Introduction

When you're modernizing your finance operations, accounts payable (AP) is a smart place to start. It’s also where many businesses face a critical decision: should you automate your AP process or outsource it?

AP automation uses software to streamline the invoice-to-pay process, using tools like Optical Character Recognition (OCR) and artificial intelligence to accelerate invoice capture, reduce human error, and improve cash flow management. Outsourcing, by contrast, shifts these tasks to a third-party provider, often to cut costs and relieve internal teams.

Both approaches aim to save time, reduce errors, and lower costs—but how they achieve those goals, and the level of control you retain, differ significantly.

In this article, we’ll break down the core differences between AP automation and outsourcing, compare costs and ROI, explore when each is the right fit, and show you how to automate AP with Quadient.

Understanding the core differences of AP automation and outsourcing

At a glance, automation and outsourcing might seem like different routes to the same outcome, but in practice, they work very differently.

The biggest difference is control. With AP automation, your team stays in charge. The software handles tasks like invoice matching, purchase order matching, data entry, and approval routing, but your AP department directs the process. Outsourcing transfers that ownership to an external provider who manages processing, payments, and vendor communication.

The methods behind each are distinct, too. Automation is powered by technology: platforms that eliminate paper invoices, trigger automated workflows, and integrate directly with your ERP system. Outsourcing relies on human service teams, often overseas, who operate using their own tools and timelines.

This impacts integration as well. AP automation tools sync with your existing ERP to deliver real-time insights, automated approval workflows, and streamlined payment scheduling. Outsourcing typically introduces third-party portals and disconnected workflows, which can slow down processes and reduce visibility.

