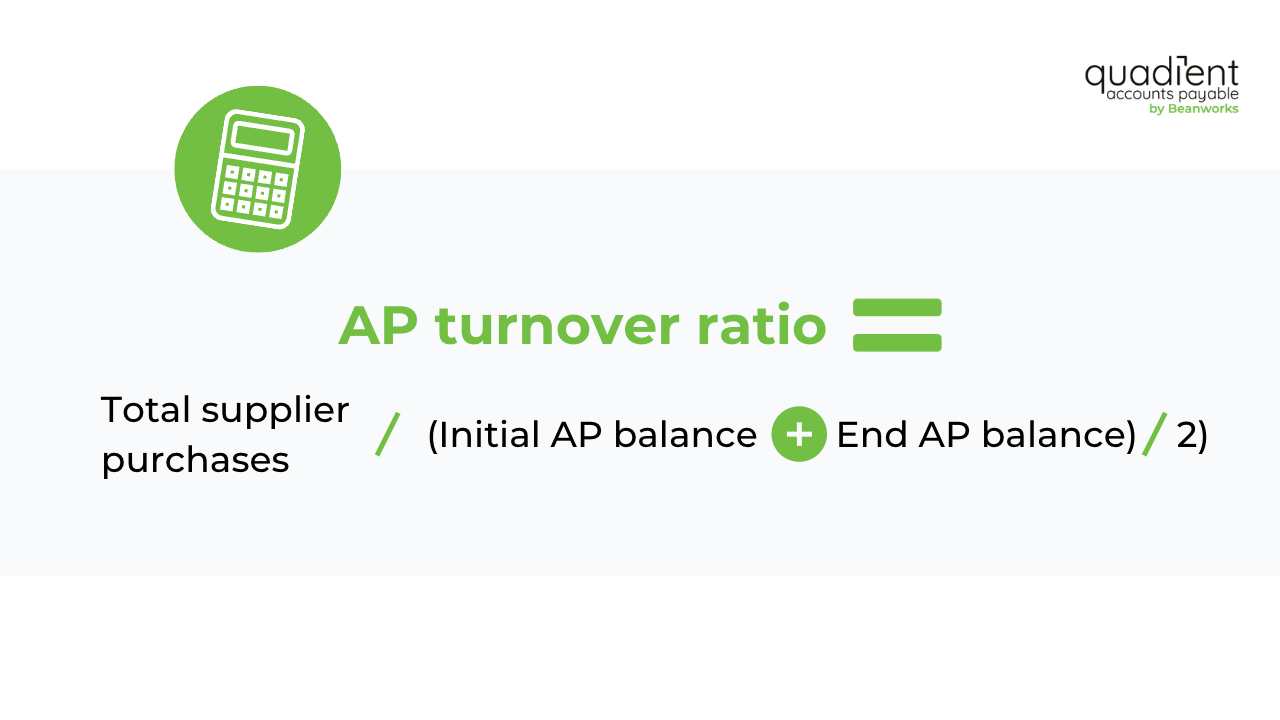

- Add the accounts payable balance at the start of the period to the accounts payable balance at the end of the period to determine the average accounts payable for the period. Divide the resulting number by 2 to get the average accounts payable.

- Determine the total supplier purchases for the period and divide that number by the average accounts payable for the period.

What’s the difference between DPO and AP turnover ratio?

Both DPO and the AP turnover ratio are financial metrics used to determine a company's ability to manage its accounts payable. While both measure the time it takes a business to pay its bills, they use different units of measurement: DPO is measured in days, while the turnover ratio is measured in years.

How to interpret DPO and the AP turnover ratio?

Interpreting financial metrics such as DPO and AP turnover ratio can help businesses and investors understand a company's overall financial health and efficiency.

Here are some key factors to consider when interpreting these ratios:

- A low DPO and AP turnover ratio may indicate that a business is having difficulty paying its suppliers; however, it could also mean that the business is paying invoices strategically to keep cash in hand as long as possible.

- A high DPO and AP turnover ratio indicates that a business pays its suppliers promptly, possibly to take advantage of early payment discounts. It may be used to negotiate more favorable credit terms in the future.

- DPO and AP turnover ratios vary by industry or company size, as larger businesses typically have more negotiation power to delay when payments are due.

- Both metrics are most useful when analyzed over time to identify trends.

How to improve your DPO and AP turnover ratio

AP automation solutions, like Quadient AP by Beanworks, make monitoring and improving your DPO and AP turnover ratio easier.

Quadient AP automation offers real-time dashboard reporting, supporting CFOs to design and track KPIs that are tailored to AP workflows — from purchase orders (POs) and invoices to payments and expenses. Users can easily customize metrics to support specific requirements or goals. Since data is automatically extracted and stored in one place, it is conveniently accessible to everyone.

All information is automatically updated as the platform processes transactions and financial data. The software provides the total volume of invoices, purchase orders, payments, and expenses processed each day. These accounts payable tools streamline:

- The number of invoices, payments, and expenses processed within a specific timeframe

- The value of transactions

- The dollar amount of pending invoices, payments, and expenses

What accounts payable days mean for your financial strategy

DPO and AP turnover ratio are important financial metrics that can provide valuable insights into a company’s financial health and cash flow management. By measuring the efficiency of a company’s accounts payable process, businesses can identify opportunities for improvement and better manage their cash flow, often by reassessing the tools and workflows that support day-to-day operations.

It’s important to note that a low DPO and high AP turnover ratio may not necessarily indicate poor financial health, as each industry and business has unique financial needs and circumstances. However, by regularly monitoring these ratios, companies can make more informed decisions, strengthen their financial performance, and support long-term success. Contact us today to learn more.