Introduction

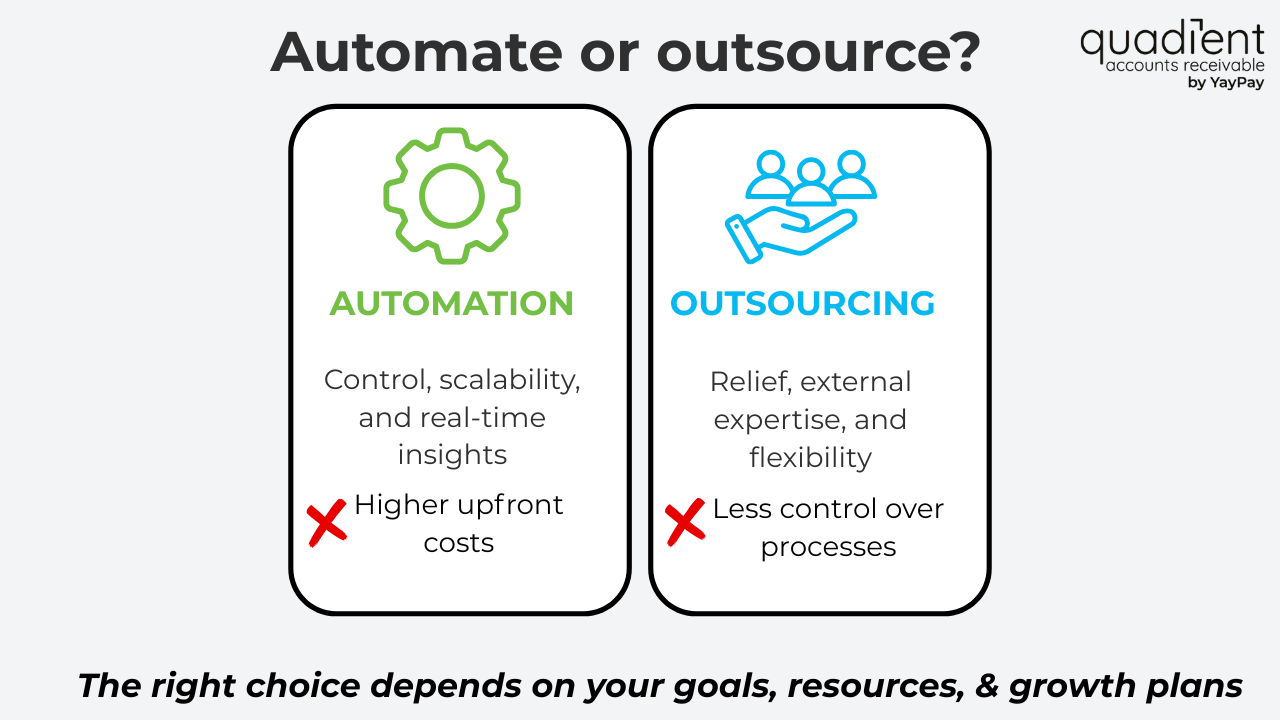

Accounts receivable (AR) processes have become increasingly nuanced and varied across industries and regions. Choosing between AR automation and outsourcing depends on your business goals, resources, and growth plans. Outsourcing AR can be an attractive option for many businesses because it frees your team from the manual work of managing invoice processing, payment processing, collections, and credit checks.

But before jumping at the opportunity to outsource AR, you should weigh the pros and cons, such as workload, efficiency, security, and cost. If you find you’d rather keep the process in-house, accounts receivable automation technology is an excellent alternative that can help simplify your accounts receivable process.

Understanding accounts receivable management

Accounts receivable management is the process a business uses to track, collect, and optimise customer payments for goods or services delivered on credit. In simple terms, it’s everything a company does to make sure customers pay their invoices on time—and to minimise the risk of late payments or bad debt.