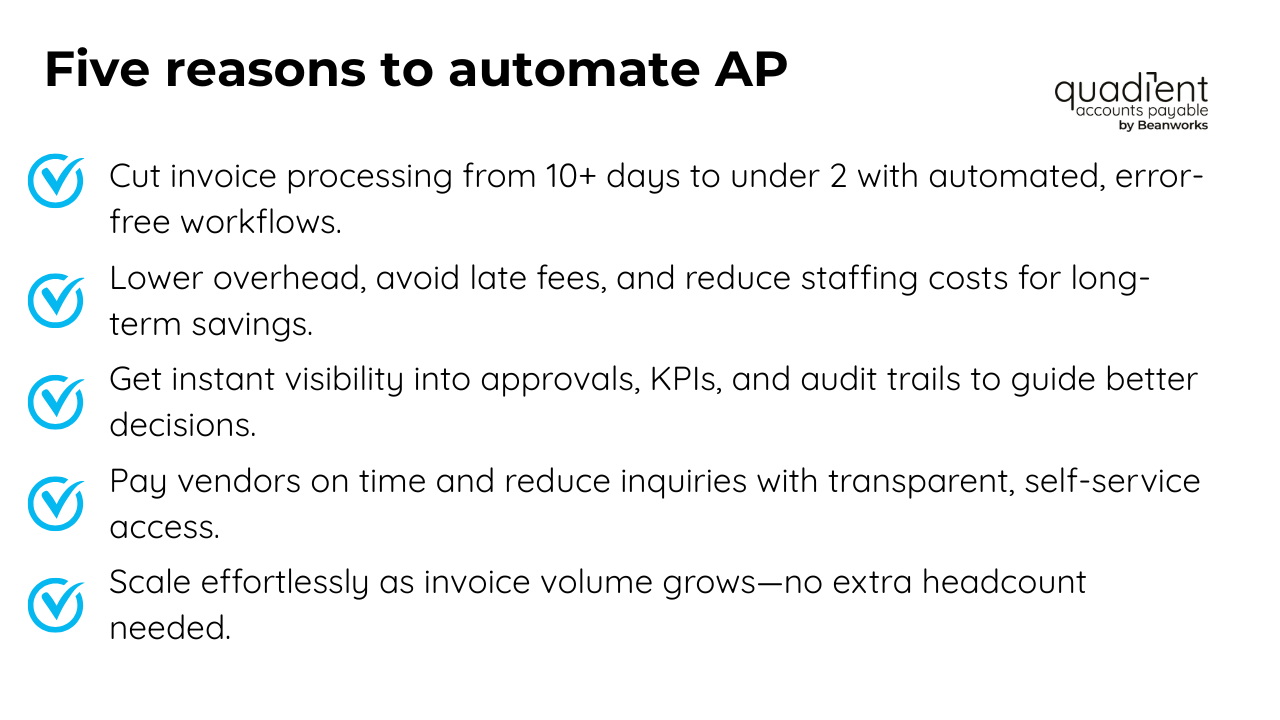

The key advantages of AP automation

If you're aiming for speed, transparency, and long-term cost control, AP automation delivers on all fronts.

Operational efficiency

With automation, processing cycles shrink from 10+ days to 2 or less. Your team avoids repetitive work like manual invoice submission, thanks to automatic invoice readers that extract invoice headers, invoice numbers, and other digital documentation instantly.

Cost savings over time

Though automation requires an upfront investment, it reduces long-term costs by:

- Eliminating late payment fees

- Reducing reliance on full-time AP staff

- Lowering payment processing overhead

- Supporting efficient payment methods like virtual cards or wire transfers

These efficiencies add up quickly, improving your return on investment.

Real-time data visibility and analytics

Automation platforms give you on-demand access to:

- Invoice status and approval timelines

- Key performance indicators

- Audit-ready reports for compliance

With real-time monitoring, data analysis, and detailed audit trails, you can spot bottlenecks, improve regulatory compliance, and make better business decisions.

Stronger vendor relationships

Timely, accurate payments build trust. With self-service portals, vendors can check status independently, reducing inquiries and strengthening your vendor management. This transparency also improves supplier relationships and vendor buy-in.

Ready to scale

As invoice volume grows, automation scales with you—no additional headcount needed. Most platforms integrate seamlessly with ERP and accounting tools, future-proofing your operations.

