Introduction

While accounts payable (AP) is a critical part of financial operations, it’s often overlooked until something goes wrong. A missed payment, a duplicate invoice, or a vendor dispute can quickly reveal the cracks in a manual, outdated process. That’s why understanding and mastering full-cycle accounts payable is critical to an organisation's financial success.

Full-cycle AP covers every step of the process—from invoice receipt to approvals, payments, and reconciliation—forming a streamlined payable process flow that supports operational efficiency and accurate financial statements.

When this cycle runs efficiently, it safeguards financial accuracy, strengthens vendor relationships, and promotes operational health. But when it’s manual and fragmented, it opens the door to errors, delays, and compliance risks.

This guide explains the complete AP process, why it matters, and the hidden costs of doing it the old way.

What you’ll learn:

- The key components of a full-cycle AP process

- Why a structured workflow is essential

- Common pitfalls of manual AP management

- How automation improves accuracy and transparency

- What better AP mean for your bottom line

What is the full-cycle accounts payable process?

Full-cycle accounts payable refers to the complete, end-to-end process of managing a company’s outgoing payments—from the moment an invoice is received to the final step of reconciliation and audit readiness. It's the backbone of strong financial operations, ensuring accurate, timely, and correctly recorded payments.

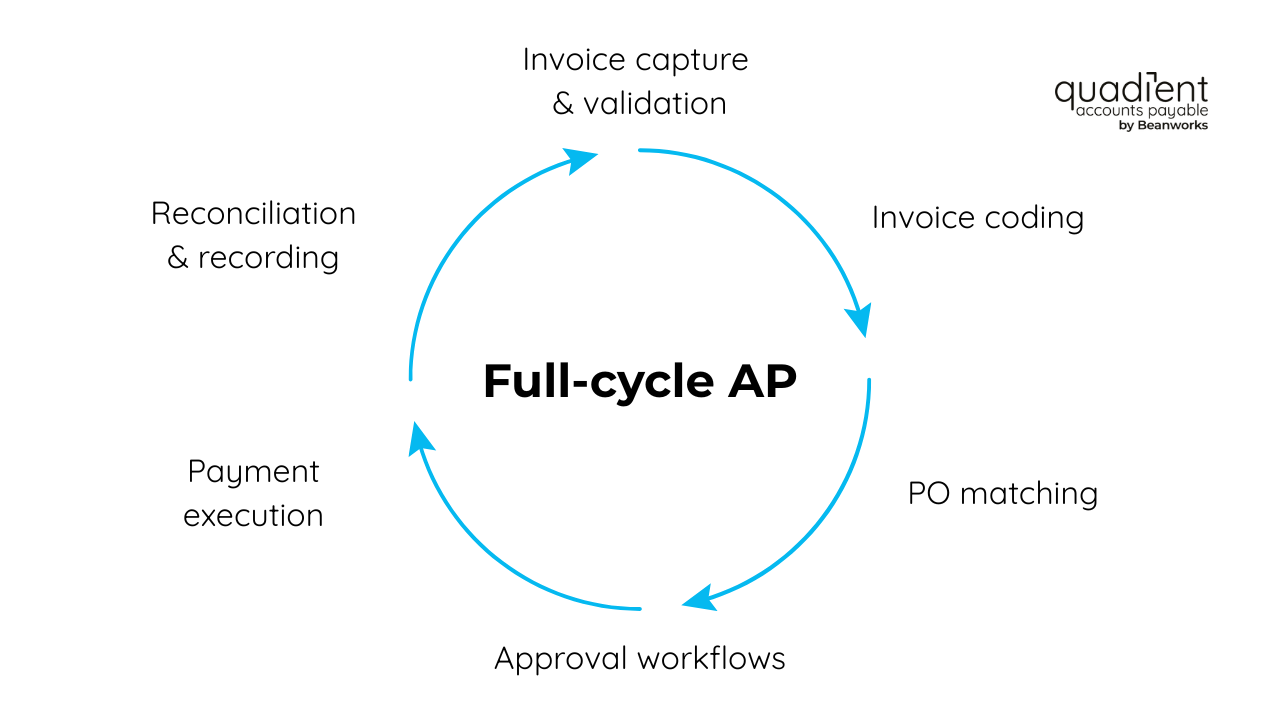

Here’s what the full-cycle AP process includes:

- Invoice capture and validation – Invoices arrive by email, mail, or Electronic Data Interchange (EDI) and are checked for completeness and accuracy.

- Invoice coding – Assign GL codes and cost centres to classify expenses correctly for budgeting and reporting.

- PO matching – Validate invoices by checking them against purchase orders or contracts before approval.

- Approval workflows – Validated invoices are routed to the appropriate stakeholders for approval, based on predefined rules.

