Introduction

SAP Business One is a well-known German ERP platform globally launched in 2004. It is optimized for small and midsize businesses (SMBs) and is used by more than 80,000 organizations in the world. SAP Business One offers better control and visibility for SMBs. As with most ERP systems, integrations represent a strategic way to extend SAP Business One's capabilities and to automate workflows, reduce manual tasks, and connect the ERP to the different tools your teams already use every day.

This article details the main integration options, why they matter (now more than ever), and how solutions like Quadient AR Automation help SMB teams work much more efficiently (with up to 403% ROI according to Quadient analyst studies).

What is SAP Business One?

SAP Business One (SAP B1) is an ERP system developed by the giant tech company SAP, it is built mainly for growing businesses. Like most ERP systems, it brings several key functions into one platform, including accounting, sales, CRM, purchasing, inventory, and manufacturing planning.

SAP B1's core capabilities include:

- Financial management

- Customer and sales management

- Inventory and distribution

- Procurement

- Production planning

- Reporting

SAP Business One is widely used in manufacturing, distribution, retail, and e-commerce because it's flexible, can grow as your needs change, and is more affordable than enterprise ERP systems.

Why integrations matter for SAP Business One (and other ERP systems)

SAP Business One handles core ERP needs, but integrations can unlock much more efficient workflows. Without integrations, teams often rely on spreadsheets, manual uploads, or duplicated data entry. These, in turn, slow processes and are error-prone, with a constant risk of errors.

Integrations connect SAP B1 with CRM, e-commerce, payroll, banking, and reporting tools, so data flows automatically between systems. Orders, inventory levels, invoices, and payments stay in sync. Finance teams spend less time fixing data and more time on analysis, forecasting, and control. Reporting improves because SAP Business One becomes a reliable single source of truth.

For finance teams, the value of integration goes beyond efficiency. Integrated systems reduce manual journal entries, minimize reconciliation issues, and shorten the close cycle by ensuring transactions post accurately and on time. When data flows automatically between SAP Business One and connected systems, reporting becomes more reliable, and audit trails are easier to maintain. This also reduces reliance on spreadsheets, giving controllers greater confidence in the numbers and more time to focus on analysis, forecasting, and cash flow management.

When sales orders, invoices, and payments move automatically through the order-to-cash process, teams avoid the manual effort tax that slows order fulfillment and hurts customer satisfaction. Accurate, integrated data strengthens customer relationships by ensuring consistent billing, faster issue resolution, and better cross-departmental coordination.

Signs it’s time to integrate SAP Business One

Integrations become essential as a business grows and processes become more complex. Many teams start with SAP Business One running well on its own, but reach a point where manual work and disconnected systems create risk.

Common triggers include launching or expanding an e-commerce channel, where orders, inventory, and payments must stay in sync in real time. Managing multiple web stores, POS integration, and omnichannel requirements quickly exposes gaps between systems.

Integrations also become critical when companies add payroll, HCM, or payments platforms. Without integration, finance teams are left to manually reconcile payroll expenses, employee data, and cash movements.

Connecting payroll, workforce, and payments platforms to SAP Business One ensures employee, job, wage, and pay data flows accurately into finance, improving control and reducing manual handling.

If any of these scenarios apply, integration is a foundational requirement to maintain visibility, control, and efficiency as the business scales.

Understanding the SAP Business One Integration Framework (B1if)

SAP Business One integrates with other systems via the SAP Business One Integration Framework (B1if). This middleware enables data exchange between SAP B1 and both SAP and non-SAP systems.

B1if works with SAP HANA and Microsoft SQL Server and supports cloud, on-premises, and hybrid environments. It uses standard technologies such as APIs, XML, HTTP, and OData. Together with the DI API and Service Layer, B1if enables SAP Business One to securely send and receive data, manage mappings, and automate workflows between systems.

SAP B1if can also be part of a broader integration stack that includes SAP Data Services, ETL tools, and other API-based or .NET integration approaches to support more complex integration requirements.

Types of SAP Business One integrations

Integration scenarios

These are predefined or custom workflows that move data between SAP B1 and other systems. They are commonly used in dashboards, mobile apps, POS systems, e-commerce platforms, and automated processes such as order-to-invoice and inventory updates.

Integration Hub

The Integration Hub offers ready-made templates for popular cloud applications. This includes connectors to e-commerce platforms such as Shopify and Magento, as well as tools for payments, shipping, email marketing, and expense management. These templates reduce setup time and avoid custom development.

