Introduction

As businesses grow, their finance teams face increased pressure in managing accounts payable (AP). What starts as a manageable workflow can quickly become chaotic without the right systems in place. Scaling accounts payable with manual processes leads to slow cycle times, errors, and strained vendor relationships. That’s where payment automation comes in.

Payment automation enables businesses to scale their payable cycle efficiently. By eliminating manual data entry and streamlining approval workflows, it reduces human errors and payment delays while improving visibility and control.

Let’s explore how automating your AP process helps your company grow stronger and smarter.

What is the accounts payable process?

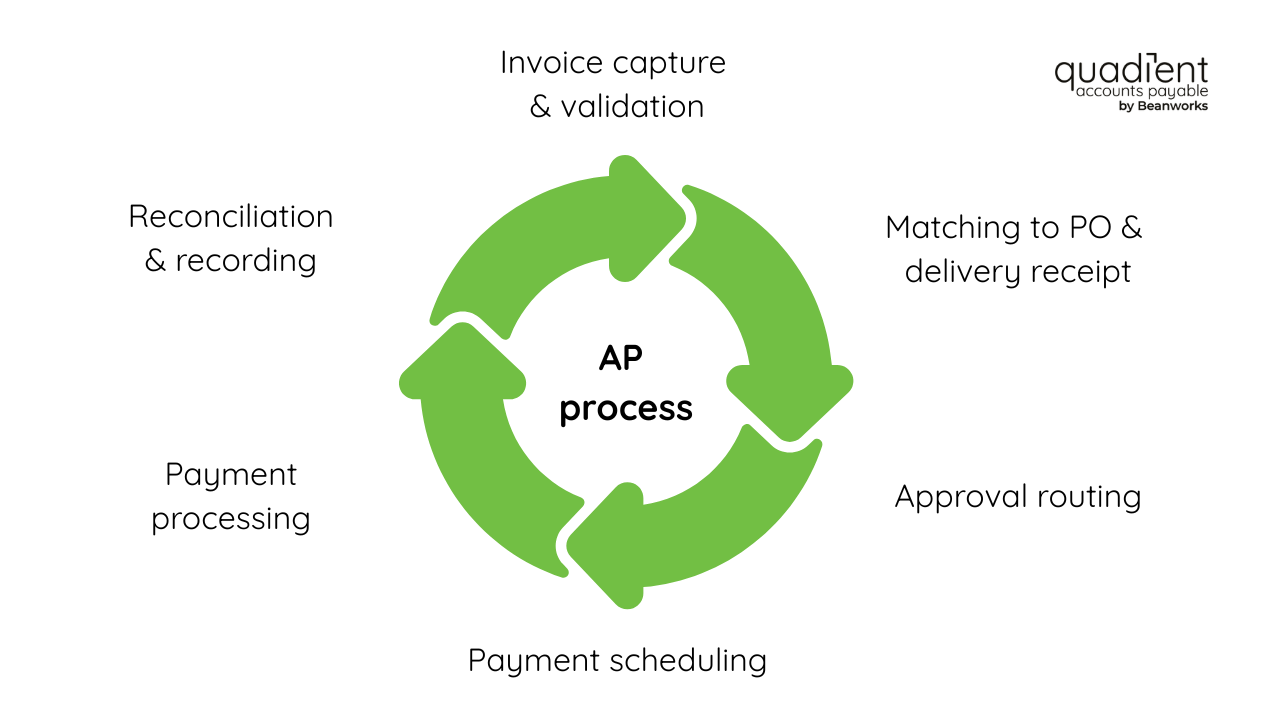

The accounts payable process includes a complete cycle of tasks that start with receipt of vendor invoices and end with payment.

Here are the key steps:

- Invoice capture and validation

- Matching invoices to the purchase order and delivery receipts

- Approval routing

- Payment scheduling

- Payment processing

- Recording entries in the general ledger and reconciling against the balance sheet

Each of these steps demands accuracy, speed, and a secure audit trail. When managed manually, that’s a tall order.

