Introduction

Managing accounts receivable (AR) without understanding your customers’ credit risk is like driving with your eyes closed. You might stay on the road for a while, but eventually, you're going to crash.

Credit risk analysis provides finance teams with the visibility to assess customer creditworthiness, reduce the likelihood of default, and make informed, data-driven decisions around customer relationships, credit ratings, and timely payment performance. It’s how companies protect cash flow, reduce bad debt expense, and maintain healthy AR turnover ratios.

Today’s financial operations teams can streamline the process with AR automation and credit risk management tools, turning what used to be manual guesswork into scalable, proactive credit control. Platforms like Quadient’s AR automation and credit management solutions integrate seamlessly with systems like Business Central and generate real-time insights from customer reports, AR data analysis, and accounts receivable aging metrics.

This article explains what credit risk analysis is, how it improves accounts receivable management, and how to apply it step-by-step using smart technology and best practices.

What is credit risk analysis?

Credit risk analysis evaluates the likelihood that a customer will pay invoices in full and on time. This forms the foundation for setting payment terms, credit limits, and interest rate policies on credit sales.

Core elements include:

- Financial health: Reviewing balance sheets, loan amounts, cash reconciliation reports, and operating assets.

- Payment history: Analysing aged accounts receivables, disputes and deductions, and past-due aging buckets.

- Industry risk: Using trend analysis and customer credit reports to assess market and sector stability.

Every time you issue an invoice, you're essentially offering trade credit. Understanding credit risk ensures you do it wisely, based on a customer’s credit history, financial obligations, and potential default risk.

How credit risk analysis supports accounts receivable

Credit decisions shape AR outcomes. Extending too much credit to risky customers increases your chances of late payments, disputes, and write-offs. Be too cautious, and you limit sales.

Smart AR teams use credit risk analysis to:

- Take a proactive approach: Spot credit issues before they become problems.

- Make holistic decisions: Use more than gut feelings—leverage customer reports, AR data analysis, and credit scores.

- Practice strategic risk-taking: Confidently extend credit where appropriate, and put controls in place for high-risk accounts.

Ignoring credit risk can increase Days Sales Outstanding (DSO), slow collection efforts, and strain your AR turnover ratio. By analysing aging reports, monitoring credit balances, and evaluating financial ratios like the debt service coverage ratio, AR teams can improve customer accounts management while minimising exposure at default.

How credit risk analysis improves cash flow and reduces bad debt

Bad debt rarely arrives without warning. It begins with small missed payments, often from accounts that had previously shown signs of risk.

Credit risk analysis improves cash flow management by:

- Flagging issues early: Use AR reports, customer credit reports, and payment reports to identify problems before invoices pile up.

- Monitoring continuously: Use tools like Quadient AR Automation to detect changes in behaviour through automated alerting and dashboards.

- Keeping AR turnover ratio healthy: Lower bad debt ratios and protect working capital with consistent analysis and oversight.

When integrated with cash flow forecasting and AR automation, credit risk analysis becomes a driver of long-term financial stability. Tools that monitor overdue accounts using credit checks and historical average accounts receivable help predict the probability of default and prevent financial distress.

