It is important for enterprise business owners to evaluate their account receivables (AR) management strategies, especially when operating with margin constraints. Your business may be growing and you must strategically sacrifice margins, or you may be in an industry with narrow margins in the first place. Sageworks research shows that certain industries even generate negative margins, with software publishers at -5%, beverage manufacturers at -3.7%, and manufacturers of semiconductors and other electronic component at -0.3%. Regardless of your industry, following the five payment strategies below will ensure the positive cash flow that will feed the success of your business.

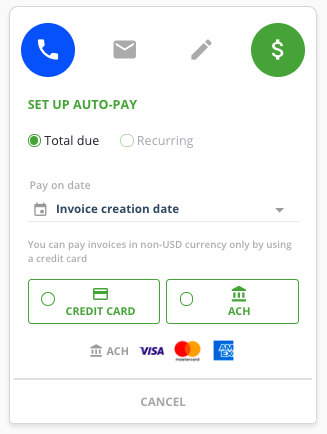

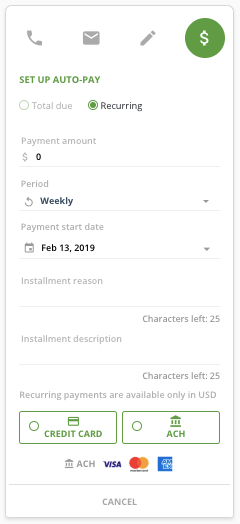

1. Closely Manage Payment Terms and Incentivise Early Payment The first step to optimising AR management is to set a standardised payment policy and provide incentives for early payment. Setting the shortest possible set of payment terms upfront will reduce collection complexities down the line, especially since some customers will want to negotiate their terms. You can also increase the likelihood of on-time payment by pointing out your payment policy and your incentives for early payment during the sales process. Furthermore, you can put customers who are less creditworthy on an auto-payment plan in your YayPay portal from the start.

The first step to optimising AR management is to set a standardised payment policy and provide incentives for early payment. Setting the shortest possible set of payment terms upfront will reduce collection complexities down the line, especially since some customers will want to negotiate their terms. You can also increase the likelihood of on-time payment by pointing out your payment policy and your incentives for early payment during the sales process. Furthermore, you can put customers who are less creditworthy on an auto-payment plan in your YayPay portal from the start.

2. Proactively Build a Positive Customer Relationship Build a positive relationship with your customers through proactive communication before you have to engage them in collections conversations. Leverage YayPay’s customer portal to send meaningful reminders prior to an invoice going past due, and provide immediate access to all outstanding invoices so your customer can take action. Make sure to institute a process of sending proactive payment reminders within 15, 10, or 5 days prior to due date. Be sure to include the invoice with your payment reminder to facilitate immediate action. Your proactive communication will give them time to begin planning for this payment now. This will allow you to get ahead of any questions or invoicing needs (address, business ID, and others) that are common causes for payment delays.

Build a positive relationship with your customers through proactive communication before you have to engage them in collections conversations. Leverage YayPay’s customer portal to send meaningful reminders prior to an invoice going past due, and provide immediate access to all outstanding invoices so your customer can take action. Make sure to institute a process of sending proactive payment reminders within 15, 10, or 5 days prior to due date. Be sure to include the invoice with your payment reminder to facilitate immediate action. Your proactive communication will give them time to begin planning for this payment now. This will allow you to get ahead of any questions or invoicing needs (address, business ID, and others) that are common causes for payment delays.

If your business is able to offer an early payment incentive, such as a discount, send a reminder near the end of that period as well - for example, reminding them that in five days they are no longer eligible for the early payment incentive.

3. Prompt Past Due Communication

Studies by the CRF and Commercial Law League of America found that the likelihood of successful collection drops by nearly 30% by the time an invoice is 90 days past due. Sending a past due notice as soon as the invoice becomes delinquent will increase the overall likelihood of payment and decrease your DSO, compared to standard 30-day past due communication. You can also reduce your DSO by sending frequent communication thereafter, with each notice taking an increasing firm and serious tone. Additionally, as the invoice ages, reach out to senior stakeholders and sales account managers via the Escalate option on the YayPay portal for collaboration on collecting overdue payments.

4. Payment Negotiations

If an invoice is more than 40 days past due, you should begin payment negotiations with your delinquent customer.

Inquire as to why they are delayed in making payment on the invoice and get them to agree to a payment date or payment plan. Establishing a mutually agreed upon plan will make it more likely that your customer will follow through.

When your past due customer assures you they will pay, have them set a timeline that includes specific dates. Record this data on your YayPay portal to streamline the communication workflow and set up reminders that can be triggered upon non-payment.

5. Offer Online Payment

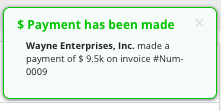

Offering online payment for your invoices increases the likelihood of payment by 30%. Online payment features allow your customers to pay their invoice faster, compared to sending a check in the mail. Directing your customers to their invoices on the YayPay customer portal encourages proactive management of account status and prompt payments. YayPay’s payment module has increased electronic payment 100% month over month for many of our customers. If you are operating with lower margins, you can also benefit by setting payment restrictions on YayPay so that only certain payments methods are accepted after a certain time.

Operating a business with margin constraints does not necessitate a weak cash flow if you can proactively optimise your payment strategies. Introducing workflow automation and the many payment module features that YayPay offers can help your AR team leverage these strategies across your entire customer portfolio, and keep your company fueled with enough cash to succeed.