Why scaling AP is challenging

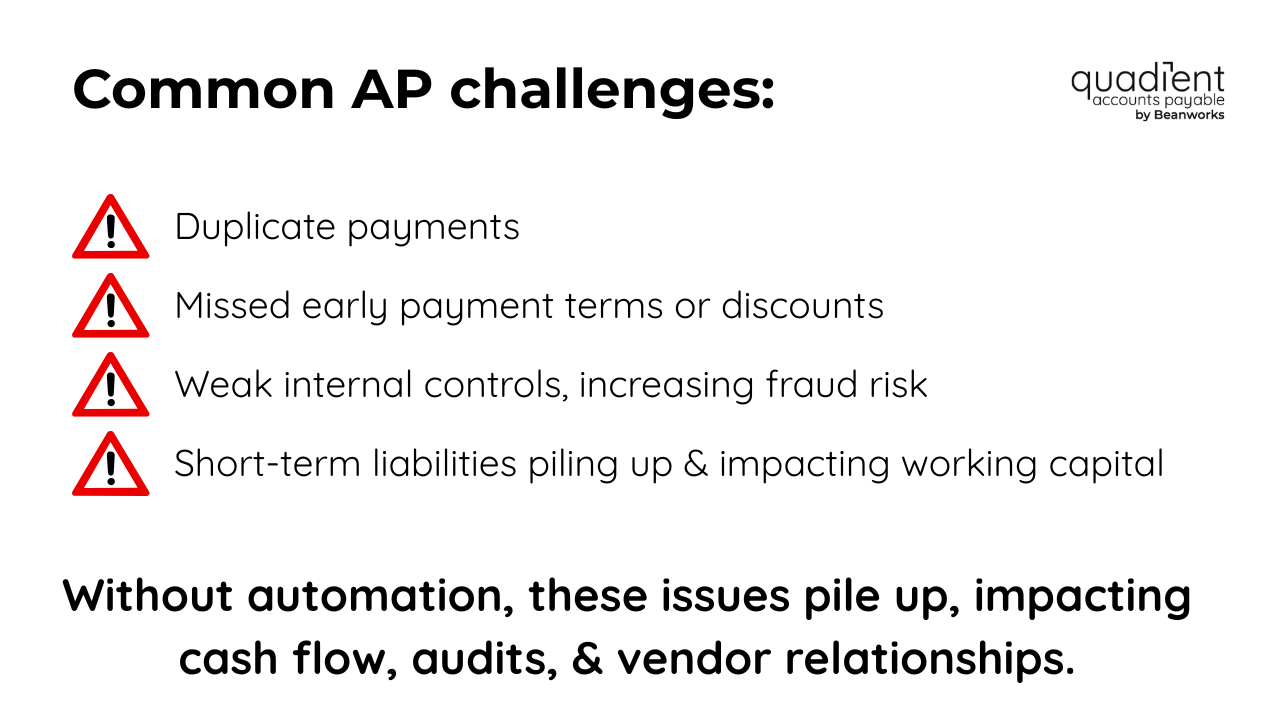

As your company grows, AP becomes more complex. More vendors. More invoices. More GL codes. More approval steps.

Common challenges include:

- Duplicate payments

- Missed early payment terms or discounts

- Weak internal controls, increasing fraud risk

- Short-term liabilities piling up and impacting working capital

Without automation software, these issues compound, affecting your cash flow, audit readiness, and vendor relationships.

What is payment automation?

Key features of payment automation

Payment automation uses software to handle AP tasks such as invoice approval, payment workflows, and reconciliation. It’s part of complete invoice management and ties into your ERP systems or accounting tools.

Key features include:

- AI invoice capture using Optical Character Recognition (OCR) technology

- Automated three-way matching

- Approval workflows with built-in segregation of duties

- Multiple payment options, such as ACH, virtual cards, and checks

- Fraud detection and alerts

- Real-time analytics and invoice tracking

Tools that power automation

The best tools plug into your current systems, whether it’s QuickBooks, Sage, or a custom ERP.

Look for:

- Cloud-based setup

- Smart workflows

- Centralized vendor portals

Explore Quadient’s AP automation solutions to see how this looks in action.

How automation improves the AP workflow

Fewer manual touchpoints

AI and OCR eliminate the need for manual entry. Invoices go straight into the system, get coded, and are routed to the right approver. This reduces errors and saves time.

Greater visibility and control

Track invoices in real time. Know where each one stands. Get a complete audit trail. Fix issues fast and stay compliant.

Scalable, remote-ready teams

Finance teams can work from anywhere without losing speed or control.