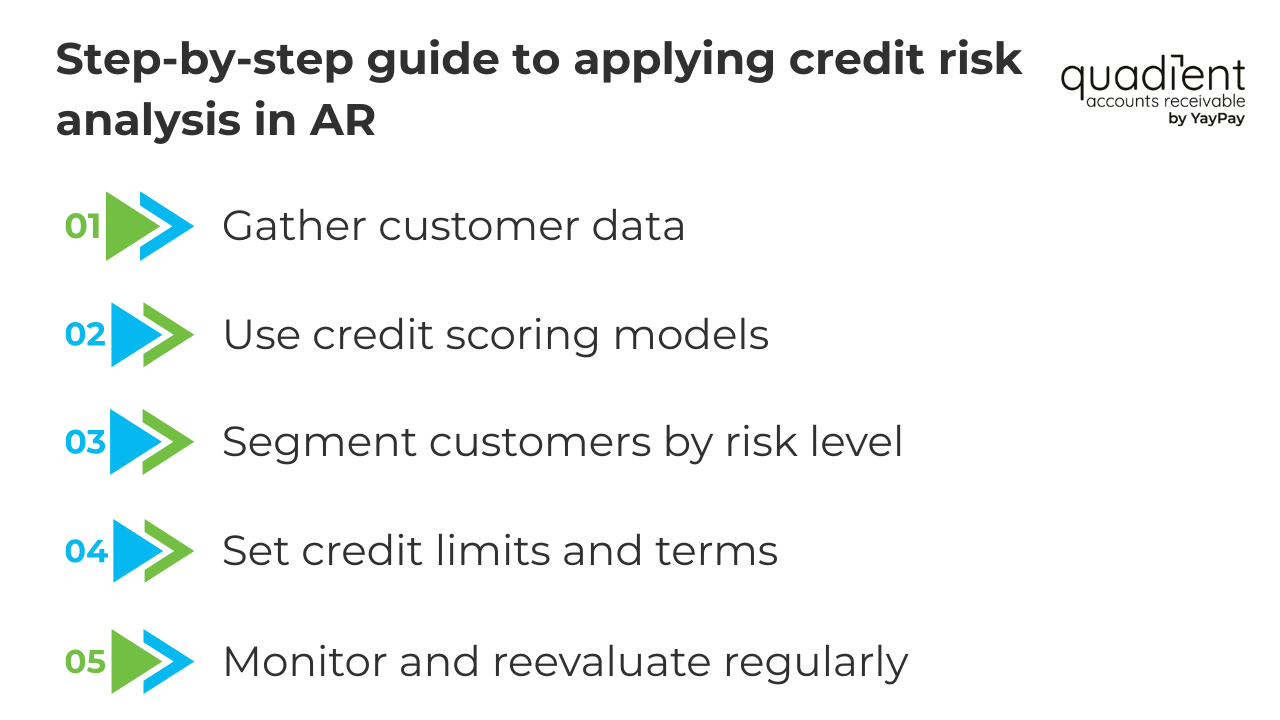

Step-by-step guide to applying credit risk analysis in AR

Step 1: Gather customer data

Start with financial statements, customer ledger entries, and payment history. Supplement with credit agency data and ERP exports.

Step 2: Use credit scoring models

Create internal scoring based on historical AR data, or layer in third-party tools like Dun & Bradstreet, Allianz Trade, or CreditSafe.

Step 3: Segment customers by risk level

Group customers into tiers based on payment behaviour, AR days, sales reports, and accounts receivable-to-sales ratio.

Step 4: Set credit limits and terms

Use trend analysis and ratio analysis to determine appropriate limits. For high-risk accounts, tighten terms and add monitoring triggers to ensure compliance.

Step 5: Monitor and reevaluate regularly

Credit levels are not static. Watch for signs of stress, such as changes in transaction reports, disputes and deductions, or missed invoice due dates.

Best practices for managing credit risk

Best-in-class finance teams don’t leave credit decisions to chance. They build structure into their AR process.

- Define clear credit policies: Outline how credit terms are set, enforced, and reviewed.

- Train AR staff: Make sure teams can identify risk flags and follow escalation protocols.

- Review accounts regularly: Schedule audits using customer balance to date, aging buckets, and collection process status.

- Collaborate cross-functionally: Sales, legal, and AR should agree on credit terms and resolution strategies.

With tools like self-service payer portals, checking account integrations, and mobile app alerts, managing credit is easier and more transparent.

Tools and metrics for credit risk in AR

Technology can do a lot of the heavy lifting. Here are some tools and metrics that help:

Software options

- Third-party tools: CreditSafe, Dun & Bradstreet, Equifax, Allianz Trade

- Internal tools: Custom scoring models, Power BI dashboards

- Quadient solutions: AR automation with built-in credit management, automated scoring, and alerting features

Key metrics to track

- DSO and average collection period

- Accounts receivable turnover and receivables turnover ratio

- Accounts receivable aging and aging buckets

- Accounts receivable collection period and accounts receivable-to-sales ratio

- Collection efficiency and bad debt ratio

Automation helps reduce manual review time, streamline AR reports, and generate alerts based on rules, thresholds, and trend lines.

