Introduction

In finance's ever-evolving landscape, a remarkable transformation is underway in handling accounts payable (AP). This shift is akin to a revolution, and its driving force is AP automation – particularly the process of automated invoice handling.

This article discusses the top ten benefits of automated invoice processing and how it works. We’ll also share five steps to automate the invoice process.

What is automated invoice processing?

Automated invoice processing, often called digital invoice processing, involves using sophisticated software to make handling AP tasks more efficient and streamlined. It replaces cumbersome manual processes with automated workflows, reducing the need for human intervention. Automated invoice processing software harnesses the prowess of Artificial Intelligence (AI), Machine Learning (ML), and Optical Character Recognition (OCR).

The top ten benefits of automated invoice processing

- Boosted efficiency: At the heart of automated invoice processing lies a remarkable boost in efficiency. Automating time-consuming manual tasks allows employees to focus on more strategic aspects of the AP process.

- Less manual data entry: Say goodbye to the monotony of manual data entry when processing invoices. Automated systems drastically minimize the need for manual data input, significantly decreasing the potential for errors in the process.

- Smooth approvals: The often complex and time-consuming AP process involves multiple approval stages. Automated workflows ensure a seamless flow of approvals, eliminate bottlenecks and speed up the overall process.

- Quicker payments: Automated invoice processing leads to faster invoice approval and payment. This positively impacts cash flow by ensuring timely settlements.

- Precise payments: Automation ensures accurate payment calculations, reducing financial errors.

- Greater accuracy: The transition from manual to automated processes eliminates the human error element. This leads to more accurate financial data and reliable records.

- Error prevention: Duplicate payments and overpayments can be detrimental to a company's financial health. Automated validation mechanisms prevent such errors, safeguarding financial resources.

- Increased visibility: Automated invoice processing provides real-time visibility into the payment cycle. Stakeholders gain insights into each invoice's status, enabling better decision-making.

- Timely payments: Late payments hurt the bottom line. Automated reminders ensure on-time payments. This fosters strong business relationships and benefits your bottom line.

- Lower labor costs: Manual invoice handling is labor-intensive and costly. Automation reduces labor expenses, letting you allocate resources more efficiently.

Now, let's explore how these automated invoicing benefits can be further enhanced through related strategies:

- Modern Invoice Delivery Methods: Leveraging modern invoice delivery methods can complement the efficiency of automated invoice processing, enhancing overall AP operations. Learn more about modern invoice delivery methods.

- Client Document Portals: Enhance collaboration and communication with clients by integrating document portals into your automated invoicing system. Discover the advantages of client document portals.

- Payments with Invoicing Solutions: Seamlessly integrate payment options into your automated invoicing software to expedite payment processing and improve cash flow management. Explore the benefits of payments with invoicing solutions.

- Electronic Invoice Presentment and Payment: Optimize the invoicing process by incorporating electronic invoice presentment and payment capabilities, ensuring swift and secure transactions. Understand the advantages of electronic invoice presentment and payment.