Subsidiary integration

This supports companies with multiple entities. Data can flow between SAP Business One systems used by subsidiaries and a central SAP ERP at headquarters. It enables standardized processes and consolidated reporting across regions or business units.

Intercompany integration

For businesses running multiple SAP B1 databases, intercompany integration automates transactions between them. This includes intercompany sales, purchasing, inventory transfers, and financial eliminations. It reduces manual reconciliation and speeds up the month-end close.

High-impact SAP Business One integrations

Accounts payable automation

AP automation eliminates paper invoices and manual entry. Invoices are automatically captured, validated, approved, and scheduled for payment in SAP B1. This improves accuracy, strengthens controls, and speeds up closing.

CRM integrations

Connecting SAP B1 with CRM systems such as Salesforce or HubSpot helps keep customer and sales data aligned. Sales and finance teams work from the same information, improving forecasting and the quote-to-cash process.

E-commerce and inventory sync

Integrations with platforms such as Shopify, WooCommerce, or Magento automate order creation and ensure accurate inventory levels across channels. This prevents overselling, speeds fulfillment, and improves customer experience.

BI and reporting tools

BI tools such as Power BI and Tableau integrate with SAP Business One to deliver real-time dashboards and insights. Controllers gain faster access to accurate financial and operational data without manual reporting.

Payroll and HR systems

Payroll and HCM integrations connect SAP B1 with tools like ADP or other platforms. Payroll entries, employee data, and labor costs sync automatically, reducing errors and simplifying reconciliation.

How to set up SAP Business One integrations

Most integrations are built using the SAP Business One Integration Framework with the DI API or Service Layer. Teams define what data moves between systems, map fields, set triggers, and test thoroughly before going live.

Many companies also work with certified SAP integration partners. Partners help with configuration, testing, security, and long-term support, especially for complex or finance-critical integrations.

Choosing the right integration approach

The right integration approach depends on how critical the workflow is to finance and cash flow.

Native SAP Business One Integration Framework (B1if) works well for simple, well-defined integrations. It’s a good fit when connecting one or two systems, handling standard data flows, and when internal teams can manage testing and ongoing maintenance.

Third-party integration tools are better suited to higher volumes and cloud-based environments, where monitoring and exception handling are more critical. They simplify error handling and help teams spot issues faster.

Integration partners are the safest option for finance-critical automation. When integrations affect invoicing, collections, revenue recognition, or audit readiness, partners help account for key process exceptions, implement robust controls, and reduce risk as transaction volume and complexity grow.

For finance teams, the goal is not just connectivity. It’s reliable automation that improves visibility, supports faster close, and protects cash flow. Choosing the right integration path early helps ensure SAP Business One remains a strong foundation for scalable financial operations.

Common mistakes to avoid

1. Treating integration as an IT-only project: Integrations directly affect cash flow, reporting accuracy, and financial controls. When finance teams aren't involved early, integrations often miss key requirements such as invoice timing, credit rules, or approval workflows. For example, an AR integration may push invoices into SAP Business One correctly, but fail to reflect payment status or dispute flags that finance relies on to manage collections. Integration decisions should be owned jointly by finance, operations, and IT.

2. Over-customizing before understanding process exceptions: Custom logic is often added to handle process exceptions, but excessive customization increases risk and maintenance effort. Many exceptions, such as partial payments, credit notes, or split shipments, can be handled with standard automation if planned in advance. Over-customization can also delay upgrades and make integrations harder to scale as transaction volumes grow.

3. Ignoring master data readiness: Automation relies on clean, consistent data. If customer records, item codes, tax rules, or payment terms are inconsistent in SAP Business One, integrations will amplify those problems. For example, mismatched customer IDs between SAP B1 and a billing or payments system can cause invoices to post incorrectly or prevent payments from reconciling. Data standardization should happen before integration, not after.

4. Failing to plan for process exceptions that affect cash flow: Process exceptions are where integrations are most likely to break down. Common examples include disputed invoices, partial payments, refunds, multi-currency transactions, or changes after an invoice is issued. If these scenarios are not mapped and tested, finance teams lose visibility and control. This is especially critical for accounts receivable, where missing or delayed data directly impacts cash flow and collections prioritization.

