Introduction

Accounts receivable (AR) is an asset and a critical part of any business. It represents money owed to your business by customers who purchased goods or services on credit. As a number, it appears in your financial statements, and from an operational perspective, accounts receivable is a critical customer-facing department. In this article, we will break down the difference between assets and liabilities and why AR is a central business asset.

The nature of accounts receivable

Definition of accounts receivable

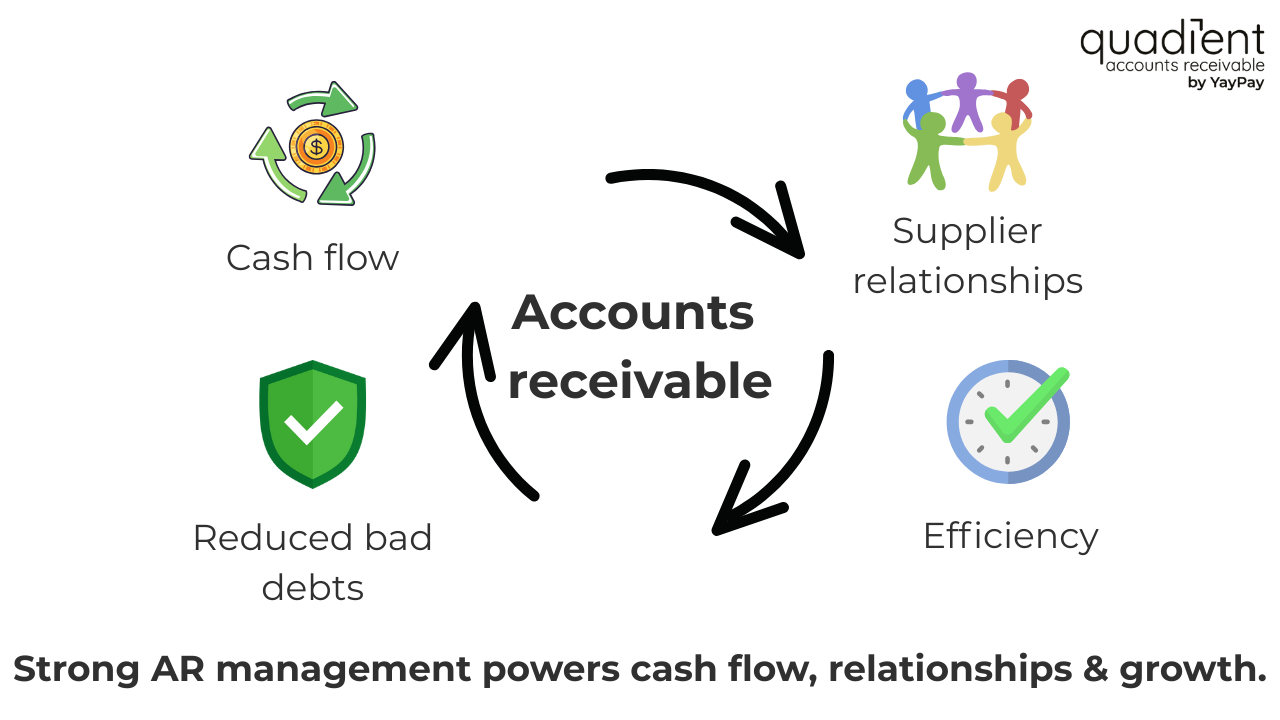

Accounts receivable are a critical component of a healthy financial ecosystem for businesses worldwide. A well-managed accounts receivable department offers several benefits to a company, including improved cash flow, reduced bad debts, enhanced supplier relationships, and more efficient operations.

How accounts receivable works

Accounts receivable is the process by which a business tracks and collects money owed by its customers for goods or services delivered on credit. When a company sells a product or service without immediate payment, it generates an invoice that details the amount due, payment terms, and the due date. The AR process involves recording the invoice in the accounting system, monitoring outstanding balances, sending reminders, and following up on late payments.