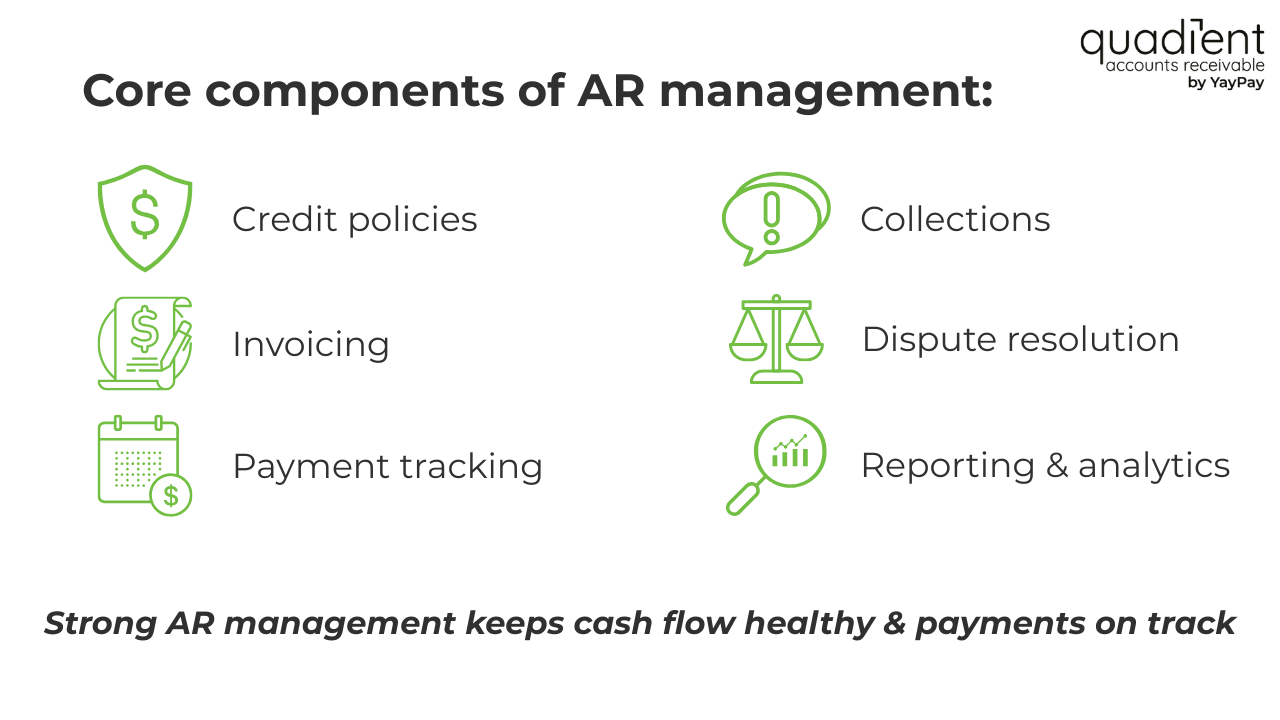

Core components of AR management are:

- Credit policies – Setting rules for who gets credit, how much, and under what terms.

- Invoicing – Issuing accurate, timely, and transparent invoices.

- Payment tracking – Monitoring outstanding invoices and due dates.

- Collections – Following up on late payments with reminders, escalations, or collections processes.

- Dispute resolution – Handling invoice errors, customer complaints, or payment discrepancies.

- Reporting and analytics – Measuring AR performance with metrics like Days Sales Outstanding (DSO), aging reports, and bad debt ratio.