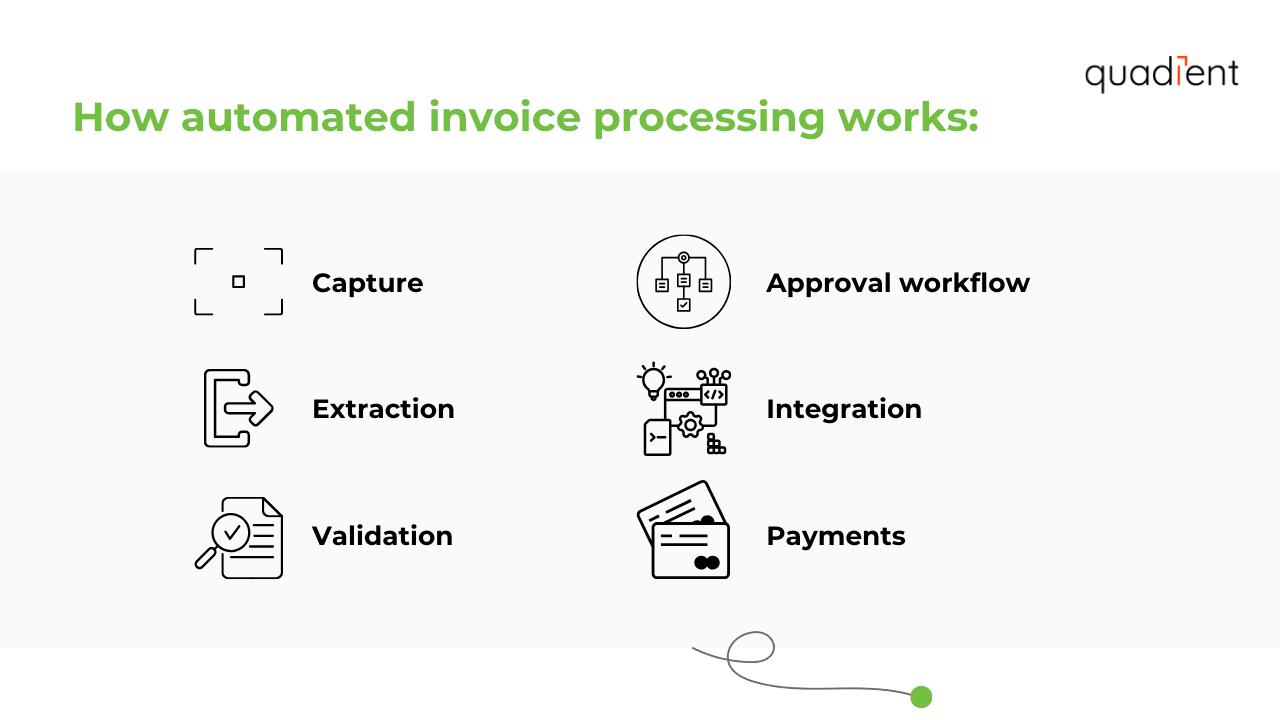

How does automated invoice processing work

Automated invoice processing is like having a friendly robot that organizes and manages your invoices without breaking a sweat.

Here's the scoop in simple terms:

1. Capture: The process begins with your robot (software) scanning incoming invoices for essential details.

2. Extraction: The robot extracts vital information from the invoices, such as the invoice number, date, items purchased, amounts, etc.

3. Validation: The robot ensures that the extracted information matches your records and business rules. If there's an error, it flags it for your attention.

4. Approval workflow: The robot facilitates your company's approval process. It knows who needs to review and approve the invoice before payment.

5. Integration: Once the invoices are approved, your robot syncs the data with your accounting or ERP system.

6. Payments: Finally, your robot helps schedule and track payments, making sure bills get paid on time.

Five steps to automate invoice processing

Step 1: Select the right invoicing software

The first and most crucial step is choosing the right invoicing software for your business. Research the options and select the solution that best suits your business needs. Consider the software’s features, integration capabilities, scalability, and pricing.

Step 2: Customize your invoices

Tailor your invoices to reflect your brand's identity. Software, like Quadient Impress Invoice, allows you to customize templates with your company's logo and colors.

Step 3: Ensure data security and compliance

Data security is crucial when transitioning to digital invoicing. Choose software that guarantees robust security measures and adheres to data protection regulations, ensuring your sensitive information is well-protected

Step 4: Integration for smooth sailing

Find invoicing software that seamlessly integrates with your other applications, such as Enterprise Resource Planning (ERP) and accounting systems. This integration eliminates duplication of efforts and maintains consistency across platforms.

Step 5: Embrace digital transformation

As technology advances, adopting digital invoicing becomes essential for your business's competitiveness and customer satisfaction. It's not just about cost savings; it's about streamlining processes and enhancing your business operations.

Solutions like Quadient Impress Invoice don't require complex IT setup. This software easily integrates with your existing systems and even allows you to add personalized marketing messages to your invoices. It also simplifies other customer communications, making your invoicing journey smoother than ever.

Conclusion

The evolution from manual invoice processing to automated systems marks a pivotal step in modernizing accounts payable processes. The digital transformation brought about by automated invoice processing has tangible benefits - streamlined workflows, heightened accuracy, and significant cost savings. Embracing this innovation propels businesses into the digital era, fueling efficiency and cultivating growth.