Introduction

The invoice approval workflow in accounts payable (AP) plays a pivotal role in ensuring accuracy, compliance, and operational efficiency. By meticulously scrutinizing and authorizing invoices, this workflow safeguards against errors, fraudulent activities, and unnecessary expenditures. In this article, we delve into the crucial role of this workflow. We’ll cover the steps typically involved in manual invoice approval workflows, the drawbacks of manual processes, and the top seven benefits of automating this critical workflow.

What is the invoice approval workflow?

The invoice approval workflow is a series of steps that must be followed to authorize the payment of supplier invoices. This key accounts payable process typically involves verifying the information and obtaining the required approvals before remitting payment.

The AP invoice approval workflow is a control mechanism that not only maintains transparency and accountability but also facilitates timely payments to suppliers.

The typical manual invoice approval workflow

The key steps typically involved in the manual invoice approval process include the following:

- Receipt and review: Upon receipt of an invoice, AP staff verifies its authenticity and checks for discrepancies. They ensure the invoice contains the necessary information, such as vendor details, invoice number, date, description of goods or services, quantities, prices, and applicable taxes.

- Matching and validation: The next step is to match the invoice with the corresponding purchase order (PO) and/or receipt of goods or services. AP staff compare the invoice details with supporting documents to ensure they align. Any discrepancies or deviations are investigated and resolved by communicating with the relevant departments or vendors.

- Approval routing: Next, the invoice is routed for approval. Routing varies based on the organization's structure and hierarchy. Typically, the invoice is sent to the department or individual responsible for initiating the purchase to verify the accuracy and to approve the invoice if everything is in order. High-value invoices may require multiple levels of approval.

- Approval authorization: After the invoice has been approved, it is sent to the designated authority or manager within the AP department. This final approver ensures compliance with internal policies and procedures, assesses the financial impact, and confirms the availability of funds. If the invoice meets all the criteria, it is authorized for payment.

- Payment processing: Finally, the invoice is marked as approved and forwarded to the payment processing stage. The AP team manually enters the invoice details into the accounting system, updates the vendor's account, and initiates the payment. The invoice may be paid immediately or scheduled for payment on a specific date based on the payment terms.

It's important that organizations maintain a comprehensive audit trail of this process, documenting the individuals involved, dates of approval, and any comments or clarifications. This helps ensure transparency, accountability, and effective financial control. It also allows for easy retrieval of information during audits or in case of any discrepancies or disputes in the future.

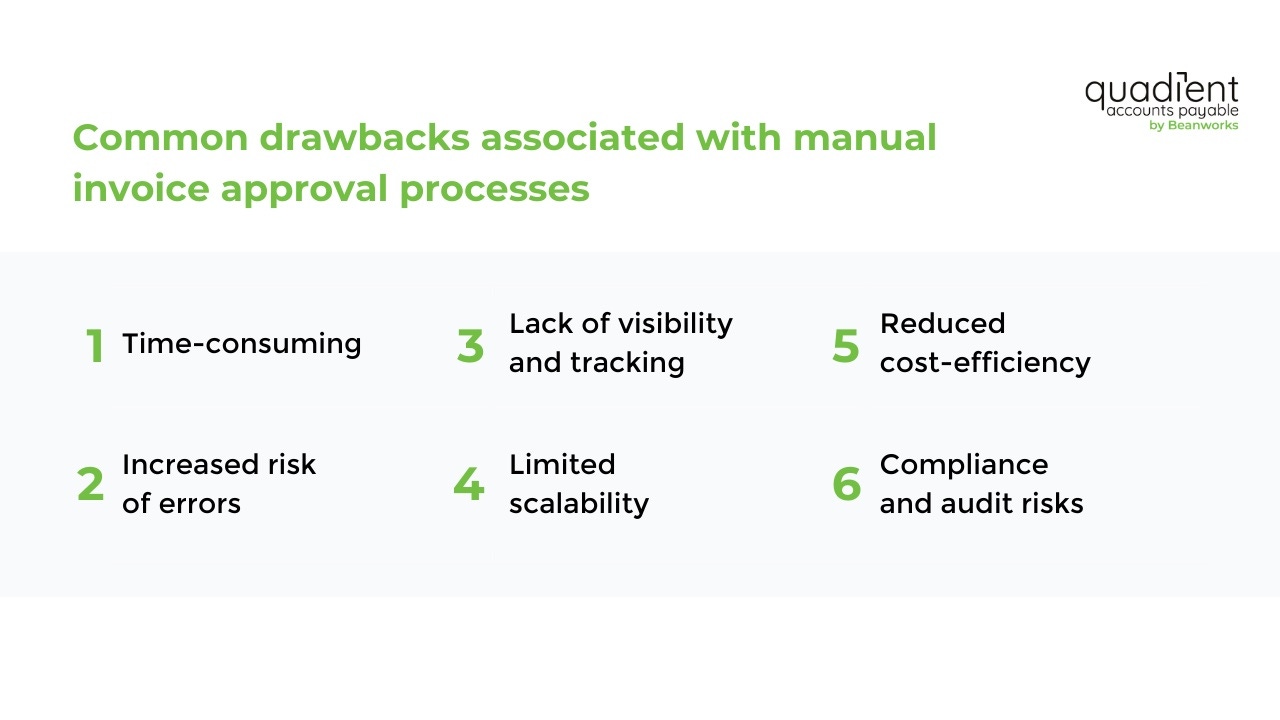

Drawbacks of manual invoice approval workflows

While manual invoice approval processes in AP are widely used, they come with several drawbacks that can impact efficiency, accuracy, and cost-effectiveness.