Key advantages of AR automation

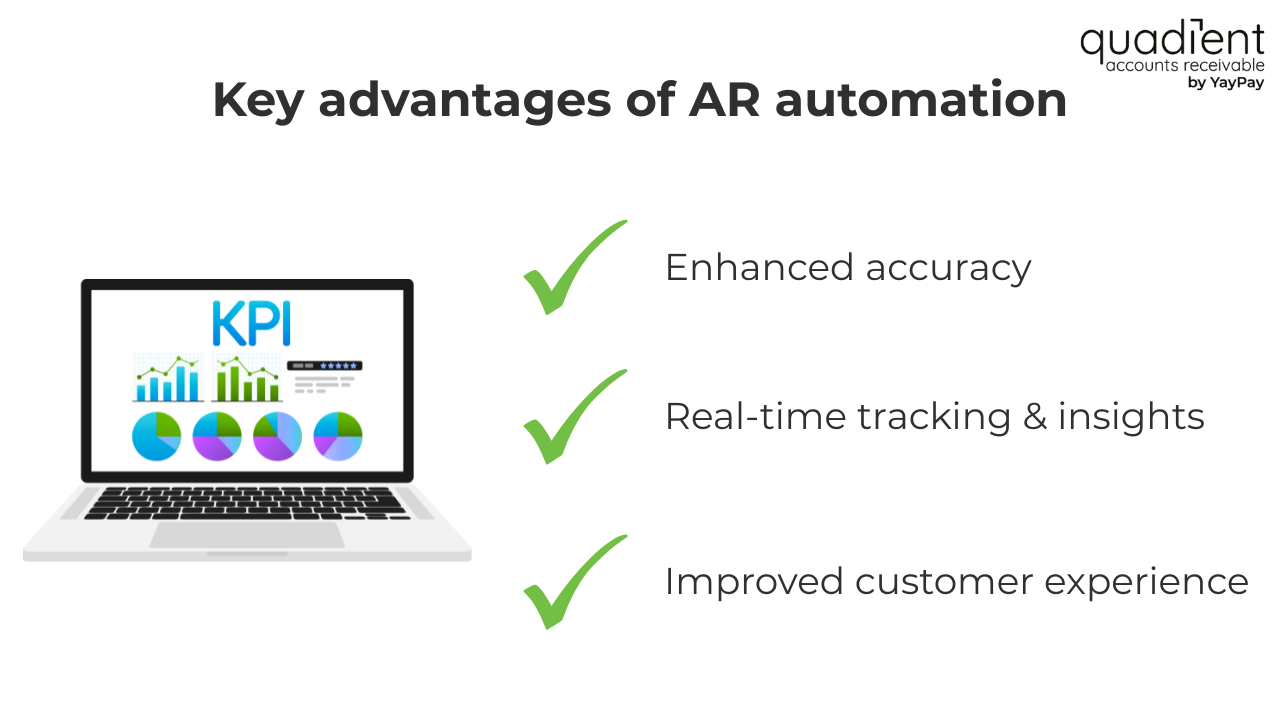

Enhanced accuracy and error reduction

Automation reduces errors in invoices, payment matching, and reconciliation. You experience fewer disputes with customers due to clean, consistent billing. Automated credit checks, payment reminders, and escalation workflows help flag risky accounts early. While the human touch is essential, automation reduces the reliance on human follow-ups, resulting in fewer missed payments and overlooked invoices.

Real-time tracking and insights

With automation comes real-time visibility into your finances. Dashboards and reports can give finance teams instant insight into outstanding invoices, cash flow forecasts, and customer payment trends.

Improved customer experience

Customers get clear, timely invoices and multiple digital payment options. Self-service portals also enable customers to easily track and pay invoices, reducing friction in communication and the need for follow-up.

Implementing AR automation software

Initial technology investment

The initial technology investment for AR automation can vary widely depending on the size of your business, the complexity of your AR process, and the type of solution you choose. Below is a breakdown of the two software costs:

Cloud-based AR automation (SaaS):

- Usually subscription-based (monthly or annual).

- Small to mid-sized businesses: $500–$5,000/month, range from $50K to depending on invoice volume and features.

- Large enterprises: custom pricing, often $50K–$250K annually.

On-premises solutions:

- One-time license fees range from $50K to $200K+, plus annual maintenance/support fees.

- This option is becoming less common as most vendors move to SaaS.

Integration with existing systems

Integration is one of the most critical (and sometimes most overlooked) factors when implementing AR automation. If it’s not handled correctly, automation can create bottlenecks instead of removing them. When considering integration with existing systems, ensure compatibility with core systems. Ensure the AR automation solution integrates seamlessly with your ERP (e.g., SAP, Oracle NetSuite, QuickBooks), accounting, and customer relationship management (CRM) systems. Additionally, verify that it supports standard APIs, connectors, or middleware to avoid costly custom builds.

