Cash flow remains a top concern for finance leaders in 2025. The cost of capital is still elevated, and many companies are holding large amounts of cash as working capital. Late payments remain common, and customer payment behaviour continues to be shaped by economic uncertainty.

The following statistics reveal the challenges that accounts receivable (AR) teams are navigating this year. They also show why automation is becoming a practical way to accelerate collections, reduce risk, and strengthen working capital.

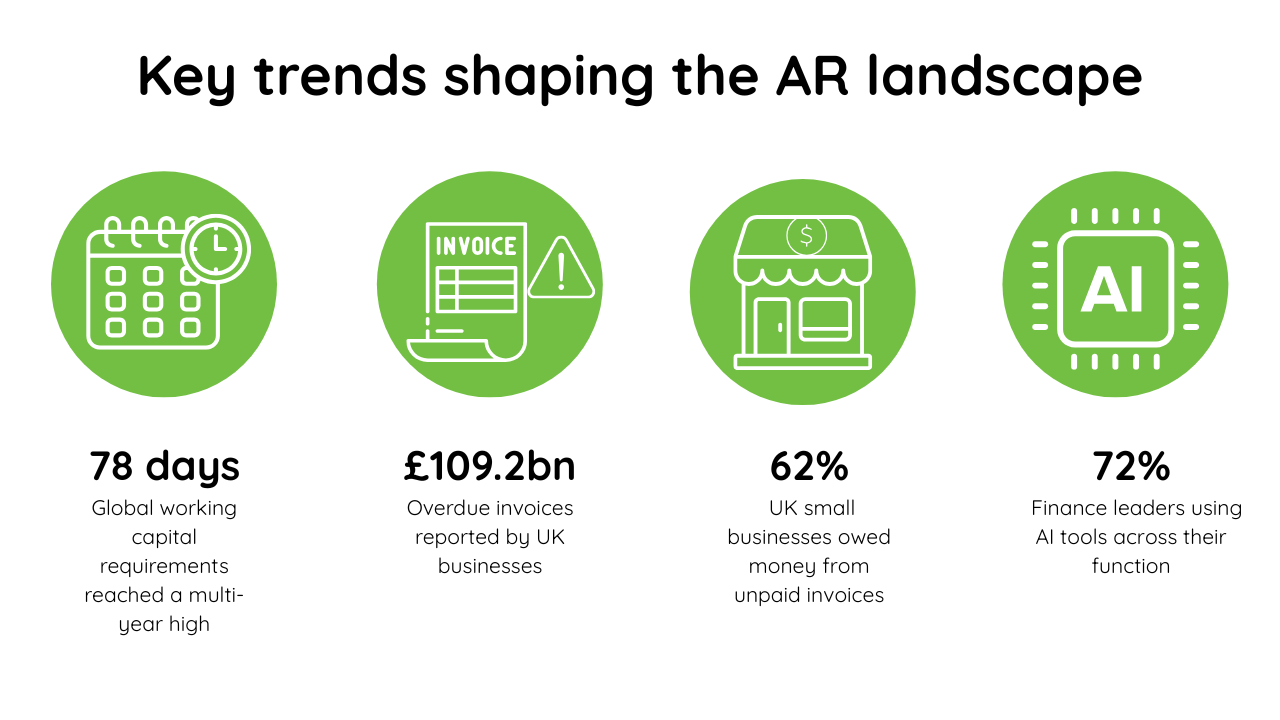

Working capital and cash flow trends

Companies are handling longer payment cycles and higher cash demands in 2025.

- 35% of companies worldwide now have working capital requirements exceeding 90 days of turnover.

- Global working capital requirements increased by 2 days to reach 78 days, their highest level since 2008.

- Global days sales outstanding (DSO) rose by 2 days, increasing the amount of cash tied up in receivables.

- In the UK, net working capital days have risen by 48% since 2015, the sharpest increase of any major market analysed.

