Introduction

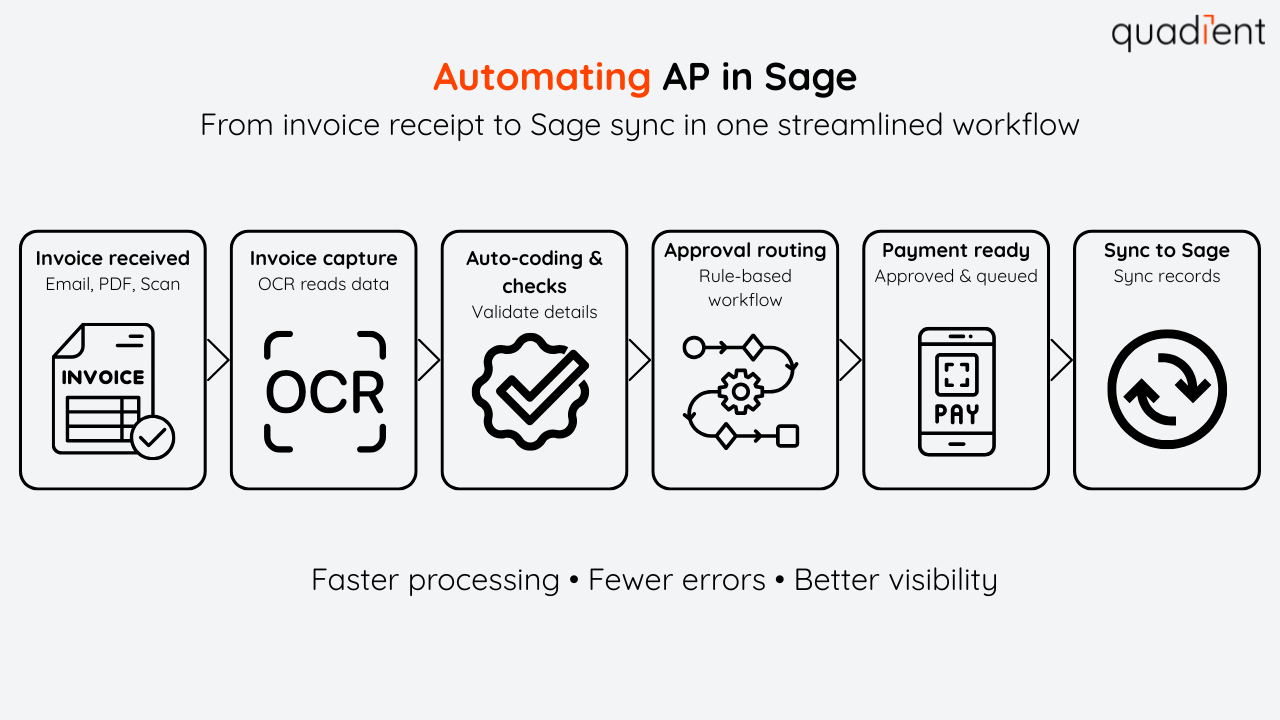

Sage is an enterprise resource planning (ERP) platform developed by The Sage Group, based in the UK (in Newcastle). Sage is the ERP choice for more than 6 million businesses in the world (Sage). When you add accounts payable (AP) automation to Sage, the platform allows you to process invoices in a much easier way through the reduction of manual data entry.

In this article, we’ll walk you through what Sage offers, why AP automation matters (especially now), and how to get started with integration.

What to know about Sage ERP

Sage offers a family of several ERP products (like Sage 50, Sage 100, Sage 300, Sage X3, and Sage Intacct) that combine accounting, inventory as well as payroll inside a single system. Each can be deployed on-premises or in the cloud and they are used across many industries.

Sage also works well with third-party AP automation tools, so you can move faster and keep better control over invoices and approvals.

What are the main features of Sage 100 and Sage 50?

Sage 50 and Sage 100 both cover the essentials, but they’re essentially built for different types of teams. Here’s a quick look at their core features:

Sage 100 ERP features

- Core accounting: Manage general ledger, accounts receivable (AR), AP, and bank reconciliation.

- Payroll and time tracking: Run payroll and track employee time.

- Inventory and distribution: Track inventory, process orders, and support e-commerce workflows.

- Customer relationship management (CRM) and customization: Manage customer relationships and tailor Sage 100 with built-in tools and integrations.

Sage 50 ERP features

- Invoicing and AP/AR: Create invoices, track customer payments (AR), and manage vendor bills (AP).

- Cash and expense management: Monitor cash flow and record expenses.

- Inventory and job costing: Track inventory and job costs to understand profitability.

- Payroll and reporting: Process payroll and generate real-time financial reports.

