E-invoicing will become an obligation in the UK and Ireland. E-invoicing refers to the exchange of invoice data between suppliers and buyers in a structured data format (usually XML) that finance systems can process automatically. In the UK, the government has confirmed that mandatory e-invoicing for all VAT (Value Added Tax) invoices will be introduced in 2029. In Ireland, public administrations have been required to receive structured e-invoices for years, and the European Union's (EU’s) VAT in the Digital Age legislation (ViDA) reforms will take effect in 2030, making e-invoicing mandatory for businesses as well.

Global trends show e-invoicing is becoming the norm

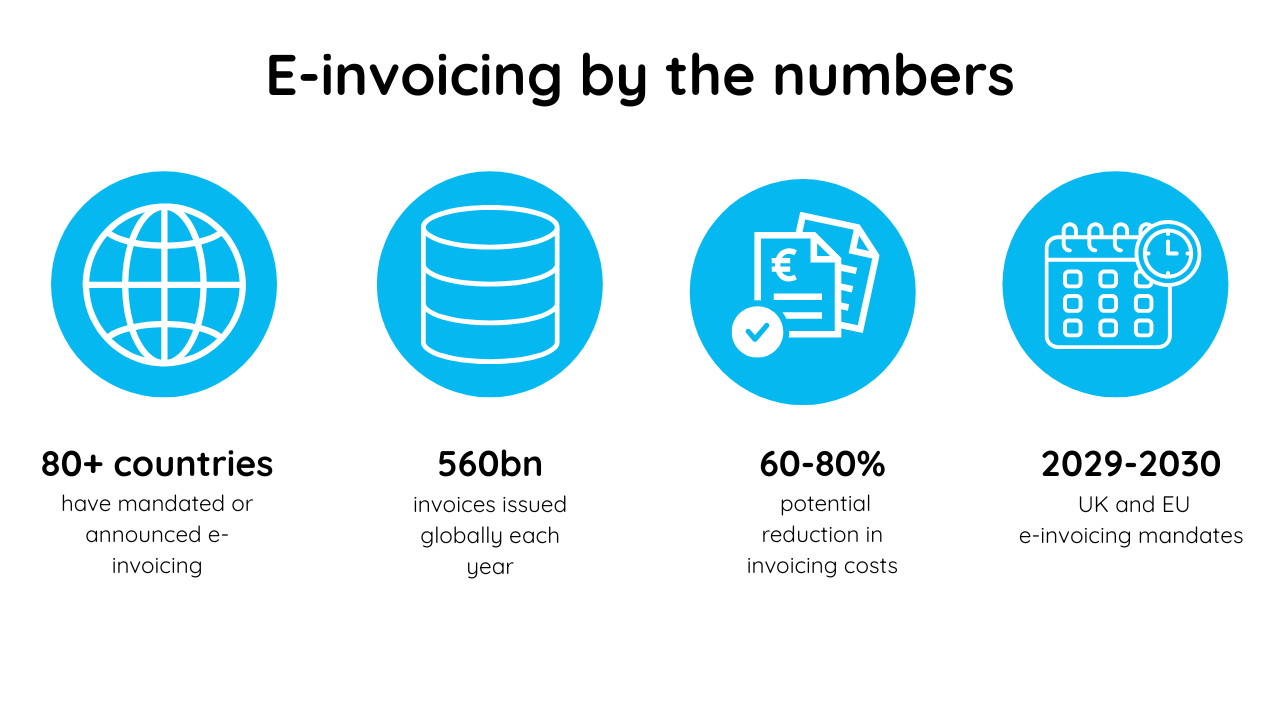

Mandates to make e-invoicing mandatory are emerging across the world. The shift to structured e-invoicing is in motion everywhere, with the goals to combat fraud and allow faster and automated transactions.

1. More than 80 countries in the world have already mandated e-invoicing or announced plans to do so in the coming years.