Late payments and AR risk

Late payments remain widespread, increasing risk and extending collection cycles.

- UK firms logged £109.2 billion in overdue invoices in the first nine months of 2025, with a record number of large companies paying more than half of their invoices late.

- Late payments cost the UK economy nearly £11 billion a year and contribute to the closure of 38 small businesses every day.

- 45% of UK small businesses report more late payments than 12 months ago, and 24% receive payments up to 60 days late.

- 36% of UK SMEs say late incoming payments affect their ability to pay suppliers, and 18% say late payments affect their ability to pay employees.

- 52% of UK small businesses write off late payments up to 10 times a year, and 28% have used short-term finance due to late payments.

Industry-level working capital pressure and AR performance

Some industries are experiencing significant increases in working capital requirements, driving higher receivables exposure and operational strain.

- Seven industries – transport equipment, chemicals, energy, retail, machinery equipment, metals, and software/IT services – drove the rise in working capital requirements across major economies in 2025.

- Working capital requirements in Western Europe increased by 4 days for the third consecutive year, driven by longer receivables and higher inventories.

- If new 2025 trade tariffs take effect, European firms would need to finance an additional €8.5 billion, equivalent to roughly three extra days of turnover.

Small business cash flow and late payment

Late payments pose a structural issue for UK small businesses and their cash flow.

- 62% of UK small businesses are owed money from unpaid invoices, with an average outstanding balance of £21,400 per business.

- 54% of UK small businesses have invoices more than 30 days overdue, and on average, 11% of all invoices are more than 30 days overdue.

- Businesses most affected by late payments are 1.5 times as likely to report cash flow problems and 1.4 times as likely to rely on credit cards, with 47 percent increasing their card use in the past year.

AR automation and finance leadership

Automation is becoming a vital tool for finance leaders as they work to improve performance and reduce manual effort.

- The global AR automation market is valued at USD 3.40 billion in 2025 and projected to reach USD 5.95 billion by 2030.

- Cloud platforms account for 81.2 percent of AR automation spending in 2025, reflecting a strong shift toward SaaS-based solutions.

- North America accounts for 44.9% of global AR automation revenue in 2025, while the Asia-Pacific region is the fastest-growing, with a 14.3% CAGR.

- 72% of finance leaders report actively using AI in their function, including forecasting, risk scoring, fraud detection, and data processing.

- 58% of CFOs are using automation and AI to improve performance, and 94% say AI has improved decision-making in their organisations.

Wrap up

These statistics paint a clear picture. Working capital is tightening. Late payments continue to rise. Many industries are dealing with bottomless aging buckets. Small businesses face an ongoing cash strain. And finance leaders are increasing their investment in automation and AI in response.

Automating AR is one of the fastest ways to improve cash flow, reduce risk, and strengthen working capital.

If you’re ready to simplify invoicing, accelerate collections, and give customers a smoother payment experience, explore how Quadient AR Automation can help.

Request a free demo, read verified customer reviews, and discover why analysts consistently recognize Quadient AR as a leader in AR automation.

Frequently Asked Questions

What is AR automation?

AR automation uses software to streamline invoicing, reminders, payment processing, dispute management, and cash application. It reduces manual work and helps teams get paid faster in 2025.

Why is AR automation important in 2025?

High interest rates, economic uncertainty, growing working capital pressures, and widespread late payments are pushing teams to accomplish more with fewer resources. Automation helps bridge the gap between booked revenue and cash collected.

What KPIs are improved by AR automation?

Key improvements include lower days sales outstanding (DSO), fewer overdue invoices, reduced bad debt, faster dispute resolution, and more predictable cash flow.

Does AR automation improve customer experience?

Yes. Automation supports clearer communication, online payment options, and self-service access to invoices and statements, reducing confusion and speeding up payments.

Where should teams begin with AR automation?

Most teams start with invoice delivery and automated reminders. From there, they expand into dispute workflows, online payments, and AI-driven risk scoring.