- Bank reconciliation: Reconcile bank transactions and match payments to invoices.

| Category | Sage 100 ERP Features | Sage 50 ERP Features |

|---|---|---|

| Core Accounting | Manage general ledger, accounts receivable (AR), accounts payable (AP), and bank reconciliation | Create invoices, manage AR/AP, and reconcile bank transactions |

| Payroll | Run payroll and track employee time | Process payroll and generate real‑time financial reports |

| Inventory & Costing | Track inventory, process orders, and support distribution & e‑commerce workflows | Track inventory and job costs to understand profitability |

| Cash & Expense Management | — | Monitor cash flow and record expenses |

| Order & Distribution Management | Full inventory, order processing, and distribution tools | Basic order and inventory tracking |

| CRM & Customization | Built‑in CRM tools and customization options using integrations | — |

| Reporting | Standard and customizable reporting via Sage tools | Real‑time financial reports and reconciliation tools |

Why should you automate accounts payable in Sage?

Manual AP processes in Sage (and in general) are slow and come with a high risk of human error. Entering invoices by hand takes (a lot of) time and is very risky. Typos, lost invoices, duplicate payments, or missed due dates are common, and you need to implement complex processes to protect your workflows. Paper invoices and email approvals often turn into follow-ups, delays, and “who has this invoice?” painful conversations. It makes it harder to see the status of payables at a glance, and planning becomes less reliable. Fraud risks are also higher.

AP automation solutions for Sage

Quadient AP automation for Sage

Sage AP Automation, powered by Quadient, helps you capture invoices electronically, automatically send them to the right approvers, and track everything in one place. You also get a clear audit trail, which makes it easier to stay organized at month-end and audit-ready year-round. Visit the Quadient Sage AP Automation integration page for more details.

Some of the most popular AP automation tools that integrate with Sage:

- Quadient

- MineralTree

- Stampli

- Tipalti

- AvidXchange

The best solution for your business depends on multiple parameters. Consider your volume of invoices, how complex approvals are for you, your reporting needs, and whether you manage multiple entities.

Does Sage have native AP automation?

Sage Intacct offers more built-in automation, but Sage 50, 100, and 300 typically require an add-on for a paperless AP workflow. Most teams that use these Sage versions use an add-on tool to automate invoice capture and approvals.

How to set up AP automation in Sage

How to get started, step by step:

- Start by evaluating your AP workflow: From this analysis, try to define your needs: Look for the slow (and painful) points, like invoice entry, approval delays, or missing documentation.

- Select the right AP automation tool: Choose a solution that is compatible with your version of Sage and meets your requirements but also shines at easing the most painful points you have uncovered. Consider factors such as entity management (some solutions do not support multiple entities), a complex approval chain, or special reporting needs.

- Connect the tool to Sage: Set up the integration between Sage and the AP software (often via an API or connector). This allows vendor, GL account, and invoice data to sync between the systems.

- Configure workflows and permissions: Define how invoices will flow through the new system. Set up routing rules (for example, by department, invoice amount, or vendor) and assign user roles so each approver only sees the invoices they need to act on.

- Test and train your team: Test with a small batch of invoices to ensure everything works correctly. Then train your AP team and approvers so they're comfortable approving invoices in the new system.

What are the main advantages of automating AP in Sage?

- Reduce manual data entry: Invoice details can be captured automatically and sent into Sage, saving time and preventing errors.

- Increase accuracy and reduce fraud risk: Automation catches duplicate invoices as well as common mistakes. It also enforces consistent approval procedures and creates an audit trail. This greatly reduces the risk of fraud and errors.

- Speed up approvals and payments: Digital workflows eliminate the delays of paper or email approvals. Invoices are reviewed and approved faster, so vendors get paid on time and you avoid late fees.

- Improve visibility: See what’s been received, what’s waiting on approval, and what’s ready to pay so you can plan cash flow with fewer surprises, and make better decisions for the future of your business.

- Ensure compliance and audit readiness: Every approval is logged, and all documents are stored in one place, making audits and compliance much simpler.

Conclusion

For Sage users still handling AP manually, setting up an automation solution is a fast way to boost efficiency. It cuts down on data entry (and re-entry), speeds up approvals, and provides better visibility into payables and cash flow. Sage AP Automation, powered by Quadient, is one such solution. It provides digital invoice capture, automated approvals, and invoice tracking in a streamlined workflow alongside your Sage system.

Want to learn more about integrations? Please check related articles:

- Maximize SAP Business One with these powerful integrations

- Streamline your business with the best Acumatica ERP integrations

- Best Xero integrations: Tools, benefits, and setup tips

- Microsoft Dynamics 365 integrations: tools, advantages, and how to implement

- Sage Intacct integrations made simple: Best tools, their benefits, and top tips for setting them up