Introduction

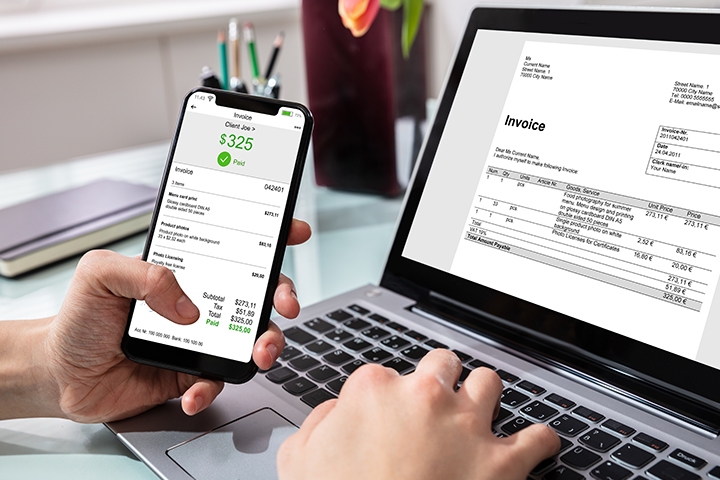

Today, the fast pace of transactions is prompting businesses to adopt electronic billing solutions, enabling companies to manage cash flow better and stay on top of their bills more efficiently. E-invoicing can be described as the exchange of an electronic invoice document between a supplier and a buyer in electronic format. It involves issuing, transmitting, and receiving an invoice in a structured data format, allowing for automatic and electronic processing.

What is e-invoicing?

The invoicing process begins when the customer indicates they want to make a purchase. If the buyer and seller agree on the terms, the accounts payable department creates a purchase order.

The purchase order is a legally binding document that validates the terms of the trading agreement. It stipulates how the vendor will deliver goods, the unit costs of each item, and the total amount owed. The invoicing phase starts when the seller fulfills the order.

The invoice is a critical part of the company's internal operations. Businesses can use invoices to improve operations by retrieving documents to determine supply chain inadequacies. Invoices are also a record of transactions that can facilitate tax compliance. An e-invoice maintains the same content and validity as a traditional paper invoice, but in a structured format. Electronic invoicing makes it easier to manage and monitor transactions between different parties.

E-invoicing, in simple terms, involves shifting traditional paper invoices to online invoices. It is an electronic billing process between a supplier and buyer on an electronic data interchange system. An e-invoice has information like the contents of the paper invoice. But it is more than simply a digital version of the invoice.

An electronic invoice has a structure enabling the bill to integrate with other accounting software or ERP systems. The e-invoicing requirements allow the application to quickly archive and retrieve data when needed. It speeds up the billing process, reducing errors that could cost the business and encourage fraud.

Statistics suggest electronic invoices may save businesses between 60% and 80% compared to paper-based processes. Digital billing also enables real-time reporting and facilitates contract and tax compliance.

Challenges of traditional paper invoices

Physical invoices generate a significant amount of paperwork that can be cumbersome to manage and track. Sometimes businesses create multiple hard copies of the invoice to ensure all parties get a copy. Depending on the organization, it can generate thousands of documents that can be difficult to track.

When a customer calls, the accounts payable clerks may struggle to locate a physical copy of an invoice. Your staff may spend a lot of time searching for the invoice in heaps of paperwork when a customer requests a payment status. E-invoicing enables the business to meet the demands of a fast-moving supply chain by saving valuable time.

Paper-based processes involve manual data entry, often fraught with human errors. Mistakes may result in the delivery of invoices to the incorrect address or the incorrect price being charged to a client. Accounts payable clerks may spend hours correcting errors, increasing the cost per invoice.

Lost documents and human errors may lengthen the approval process. As a result, manually reconciling purchase orders, invoices, and contracts can be challenging to complete on time. These challenges can negatively impact vendor relationships.

Governments around the world, and especially in Europe, are rapidly adopting electronic invoicing regulations. Several countries have already implemented regulations that compel organizations to provide electronic invoices through their ERP systems. The primary goals of e-invoicing regulations are to reduce procurement costs and to facilitate real-time tax reporting. Additionally, e-invoicing provides governments with more up-to-date data on the performance of their economies.

Learn more about e-invoicing regulations.

Why opt for e-invoicing?

As e-invoicing mandates roll out, it is imperative to start considering an e-invoicing service provider. E-invoicing automates the invoicing process.

An electronic invoicing system reduces the time accounting clerks spend validating traditional paper-based invoices. And businesses receive fewer service calls from customers seeking information about transactions.

E-invoicing systems work in tandem with ERP systems and other digital tools to speed up the invoice creation process. Consolidation with digital tools enables businesses to manage transactions with ease, and boosts transparency and confidence in the process, speeding up the invoice-to-payment cycle, resulting in faster bill payments.

Another advantage of e-invoicing is that it enables faster and more efficient data analysis. Businesses can monitor and check the document's status in real-time, eliminating the risk of privacy violations, and the organization can adapt quickly to rapidly changing supply-chain demands.

Even though e-invoicing is not mandatory in every country (yet), it can facilitate contract and tax compliance in adherence with the tax authority. For example, the digital invoice will auto-populate fields, making the tax return process simpler and error-free. You can also configure the system to operate within specific business rules. Accounting clerks may quickly retrieve documents to access historical business data.

Getting started with e-invoicing

E-invoicing is becoming a critical management tool in the ever-changing business landscape, and electronic invoicing mandates are at the forefront in many European countries. It integrates seamlessly with your existing ERP platform and other organizational systems. The process ensures consistent results and can help companies grow. While it may seem daunting, transitioning from a paper-based system to e-invoicing is actually quite simple and can offer significant cost savings. Your business will simply require a digital platform that communicates seamlessly and integrates effectively with your existing operations.

Streamline processes and save time and money with e-invoicing!

Quadient Impress enables you to tailor the process and scale as your business grows, offering a turnkey architecture you can incorporate into your legacy system. The platform is flexible and user-friendly, allowing you to tailor the process and scale as you grow. With multi-channel document automation, you can reduce the time wasted on invoice processing, and your staff can focus on other critical aspects of the business.

Our solutions allow for improvements in customer relations, enhanced transparency, and reduced costs. To find out more about e-invoicing for your business or sourcing an e-invoicing service provider, contact the Quadient team today.