Advantages of outsourcing accounts receivable

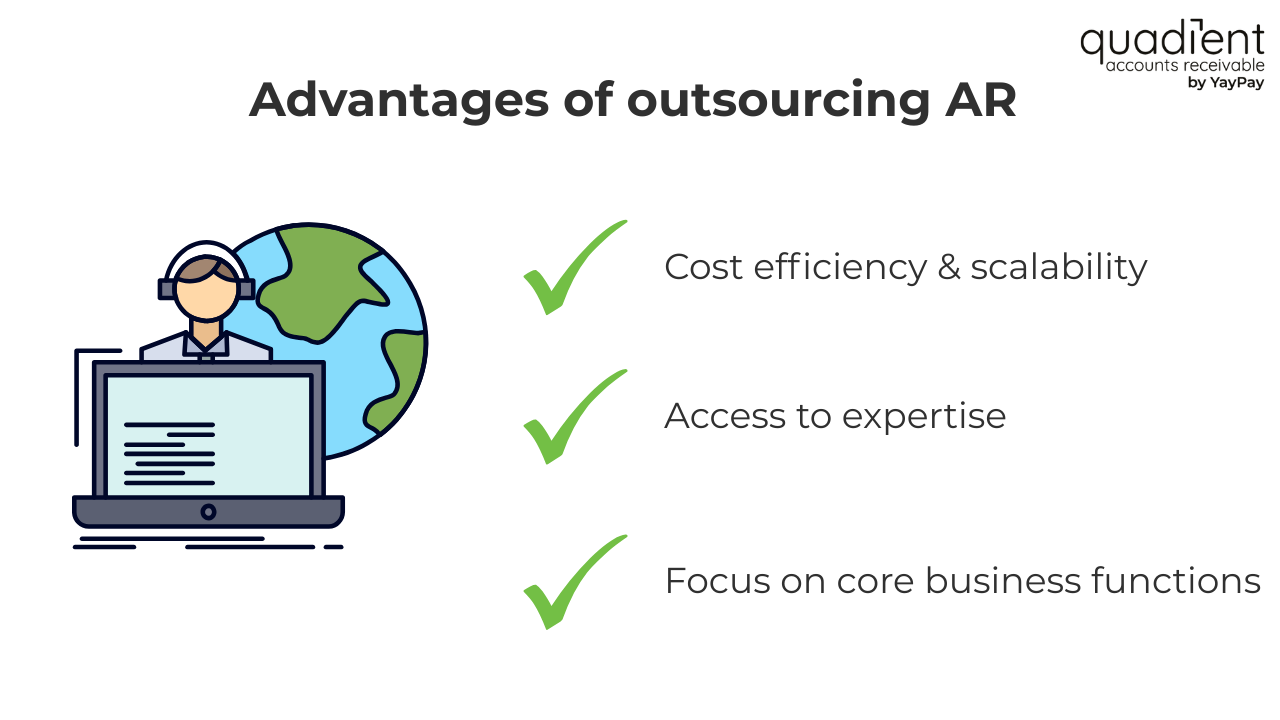

Cost efficiency and scalability

Outsourcing AR reduces the need for in-house AR staff, training, and overhead. It also avoids significant upfront investments in AR software or infrastructure. Specialised providers focus on faster collections and reducing DSO, and dedicated teams often use proven strategies and tools to accelerate payment cycles, all of which lead to improved cash flow.

Access to expertise and professional handling

When outsourcing, providers have industry knowledge and best practices for collections, dispute management, and compliance. This can be especially helpful for businesses without deep AR expertise internally.

Focus on core business functions

Outsourcing AR enables financial operations teams to free up time, allowing them to focus on strategy, forecasting, and growth initiatives instead of chasing payments. Furthermore, many outsourcing partners use modern AR tools (automation, analytics, payment portals), which means you can benefit from technology without needing to purchase or manage it yourself.

Challenges of AR automation

Upfront costs and technology dependence

Subscription fees are predictable; however, implementation, integration, and training can require a significant upfront investment, especially for mid-market and enterprise systems. There is also a need for regular updates, new compliance rules (such as e-invoicing mandates), and evolving ERP systems that require ongoing monitoring. Without proper vendor support, businesses risk disruptions.

Potential integration challenges

Connecting AR automation tools with existing ERP, accounting, and CRM systems can be tricky. Legacy systems may lack modern APIs, requiring custom development and extra costs. Furthermore, on a human level, staff may be resistant to moving away from manual processes they are familiar with. Finance teams must be trained to use dashboards, workflows, and self-service tools effectively.

Downsides of outsourcing AR

Reduced control over processes

Since you are handing over your processes to a third party, you now rely on them to manage critical financial processes. This gives you limited visibility into daily collections activity compared to in-house or automated solutions.

These third parties and outsourcing partners may handle communications in ways that feel impersonal or inconsistent with your business's communication style. This can damage customer relationships and loyalty if not managed carefully.

Data privacy concerns

Privacy and customer data concerns are also a topic of concern when it comes to third parties, as sensitive customer and financial data must be shared with these parties. There is a risk of breaches, non-compliance with GDPR, SOC 2, SOX, or regional e-invoicing rules if the partner lacks robust security measures.

Factors to consider when choosing

Operational capacity and resource availability

- Accounts receivable automation: Best for standardised, repeatable AR processes (invoicing, reminders, payments).

- Accounts receivable outsourcing: Better for handling complex collections, disputes, international receivables, or if internal expertise is lacking.

Budget constraints and financial goals

- Accounts receivable automation: Higher upfront investment (in software, integration, and training) but lower long-term costs. Scales well with growth.

- Accounts receivable outsourcing: Lower upfront cost; ongoing variable fees (per invoice or percentage of collections). It may get expensive at high volumes.

Long-term strategic objectives

- Accounts receivable automation: Ideal for achieving long-term efficiency, scalability, and digital transformation.

- Accounts receivable outsourcing: Best suited if the goal is short-term relief, reducing admin workload, or accessing external expertise.

Conclusion

The choice between AR automation and outsourcing depends on your goals, resources, and growth plans. Automation delivers scalability, visibility, and control, while outsourcing provides expertise, flexibility, and quick relief from administrative work. Many businesses find value in a hybrid approach, using automation for routine tasks and outsourcing for complex collections. By weighing your capacity, budget, and long-term strategy, you can select the option that best supports cash flow, customer relationships, and sustainable growth.