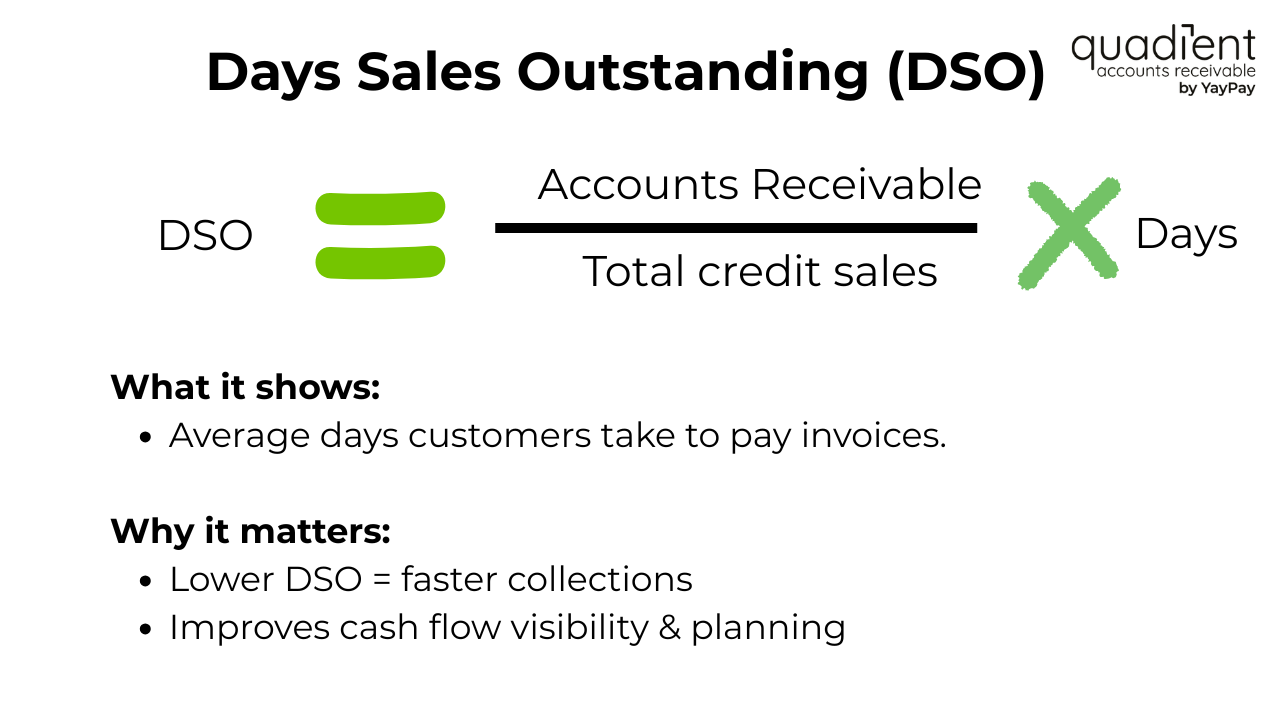

Effective AR management also includes handling disputes, applying received payments accurately, and reporting on receivables performance using metrics like Days Sales Outstanding (DSO). The goal is to ensure timely cash inflows, minimize bad debt, and maintain strong customer relationships, while providing finance teams with visibility and control over the company’s incoming cash flow.