Here are some common drawbacks associated with manual invoice approval processes:

- Time-consuming: Manual processes require a significant amount of time and effort from AP staff. Each invoice needs to be manually reviewed, matched, and routed for approval. This can be especially burdensome for organizations that deal with a high volume of invoices, resulting in backlogs and late payments.

- Increased risk of errors: Human error is inherent in manual processes. Data entry errors, misplaced or lost invoices, and incorrect approval routing can happen. This can result in payment discrepancies and financial losses. Manual processes also make it harder to detect fraudulent invoices, increasing the risk of fraud.

- Lack of visibility and tracking: Manual invoice approval processes often lack proper tracking and visibility. It can be challenging to know the status of an invoice, who has reviewed or approved it, or if it's still pending. This can result in inefficiencies, difficulties in resolving issues, and a lack of transparency in the process.

- Limited scalability: Manual invoice approval processes become increasingly challenging to manage as organizations grow. A higher volume of invoices requires additional human resources, leading to higher costs and staffing constraints. Manual processes may struggle to keep up with the demands of a growing business and may hinder scalability.

- Reduced cost-efficiency: Manual processes can be costly due to the labor-intensive nature of tasks such as data entry, invoice routing, and physical storage of paper invoices. Errors and delays in the manual approval process can result in late payment fees, missed early payment discounts, and unhappy suppliers.

- Compliance and audit risks: Manual processes pose challenges in maintaining compliance with internal policies, industry regulations, and audit requirements. Inadequate documentation, inconsistent approval procedures, and difficulties in retrieving historical data can make audits time-consuming and prone to errors.

To address these drawbacks, many organizations are transitioning to automated AP systems that utilize technology such as optical character recognition (OCR), workflow automation, and electronic approvals. Automated solutions streamline processes, enhance accuracy, provide better visibility and control, and ultimately reduce the costs and risks associated with manual invoice approval.

The top seven benefits of automating the invoice approval workflow

Automating the invoice approval workflow offers several benefits to businesses:

- Time and cost savings: Automation reduces the time and effort required for approvals by eliminating the manual handling of invoices. This streamlines the process, allowing invoices to be processed quickly and accurately. It also reduces the need for paper-based documentation, saving costs associated with printing, mailing, and storage.

- Increased efficiency: Automating the invoice approval workflow ensures a consistent and standardized approach to invoice processing. It enables businesses to define and enforce predefined rules and workflows, reducing the risk of errors and bottlenecks. Automation software routes invoices to the designated approvers based on predefined criteria. This ensures faster processing.

- Improved accuracy: Manual invoice processing is prone to human error, such as data entry mistakes or missed approvals. Automation reduces these errors by automatically extracting data from invoices, validating them against predefined rules, and flagging any discrepancies. This ensures greater accuracy and reduces the likelihood of payment errors or compliance issues.

- Enhanced visibility and control: With automated workflows, businesses gain real-time visibility into the status of invoices, allowing them to track each invoice's progress and identify bottlenecks. This enables better control over the entire approval process and helps businesses make informed decisions.

- Stronger compliance: Automated invoice approval workflows help to enforce compliance with internal policies, regulatory requirements, and contractual obligations. By incorporating compliance rules into the automation software, businesses can ensure that invoices are reviewed by the appropriate stakeholders, mandatory approvals are obtained, and necessary documentation is attached. Thus reducing the risk of non-compliance and associated penalties.

- Improved vendor relationships: Faster invoice processing and payment cycles resulting from automation can enhance relationships with vendors and suppliers. Timely payments lead to improved vendor satisfaction, better terms, and potential discounts for early payment. Automation also facilitates smoother communication and dispute resolution, strengthening business partnerships.

- Enhanced analytics and reporting: Automated workflows generate valuable data and insights related to invoice processing times, approval rates, and bottlenecks. This data can be analyzed to identify inefficiencies, optimize workflows, and implement continuous improvement initiatives. Automation enables easier generation of reports and analytics, providing management with better visibility into financial metrics and supporting data-driven decision-making.

The right tool for the job

With AP automation software, like Quadient AP by Beanworks, you can establish customized approval channels for your team. The system sends regular reminders to individual approvers until a task is completed, ensuring that no invoices are forgotten. It allows you to define specific procedures for invoices, ensuring that each process has well-defined and distinct sets of rules.

The software provides enhanced security measures to safeguard companies against unauthorized access to financially sensitive documents and helps in segregating duties. It can be configured to include approval subsets and criteria for assigning different invoices. The customizable routing features also facilitate the creation of a digital audit trail, making all relevant information easily accessible for retrieval.

These tools serve as safeguards against late fees, fines, damaged supplier relationships, and the potentially substantial costs associated with fraud.

Conclusion

Automation is revolutionizing the invoice approval workflow in AP, bringing numerous benefits to businesses. Automation eliminates the drawbacks of manual invoice approval workflows, such as time-consuming processes, increased risk of errors, limited scalability, reduced cost-efficiency, and compliance and audit risks.

With the right automation software, businesses can streamline their invoice approval workflows, reduce costs and risks, and ensure timely and accurate payments while fostering better relationships with vendors and suppliers. Embracing automation is the key to unlocking the full potential of the invoice approval workflow and driving operational excellence in AP.