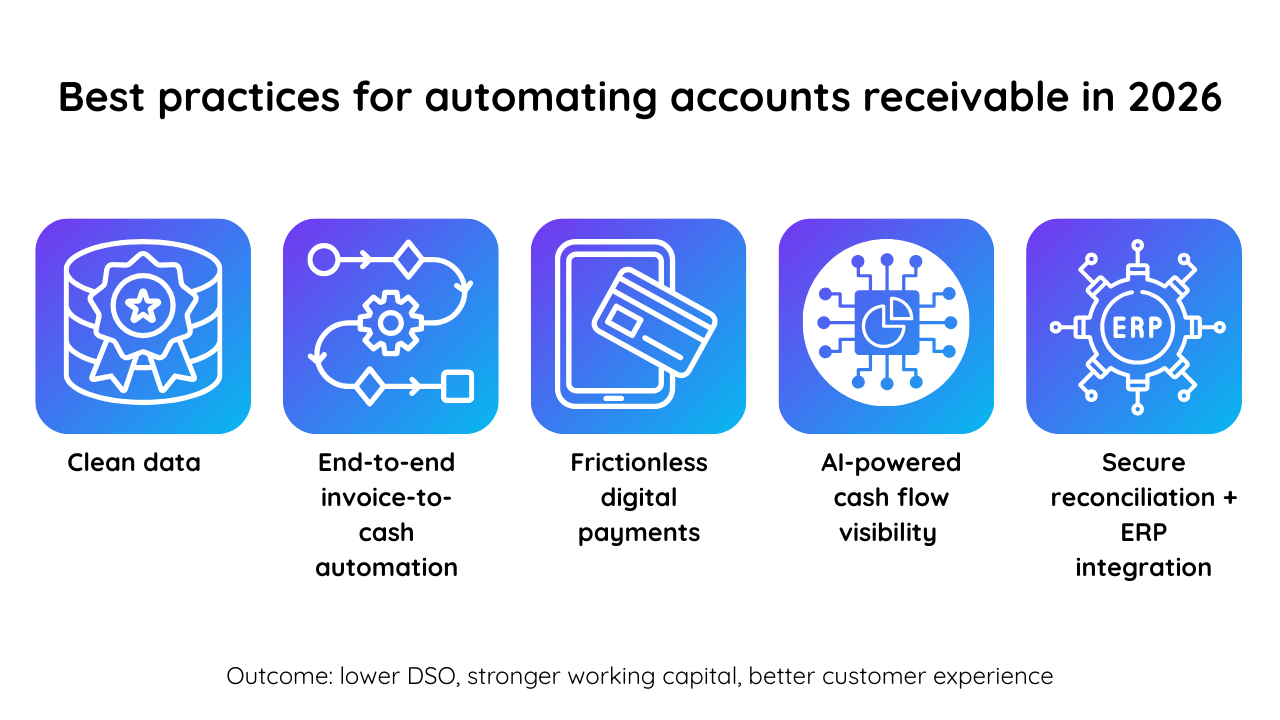

Short answer: In 2026, automating accounts receivable (AR) is becoming the norm as GenAI and smart data have elevated the field to new highs. Best practices include clean data, end-to-end invoice-to-cash automation, frictionless digital payments, AI-powered smart cash flow visibility and payment prediction, and automated reconciliation integrated with enterprise resource planning (ERP) systems. These help finance teams reduce days sales outstanding (DSO), and eliminate manual tasks.

Why automating accounts receivable is a no-brainer in 2026

AR directly impacts cash flow, and the better your AR workflows are, the easier it is to collect cash.

In 2026, as invoice volumes keep rising and payment methods multiply, automating AR is the easiest and simplest way to move forward. Customers are demanding and they have come to expect self-service payments and a smoother customer experience, when, at the same time, finance leaders need real-time visibility into cash flow.

The global AR automation market was valued at USD 3.40 billion in 2025, and North America accounted for 44.9% of the market. This reflects how quickly finance teams are investing in automation to improve performance and cash flow.

Automating AR reduces manual follow-up so teams can focus on more strategic tasks.

Best practices for automating accounts receivable in 2026

1. Ensure you start with (really) clean data

To begin, make sure that your data is accurate. This can be a complex endeavor but it is absolutely necessary. Check that customer information, invoice data, credit limits, credit policies, and account history are accurate across your ERP system and customer relationship management (CRM) platform.

2. Automate the entire invoice cycle

The biggest automation gains come from the automation of the full invoice-to-cash cycle. Automating one of the steps is a good start, but you shouldn't stop there.

Best practice is to automate:

- Invoice generation, invoice validation, and invoice delivery

- Invoice workflows and workflow automation

- Automated payment reminders and dunning sequences

- Dispute resolution, escalation and follow-up

- Payment portals, payment gateways, and electronic payment processing

- Cash application, payment matching, and payment reconciliation

- Account reconciliation

Solutions like Quadient AR Automation are built for end-to-end receivables management, so teams do not have to patch multiple automation solutions together.