Classification of accounts receivable

Why AR is considered an asset

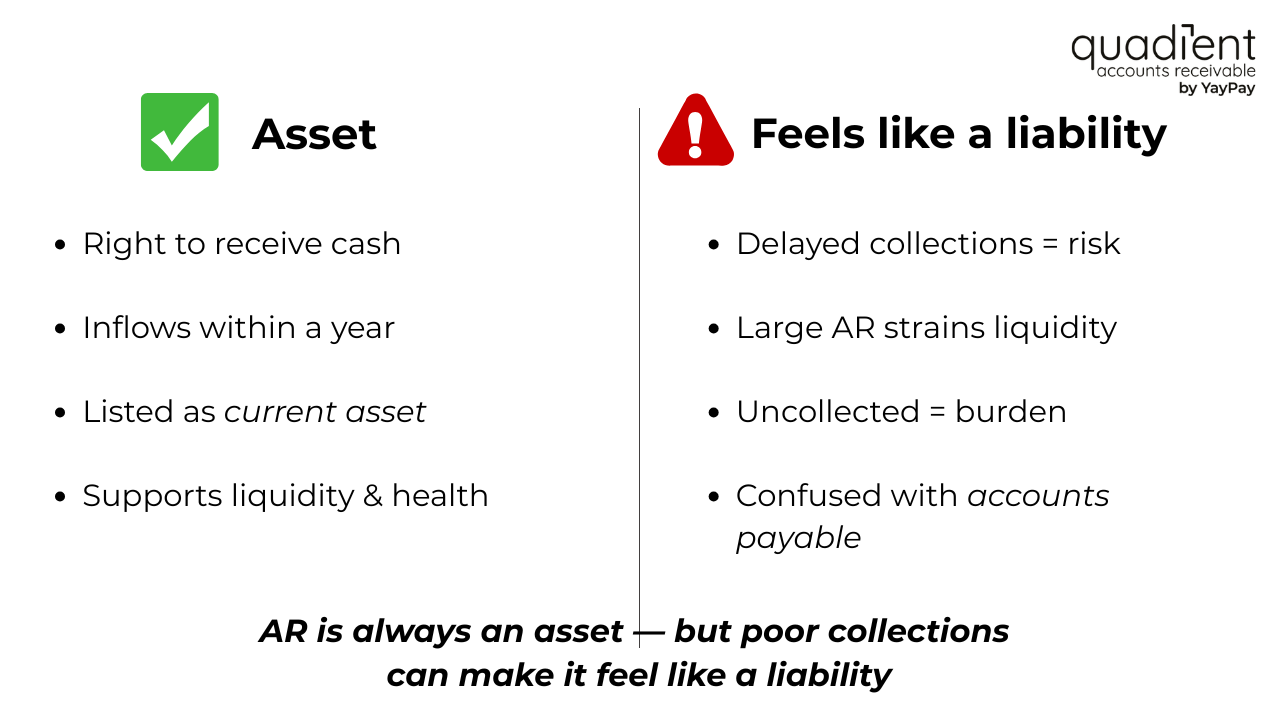

An asset is something your business owns that has economic value – something that can contribute to your financial health now or later. Accounts receivable are an asset because they represent cash that your business is expected to collect in the future.

In accounting terms, AR is recorded as a current asset, which means you expect it to convert into cash within a year. Current assets represent the resources your business has on hand to meet immediate obligations and fund operations. This category also includes cash, inventory, and short-term investments.

Common misconceptions about AR as a liability

On the balance sheet, AR is always an asset because it represents the legal right to receive cash. However, from a management perspective, if it’s not collected promptly, it can feel like a burden, which is why some categorize it as a “liability.”

It also feels like money owed, since the word “owed” is usually linked with liabilities (like accounts payable), people sometimes assume AR is a liability too. And from a cash flow perspective, a large AR balance with poor collections may behave like a liability, even though it’s technically an asset.

AR and accounts payable (AP) are two sides of the same transaction: a customer’s AR = a vendor’s AP.

Risks associated with accounts receivable

Bad debt risks

Bad debt risk is one of the biggest concerns in AR management. It is the possibility that customers who purchased on credit will not pay their outstanding invoices, either partially or in full. When this happens, the receivable must be written off as a bad debt expense on the income statement, reducing profitability.

Collection costs and challenges

Collecting AR isn’t just about sending invoices; it comes with both costs and challenges that can erode profitability if not managed well. Some of these costs may include: staffing, administrative, technology, financing, legal, and recovery expenses.

Impact on cash flow

Even if receivables are eventually collected, delays can create short-term cash shortages, and businesses may need to borrow to cover expenses, increasing financing costs.

Effective management of accounts receivable

Streamlining invoicing processes

Having good processes in place is essential for effectively managing your accounts receivable. You need clear credit policies, accurate and timely invoicing, an efficient collections process, and you must monitor and track your accounts.

Leveraging automation tools

Implementing an accounts receivable automation platform for invoicing, reminders, and online payment options is one of the most significant steps you can take, as this reduces manual errors and accelerates the cash conversion cycle. According to a PYMNTS.com survey, 87% of companies with automated AR functions process more quickly.

Setting credit policies

Having clear credit policies is also crucial to effective AR management. You need to define who gets credit, how much, and under what terms, and run credit checks before extending terms to reduce bad debt risk.

