Reduce the amount of repetitive tasks your finance team does by upgrading your manual AR processes with AR automation software. The integration process is seamless and will help with your overall business operations.

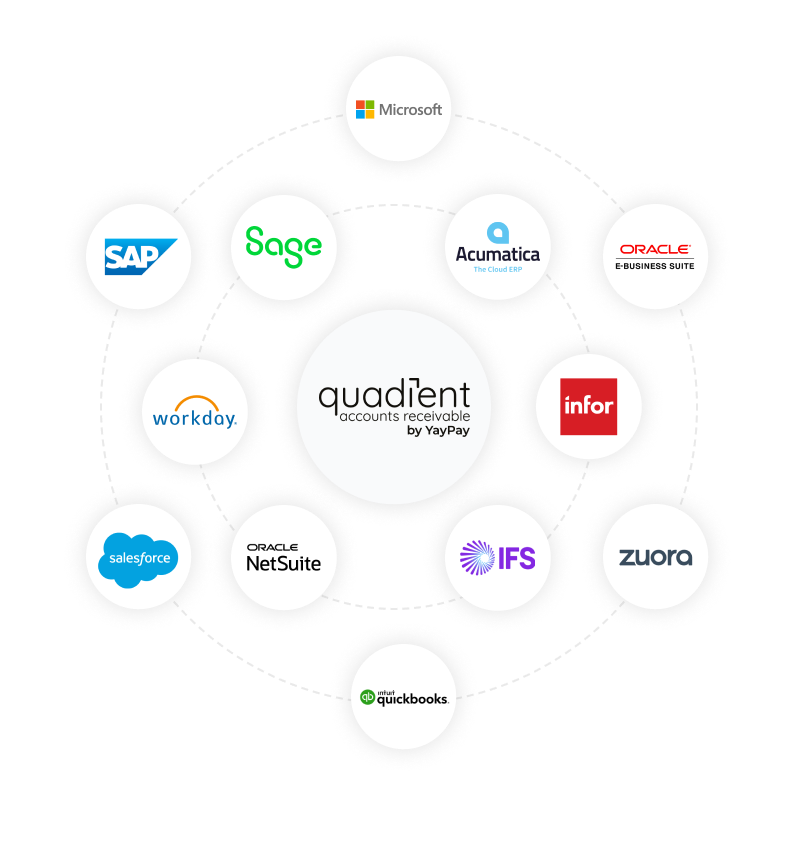

Quadient AR integrations

Improve customer relationships with better business processes

Implementing Quadient Accounts Receivable automation can significantly enhance your customer relationship management. By streamlining the invoicing and payment collection processes, you can create a positive ripple effect throughout your organisation, ultimately benefiting your customers.

Firstly, automation reduces manual errors and accelerates payment processing, ensuring that customers receive accurate invoices promptly. This reliability fosters trust and satisfaction among your clients, enhancing customer experiences.

Moreover, automated reminders and notifications can be tailored to each customer's preferences, leading to a personalised approach that strengthens your customer interactions. Automated systems also provide real-time access to payment histories and account information, empowering your customer support teams to provide more informed and responsive assistance.

Efficient cash flow management, made possible through automation, allows for better financial planning and investment in improved products and services, ultimately benefiting your customers. As a result, Quadient Accounts Receivable automation not only optimises your business processes but also creates a more positive, efficient, and customer-centric environment, bolstering customer relationships and driving long-term success.

Boost your ERP system to increase customer service

Integrating Quadient Accounts Receivable automation into your Enterprise Resource Planning (ERP) system can revolutionise your financial management and customer interactions. The key lies in selecting an AR automation system that seamlessly integrates with your ERP.

Firstly, automation ensures that financial data is accurate and up-to-date, promoting better decision-making within your ERP. This real-time synchronisation of AR data leads to improved forecasting and resource allocation, bolstering the overall efficiency of your business.

Additionally, Quadient AR automation enhances customer communication by providing a transparent and streamlined customer journey. You can access your client’s payment history, invoices, and transaction details easily, resulting in better customer experiences. Automated reminders and notifications also keep your customers informed about their outstanding balances, further improving transparency.

Overall, the synergy between Quadient Accounts Receivable automation and your ERP system strengthens financial control, minimises errors, and fosters a customer-centric approach. This integration ultimately empowers your business to make informed decisions, boost operational efficiency, and provide a more satisfying and transparent experience for your customers.

Implementation process

Our implementation team is adept at customising full integrations between your ERP environment and your Quadient AR platform instance. Whether you have multiple ERPs, or your business is multi-subsidiary, we’ll set up your systems ready for AR success.

Our team completes more than 600 projects annually

Each implementation project has an average turnaround time of 72 days

Our team has a customer satisfaction rating of 4.7 out of 5

What implementation and onboarding could look like for you

We understand every business’s ERP and CRM environment is different, so there’s no one-size-fits-all approach to our projects. For some ERPs we provide a plug-and-play prebuilt connector, but for others we’ll design a tailored implementation process that suits you and your team.

Phase 1: Project Management

We’ll work with you to outline key dates and deliverables as part of your integration journey.

Phase 2: Onboarding prep and kickoff

We’ll set up your Quadient AR user accounts and lead a kickoff call with our team and your stakeholders.

Phase 3: Build and Setup

This is when the sync to your ERP and data reconciliation will take place.

Phase 4: Configuration and testing

We’ll check all the connections are up and running, test your workflows, mailbox and payment settings, and train users on the Quadient AR platform.

Phase 5: Go-live

Training is complete and you’ll be up and running with Quadient AR! At this point you’ll be assigned a personal Customer Success Manager who will be your friendly point of contact for all things Quadient AR going forward.

Quadient AR + your ERP = a recipe for success

Read our eBooks with examples of how we complement NetSuite and Acumatica.

Ready for AR automation?

Discover what Quadient AR powered by YayPay can do for your business