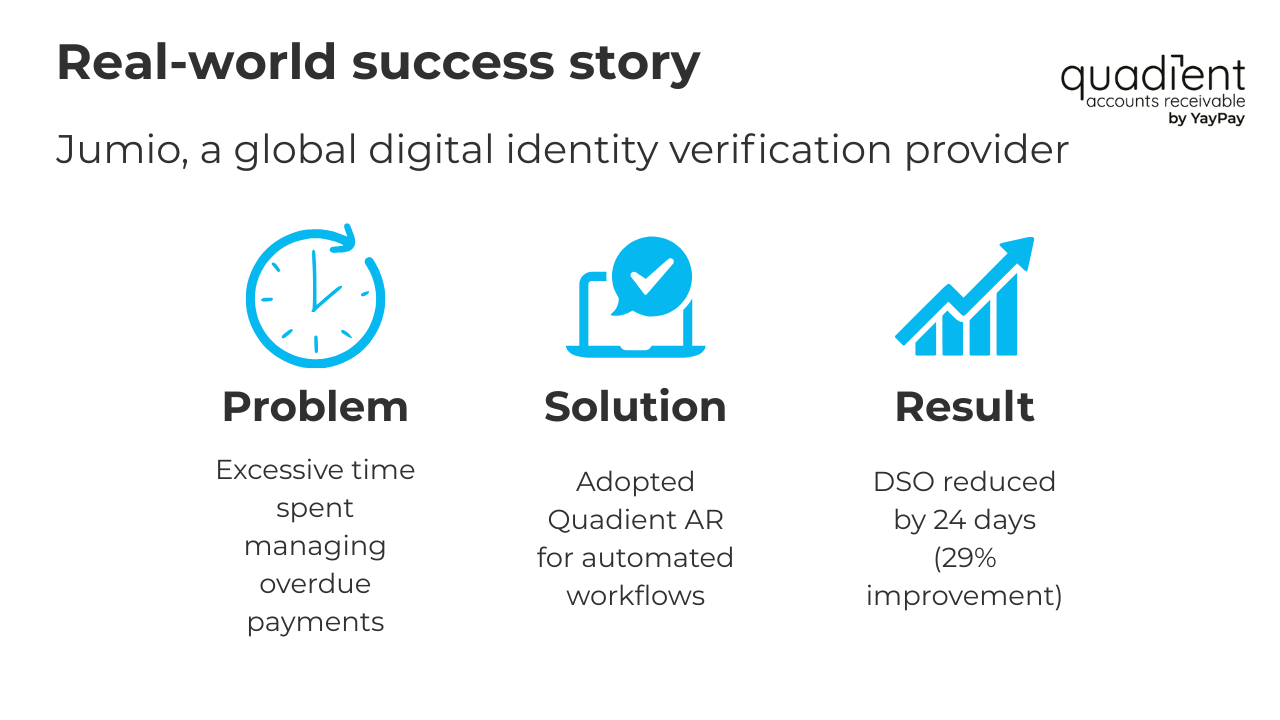

Real-world success story

Jumio, a global digital identity verification provider, was spending an excessive amount of time managing overdue payments. Their AR/AP manager dedicated a full day each week to manually emailing customers with outstanding balances, an inefficient process that strained resources and delayed collections.

After adopting Quadient AR, the team centralised all receivables data in a single location. Automated payment reminders replaced manual outreach, and customers gained access to self-service billing links, making it easier for them to view invoices and make payments on time.

The impact was immediate and measurable. Jumio reduced its DSO by 24 days — a 29% improvement—without needing to add staff. Collections became more consistent, and both internal teams and customers benefited from improved transparency through real-time visibility into account status.

Conclusion

Credit risk analysis isn’t just a task—it’s a strategy. It protects cash flow, reduces bad debt, and helps AR teams take control of financial performance.

With the right tools and a consistent process, finance teams can confidently manage credit risk, make better strategic decisions, and transition from a reactive to a proactive approach.

Improve your credit risk process with smarter tools

Explore our credit management solutions

Ready to automate your AR and credit workflows?

See Quadient AR in action