Business benefits of scaling AP with automation

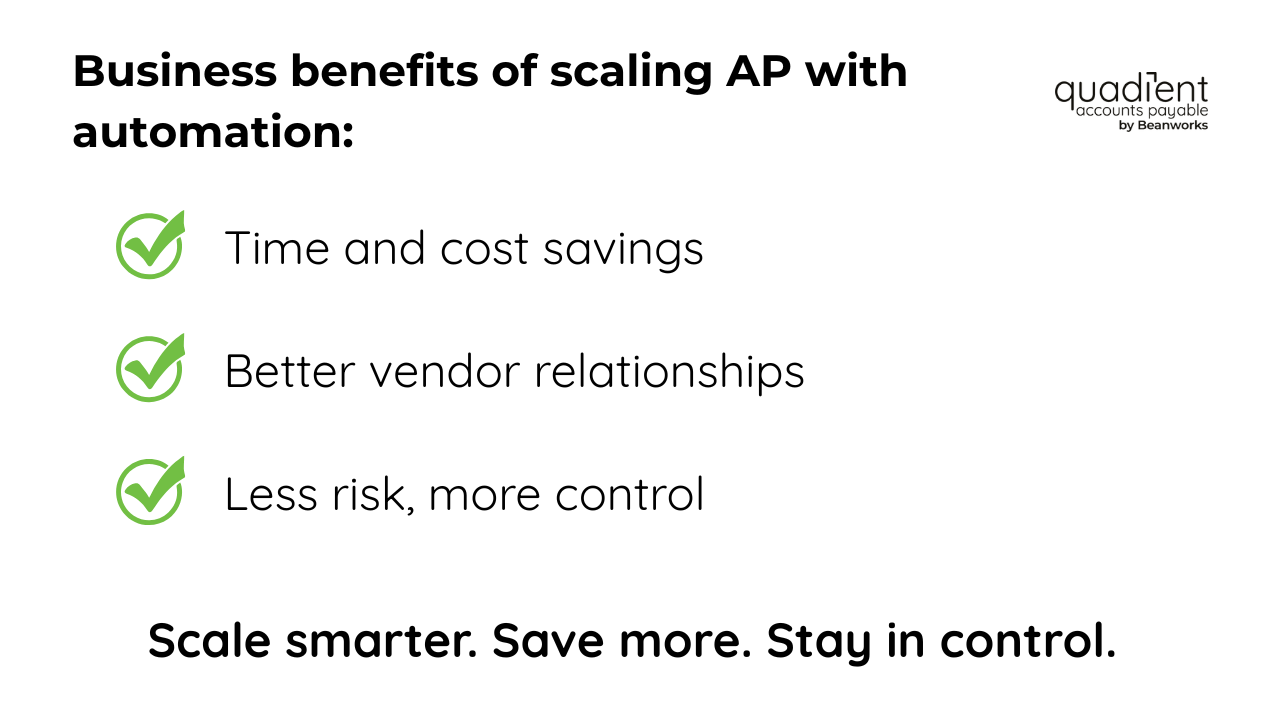

Save time and money

Cut out repetitive work. Approve invoices faster. Reduce late fees. Improve Days Payable Outstanding (DPO). Boost EBITDA.

Better vendor relationships

Pay on time. Get early payment discounts. Build trust with suppliers.

Less risk, more control

Stop fraud with built-in checks. Only pay when all documents match. Be ready for audits at any time.

How to implement AP automation for scalable growth

Step 1: Review your process

Where are the delays? Are you using paper or email? How many invoices get stuck in the approval process?

Step 2: Choose the right tool

Pick software that integrates with your ERP, supports multiple payment methods, and includes AI features like invoice capture and matching.

Explore Quadient’s guide to automated invoice processing for help making the right choice.

Step 3: Roll out in phases

Start with invoice capture. Then expand to complete payment processing. Involve finance, IT, and AP from the beginning.

Key takeaways

- Manual accounts payable doesn't scale. Payment automation does.

- Automation reduces errors, saves time, and cuts costs

- A centralized AP workflow improves cash flow, audit readiness, and vendor satisfaction

- Choosing the right AP automation tool that integrates with your current systems is critical

- Start with invoice capture and approval and grow into full automation

Conclusion

Automating your AP process isn’t just a tech upgrade. It’s a business strategy. You protect cash flow, reduce risk, and free your finance teams to focus on what matters.

Explore Quadient’s AP automation to take the first step.