3. Make payments as simple as possible for your customers

Customers pay faster when paying is easy.

In 2026, the best practice is to support:

- Customer portals for self-service payments

- Payment links embedded in all your invoices and reminders

- Offering multiple payment methods, such as credit cards, ACH, and electronic check deposits

- Setting up payment plans for selected customers

These all improve customer experience, reduce the likelihood of inbound questions, and quickly shorten your cash cycle.

4. Use automated reminders that sound human

Automated reminders work best when they are both timely and respectful.

Modern collections management is a combination of:

- Automated reminders triggered by invoice status and payment behavior

- Dunning sequences that are automatically adapted based on detected risk

- Clear, tailored, messaging to support customer satisfaction

Sounding human also helps your organization to keep communication consistent and reduce unnecessary escalation.

5. Use AI and machine learning to better predict

In 2026, AI and machine learning are used for:

- Payment prediction and predictive payment insights

- Cash flow forecasting and cash flow optimization

- Credit scoring, credit risk monitoring, as well as credit limit recommendations

- Fraud detection and fraud pattern recognition, which is becoming more and more important as AI leads to an increase number of fraud attempts

AI-powered dashboards help finance leaders make better decisions and improve cash flow visibility across the invoice-to-cash process.

6. Strengthen cash application and automated reconciliation

Cash application is one of the most expensive manual AR tasks.

Best practices include:

- Automated payment matching

- Automated reconciliation across invoices and remittance advice

- Optical character recognition (OCR) to capture remittance data

- Lockbox processing and virtual mailbox workflows

This reduces manual effort and improves accuracy.

7. Embed compliance and security into AR workflows

Automation should reduce risk, not create new risks.

Best practices include:

- Embedded compliance controls and disclosure records

- SOC 2-aligned security and audit trails

- Secure payment management and payment processing

- Controls for dispute resolution, approvals, and write-offs

Strong security protects customer information and supports long-term trust.

8. Integrate AR automation into your tech stack

Best practice is to ensure integration with:

- ERP tools (ERP sync)

- CRM platforms for shared customer context

- Payment gateways and payment processing providers

- The broader vendor ecosystem

Quadient AR Automation supports fast deployment and integration, helping businesses modernize AR without replacing core ERP systems.

Manual vs. automated AR outcomes

Metric | Manual AR | Automated AR (2026) |

|---|---|---|

Days sales outstanding (DSO) | Higher and inconsistent | Significantly lower and predictable |

Invoice processing time | Slow with errors | Fast and accurate |

Cash flow visibility | Limited or delayed | Real-time, predictive |

Manual tasks | High volume | Significantly reduced |

Customer experience | Reactive | Frictionless and self-service |

What makes Quadient AR Automation better

Quadient AR Automation supports:

- End-to-end automation in AR

- Cloud-based automation solutions across invoice-to-cash processes

- Embedded AI and ML for cash flow visibility and payment prediction

- Customer portals and payment portals that improve customer experience

- Automated collections and dispute resolution workflows

- Secure, compliant operations aligned with SOC 2 expectations

“The software is so simple and easy to use. Customers love the ability to pay online. They’re done in seconds!”

— Mehmet Shah, Director of Finance, StackAdapt.

The platform is built for finance leaders who need speed, visibility, and control.

Final thoughts

Best practices for automating AR in 2026 come down to three things: end-to-end automation, customer-first payments, and smarter decisions powered by AI.

When those pieces work together, the results are clear. DSO improves. Working capital positions improve. Teams spend less time chasing payments. Customers get a better experience.

Ready to modernize your AR and improve cash flow?

Explore Quadient AR Automation to see how end-to-end invoice-to-cash automation, embedded AI, and customer-friendly payment workflows can help you reduce DSO, improve cash flow management, and strengthen collections performance. Request a demo to see how it works.

Frequently Asked Questions

What are best practices for automating accounts receivable in 2026?

Best practices for automating AR in 2026 include using clean, reliable data; automating the full invoice-to-cash cycle; enabling self-service digital payments; using artificial intelligence for cash flow visibility and payment prediction; and improving cash application through automated reconciliation integrated with ERP systems.

What does it mean to automate accounts receivable?

Automating AR means using technology to streamline tasks such as invoice delivery, payment reminders, payment tracking, collections, cash application, and payment reconciliation with less manual effort.

How does AR automation improve cash flow?

AR automation improves cash flow by shortening the cash cycle, improving payment behavior, reducing disputes, and lowering DSO.

What metrics should finance leaders track in 2026 when it comes to AR?

Key metrics include DSO, the aging report, the collections effectiveness index, the bad debt ratio, and the accounts receivable turnover ratio.

How is AI changing accounts receivable management?

AI is a new powerful technology, it supports predictive analytics, payment prediction, credit scoring, fraud detection, and AI-powered dashboards for improved cash flow visibility.

Can AR automation integrate with ERP systems?

Yes. Leading AR automation platforms support ERP sync and integration with ERP systems, CRM platforms, and payment gateways.