5. Weak monitoring and ownership of automated workflows: Automation without visibility creates risk. When invoices fail to sync, payments don’t post, or approvals stall, teams need immediate insight. Without alerts, dashboards, and clear ownership, issues surface late, often during close. Finance-led automation should include monitoring that shows what is processed, pending, and requires action.

6. Overlooking security and access controls: Integrations often require extended permissions. Without proper controls, sensitive financial and employee data may be exposed. Integration users should follow least-privilege principles, and access should be reviewed regularly, especially when using third-party automation platforms.

7. Treating integration as a one-time project: Business processes evolve. New payment methods, new sales channels, higher transaction volumes, and system upgrades all affect integrations. Without ongoing review, automation loses accuracy and value. Successful SAP Business One integrations are treated as part of a continuous improvement strategy, not a one-time deployment.

Benefits of integrating SAP Business One

Integrated systems deliver real business value:

- One set of accurate, real-time data across departments

- Fewer manual errors and less rework

- Time and cost savings through automation

- Stronger financial controls and audit readiness

- Scalability as the business grows

Conclusion

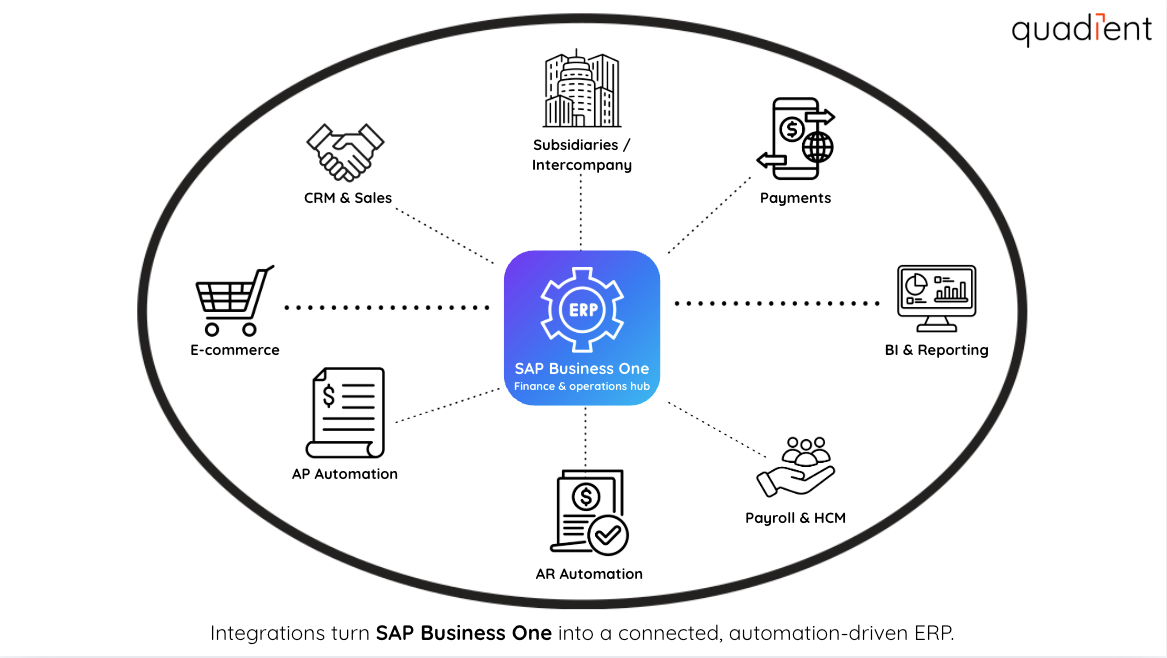

Integrations turn SAP Business One into a connected, automation-driven ERP. By eliminating manual work and improving data flow, businesses gain speed, accuracy, and visibility.

Solutions like Quadient extend SAP Business One by automating financial workflows, including accounts receivable. With integrated AR automation, teams gain real-time visibility, faster cash collection, and better collaboration across finance and operations.

Ready to reduce manual work and improve data flow? Explore SAP Business One integrations, including solutions from Quadient, built to automate financial and operational processes.

Want to learn more about integrations? Please check related articles:

- How to streamline your business with the best Acumatica ERP integrations

- Best Xero integrations: Tools, benefits, and setup tips

- How to automate accounts payable in Sage

- Microsoft Dynamics 365 integrations: tools, advantages, and how to implement

- Sage Intacct integrations made simple: Best tools, their benefits, and top tips for setting them up