2. The global e-invoicing market is valued at $24.18bn in 2025, up from $19.64bn in 2024 (which is 23.1% CAGR).

3. The global e-invoicing market is forecast to reach $52.43bn by 2029 (21.3% CAGR).

4. In its 2025 report, OpenPeppol cites the latest full-year estimate that around 560 billion invoices (paper + electronic) were issued worldwide in 2024.

5. Approximately 280 billion of those invoices relate to B2B, B2G, and G2B exchanges (latest full-year estimate: 2024).

6. Cross-border invoices are estimated to account for less than 10% of total invoice volume.

7. Across B2B/B2G/G2B volumes, an estimated 90 billion invoices are electronic (about one-third), including PDFs, which are not structured invoices.

UK policy calendar and the cost of manual invoicing

The UK is moving toward an e-invoicing mandate to combat VAT fraud. Growing pressure from late payments is also making automation and accuracy increasingly needed.

8. According to the UK government, e-invoicing technology has been in use globally for over 20 years.

9. The UK government cites that around 130 countries have implemented (or are implementing) e-invoicing frameworks and standards.

10. Estimates cited by the UK government suggest e-invoicing can reduce invoicing costs by 60–80%.

11. Manual entry of supplier invoice data has an average error rate of around 10%.

12. Late payments are estimated to cost the UK economy almost £11bn per year.

13. 28% of UK businesses are affected by late payments each year.

Ireland’s mandate and the ViDA timeline

Ireland already requires public administrations to be able to receive and process e-invoices. While the ViDA European initiative renders e-invoicing adoption mandatory by 2030.

14. In 2023, Ireland’s VAT compliance gap was 8.3% of VAT total tax liability (VTTL), equal to €1.832bn in uncollected VAT.

15. EU estimates say e-invoicing could help reduce VAT fraud by up to €11bn per year.

16. EU estimates suggest e-invoicing could reduce administrative and compliance costs by over €4.1bn over 10 years.

17. The European Commission estimates that ViDA could help EU countries collect up to €18 billion in additional VAT revenue each year.

18. Irish SMEs reported an average payment period of 41 days.

19. 25% of multinationals and large businesses were reported to be taking longer to pay SMEs, up from 15% in the previous quarter.

20. In the first quarter of 2025, Irish Revenue's report shows that 90% of payments were made within 15 days.

Wrap up

E-invoicing is becoming the norm, driven by regulation and the need to cut manual work and payment delays. For businesses operating in the UK or Ireland, being ready for e-invoicing compliance is strategic. That means ensuring systems can support structured invoices and meet compliance timelines.

Quadient helps finance teams from businesses of all sizes modernise invoicing without adding complexity. Our solution allows companies to automate invoice preparation and multi-channel delivery while supporting visibility, e-payments, as well as compliant archiving.

Contact us to learn how Quadient can support your adoption of e-invoicing. Quadient is already processing e-invoices for thousands of medium and large companies in Europe.

Frequently Asked Questions

What is e-invoicing?

E-invoicing is the exchange of structured invoice data between systems. A PDF sent via email or a scanned invoice does not qualify. Common formats include UBL, Factur-X and CII, which are all XML documents.

Is e-invoicing mandatory in the UK today?

Not yet, but the UK has confirmed it will mandate e-invoicing for all VAT invoices from 2029.

If I already send PDFs, am I compliant with Ireland’s future requirements?

No. Irish Revenue has made it clear that PDFs (or scanned invoices) will not satisfy ViDA’s structured e-invoicing requirements.

When do Irish businesses need to act?

The Irish mandate will start in November 2028 with large VAT-registered groups, then expands in November 2029 to most businesses and organisations.

What is the biggest operational change under ViDA?

For many businesses, it will be a combination of structured e-invoicing and short reporting timelines, including a requirement to issue e-invoices within 10 days. This means adopting a dedicated einvoicing platform or module.

Why is this being pushed across Europe?

Because governments want to fight VAT fraud and improve the quality and visibility of financial transactions. Businesses also benefit from the new technology, which promise fewer errors, lower processing costs, and better cash flow.