Finance automation is no longer optional for SMBs heading into 2026. With rising expectations, tighter budgets, and AI tools evolving at pace, finance teams are under pressure to deliver faster closes, stronger cash flow visibility, and more strategic insight without growing headcount.

In this on-demand session, Laura Elliston, Senior Product Marketing Manager at Quadient, explores the key finance automation trends shaping 2026, with a focus on AI adoption, AP and AR optimisation, and the expanding role of the CFO. If you missed the live webinar, this recap breaks down the most important insights and what they mean for finance teams in the year ahead.

The Biggest Finance Automation Challenges SMBs Face Heading Into 2026

Despite growing awareness of automation, many finance teams still rely on fragmented systems and manual processes. These inefficiencies often remain hidden until peak pressure moments like month-end or year-end close expose them.

A recurring theme across SMB finance teams are the manual AP and AR workflows slow down close cycles, increase risk, and limit a team’s ability to deliver strategic value. Automation isn’t just about speed, it’s about visibility, accuracy, and control.

AI in Finance: Why Adoption Still Lags in AP and AR

AI continues to dominate conversations in finance, but adoption tells a different story.

During the session, polling revealed that 87% of finance teams are not currently using AI in their financial processes. This gap between hype and reality represents a major opportunity, particularly in AP and AR.

Key insights included:

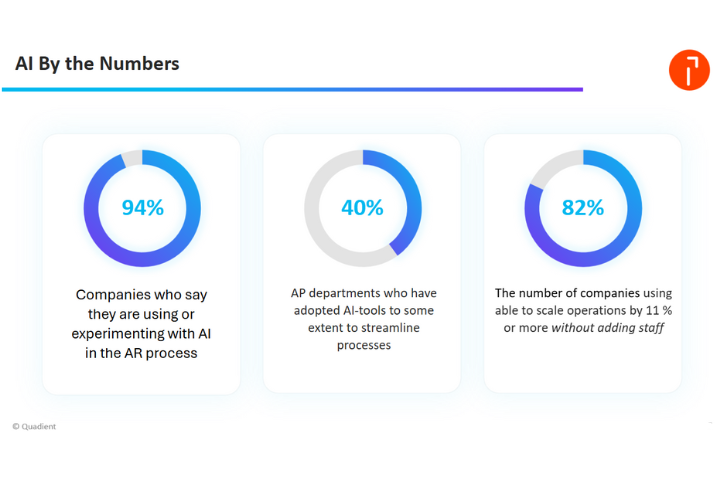

- 94% of organisations are experimenting with AI in Accounts Receivable

- Only 40% of Accounts Payable teams report using AI today

- Finance teams using AI can scale operations by 11% or more without increasing headcount

AI-driven automation enables predictive cash flow forecasting, smarter collections prioritisation, and faster invoice processing, allowing finance teams to do more with existing resources.

How Generative AI Is Changing AP and AR Workflows

Generative AI tools are rapidly transforming finance roles. Elliston compared them to “virtual interns,” delivering average productivity gains of 20% by handling repetitive and time-consuming tasks.

In AP and AR, generative AI enables teams to:

- Focus on high-value accounts

- Design payment strategies that improve cash flow

- Reduce manual invoice handling and follow-ups

However, automation alone isn’t enough.

“That level of empathy for human relationships, that’s where we still need people.”

The future of finance automation lies in augmentation, not replacement, freeing teams from manual work while preserving human judgment and relationship management.

Why Balancing Automation and Human Experience Matters

Trust remains one of the biggest barriers to AI adoption.

Laura shared research showing:

- 53% of consumers dislike AI-led interactions

- 67% of customer churn is driven by poor customer experience

- 70% of consumers will abandon a brand after just two negative interactions

For finance teams, this reinforces a critical lesson: automation must enhance, not replace customer relationships.

Smart automation allows teams to be faster and more responsive, while still ensuring sensitive conversations, disputes, and exceptions are handled by humans.

How the CFO Role Is Expanding With Finance Automation

The CFO’s role is evolving rapidly. No longer focused solely on reporting and compliance, finance leaders are now expected to drive digital transformation, growth strategy, and cross-functional alignment.

Elliston highlighted research showing that stronger collaboration between finance and sales can increase sales win rates by up to 47%. Likewise, tighter alignment with customer success teams helps reduce churn and improve customer lifetime value (CLV).

Finance automation plays a critical role here, providing CFOs with:

- Real-time visibility into cash flow and risk

- Better data for strategic decision-making

- Greater influence across the organisation

Proving ROI From Finance Automation Investments

Pressure to demonstrate ROI from technology investments continues to grow.

- 85% of CIOs are under pressure to prove measurable business impact

- 52% of organisations expect ROI within 7–12 months

- 64% report disappointment with next-generation tech investments that failed to deliver

Laura emphasised that disconnected systems are often the root cause of poor ROI. Integrated finance automation platforms combining AP, AR, AI, and analytics deliver faster payback by eliminating silos and improving collaboration.

Final Takeaway: Preparing Finance Teams for 2026

The 2026 finance automation trends point to a clear conclusion: successful finance teams will combine AI-powered automation, integrated AP and AR workflows, and human-centred decision-making.

By investing strategically, breaking down silos, and focusing on measurable outcomes, finance leaders can move beyond firefighting and position their teams as true business partners.

Want to explore these insights in more detail?

Watch the full on-demand webinar to see how finance teams are preparing for 2026, and how automation can support your next phase of growth.