Key metrics for monitoring AR performance

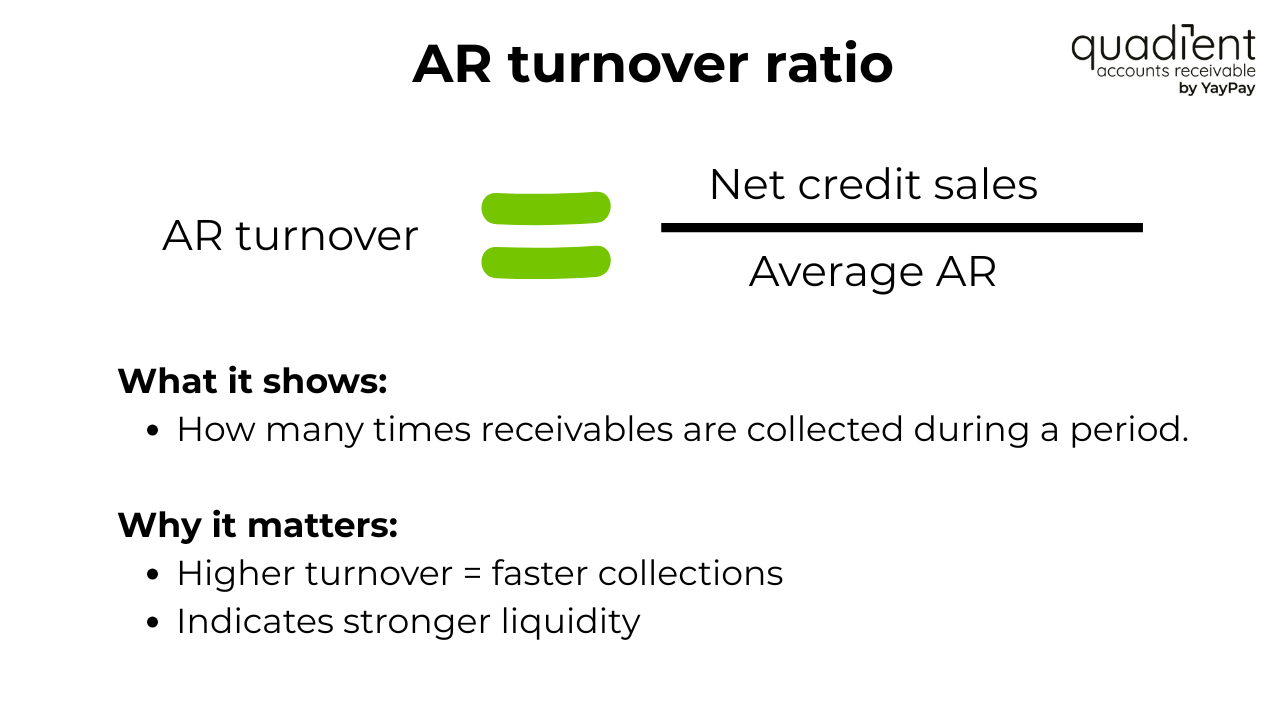

Accounts receivable turnover ratio

AR turnover = Net Credit Sales / Average accounts receivable

What it shows: How many times AR is collected during a period.

Why it matters: Higher turnover = faster collection and stronger liquidity.

Days Sales Outstanding (DSO)

DSO = (Accounts receivable / Total credit sales) x Number of days

What it shows: The average number of days it takes customers to pay invoices.

Why it matters: A lower DSO = faster collections and better cash flow.

Benefits of proper accounts receivable management

Enhanced cash flow

A proper AR management structure is critical for faster collections, which means cash is available sooner for operations, payroll, and investments. This also prevents “cash crunch” situations, where profits appear good on paper but the money isn’t in the bank.

Stronger customer relationships

A proper accounts receivable management structure is also critical for maintaining a business's financial health. When done well, it improves liquidity, strengthens customer relationships, and reduces risk. Clear, accurate invoicing and reasonable payment terms build trust. A structured but respectful collections process maintains positive relationships while ensuring timely payments are received.

Conclusion

Accounts receivable is a current asset that plays a crucial role in a business's health. While it is always listed as an asset on the balance sheet, its actual impact depends on how quickly and consistently receivables are converted into cash. Effective management requires clear credit policies, accurate invoicing, structured collections, and the right technology to reduce delays and errors.

Appropriately handled, AR supports steady cash flow, strengthens customer relationships, and creates the financial flexibility to invest in growth. Left unmanaged, it can lead to cash shortages, higher costs, and greater risk. For any business, the takeaway is simple: treat accounts receivable not just as a number in your reports, but as a critical asset that deserves attention and discipline.