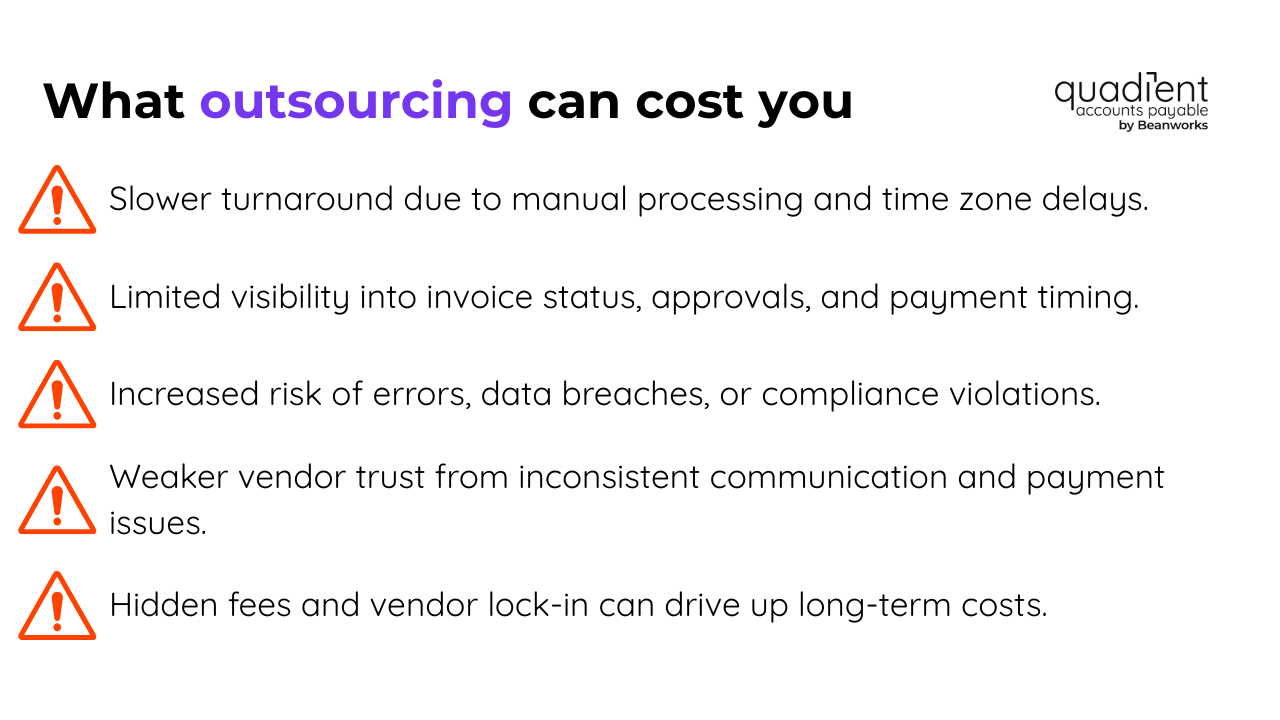

Challenges and risks of accounts payable outsourcing

Outsourcing can provide short-term relief, but it comes with trade-offs that may undermine long-term efficiency.

Potential short-term savings

It reduces labor costs and hiring pressure, especially for fast-growing companies or those with limited internal resources.

But… you lose visibility

Outsourcing often limits access to invoice information, slows response times, and creates barriers to real-time tracking.

Service-level gaps

Working across time zones can lead to delays, inconsistent exception handling, and missed SLAs—all of which can impact service quality and vendor trust.

Compliance and data security risks

Handing off sensitive financial data increases exposure to errors and non-compliance. If your provider lacks robust data encryption protocols, you may face risks related to tax compliance, fraud protection, and regulations like GDPR or SOX.

Hidden costs and vendor lock-in

In addition to base fees, many outsourcing providers charge for:

- Rush processing

- Custom reporting

- Contract renewals

- SLA enforcement

- Handling electronic invoices or general ledger codes

Over time, these extras can outweigh the initial savings and make switching providers costly.

Total cost of ownership: AP automation vs. AP outsourcing

Here’s how the financials stack up.

AP automation costs

- SaaS subscription pricing

- Volume-based or user-based tiers

- Scalable with your needs

Compare Quadient AP automation plans

AP outsourcing costs

- Per-invoice or monthly service fees

- Less pricing transparency

- Extra charges for support, reporting, or workflow changes

Long-term ROI considerations

Automation requires upfront investment but pays off with higher accuracy, better scalability, and control. Outsourcing may appear cheaper initially but often leads to hidden costs, vendor risk, and lower adaptability over time.

When to choose an AP automation solution for your business

Automation isn’t just for enterprises. Many mid-sized businesses are adopting it to cut costs, improve control, and eliminate AP inefficiencies.

It’s a strong fit if you:

- Process 100+ invoices per month

- Operate in finance, healthcare, manufacturing, or other regulated industries

- Need better approval workflows, compliance, and ERP integrations

You’ll know it’s time to automate when:

- Your AP team is overwhelmed

- You’re missing early payment discounts

- Invoice tracking is unclear

- Approvals are constantly delayed

- You're struggling with cash flow management

Automation fixes these issues with faster processes, more control, and better visibility.

How to automate accounts payable with Quadient

Step-by-step guide

- Audit your current process: Where are the bottlenecks? Where are the errors?

- Identify inefficiencies: Manual data entry? Delayed approvals?

- Evaluate automation options: Look for tools with AI, integrations and ERP compatibility.

- Roll out the solution: Set up workflows and integrations.

- Train your team: Make sure everyone knows how to use the new system.

- Monitor and optimize: Use reporting dashboards to track performance.

Why Quadient?

- Quadient modernizes your AP with:

- Smart data capture and purchase order matching

- No-code workflow configuration

- Compatibility with multiple ERPs

- Role-based dashboards and detailed analytics

- A robust digital payables platform built for scale

Explore Quadient AP Automation and plans.

Conclusion

If you're serious about optimizing financial operations, AP automation offers more value than outsourcing. It boosts control, supports regulatory compliance, improves vendor relationships, and delivers scalable cost savings. It also frees your team to focus on higher-value, revenue-generating activities. While outsourcing may offer a short-term fix, automation is the smarter long-term move.