- Payment execution – Payments are processed manually or through automated methods like ACH, wire transfers, cheques, or digital platforms.

- Reconciliation and recording – Once paid, transactions are reconciled, documented, and prepared for audits with a clear trail.

Full-cycle AP process flow at a glance:

- Invoice received (email, mail, or EDI)

- Invoice coded and validated

- Matched to PO or contract

- Routed for approval

- Payment processed (manual or automated)

- Reconciled and recorded with an audit trail

Why it matters

A well-defined AP process keeps operations running smoothly. It prevents late payments, reduces fraud risk, and improves cash flow visibility. But errors creep in when steps are skipped, unclear, or done manually, leading to missed payment discounts, delayed payments, strained vendor relationships, inaccurate reporting, and increased operational costs.

Consistency and accuracy at each phase are essential for protecting your bottom line and building financial resilience.

Understanding AP procedures and workflow

Every payable department handles AP a little differently, but high-performing teams have one thing in common: a consistent, repeatable workflow that enforces control and accountability.

84% of companies with fully automated AP processes report improved cash flow and cost savings.

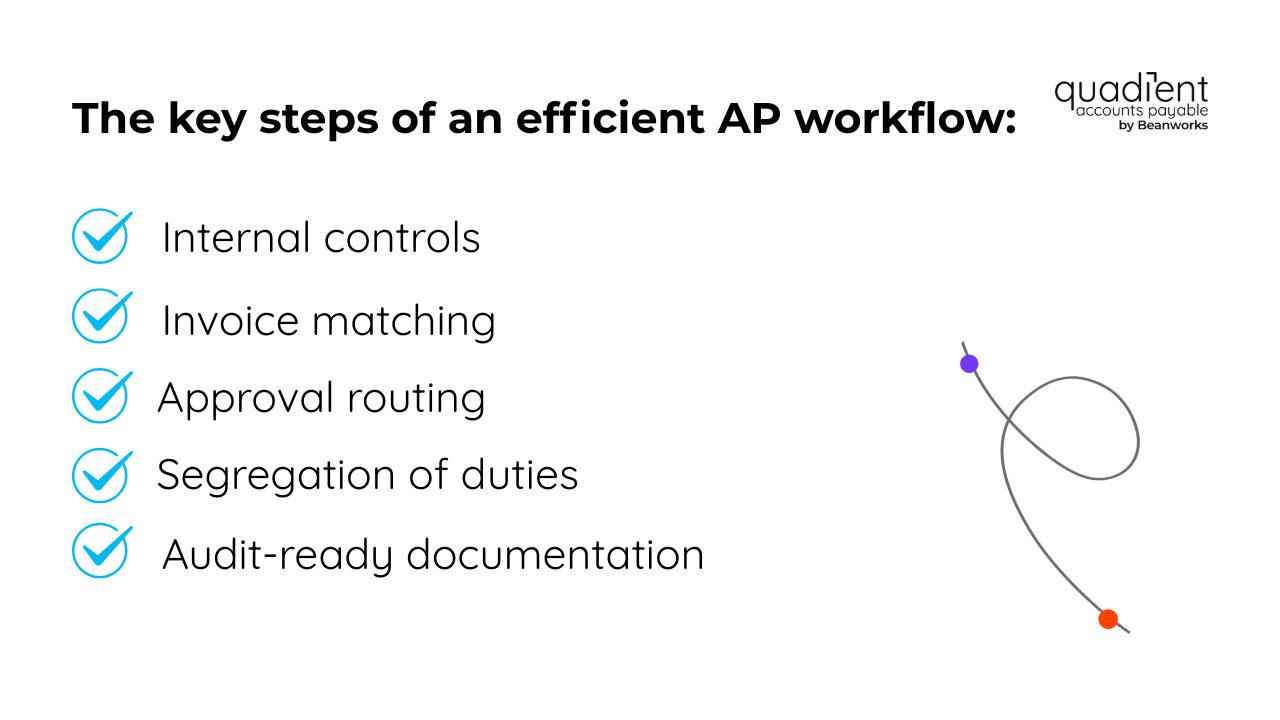

Here are the key steps of an efficient accounts payable workflow:

- Internal controls: Ensure only approved purchases are paid, and that every transaction is backed by documentation.

- Invoice matching: Cross-check invoices against purchase orders and delivery receipts to verify accuracy before payment.

- Approval routing: Route invoices to the correct stakeholders based on set thresholds, cost centres, or vendor categories.

- Segregation of duties: Split responsibilities for invoice entry, approval, and payment execution to protect against fraud risk. By separating tasks like invoice entry, approval, and payment authorisation, businesses reduce the risk of fraud and ensure accountability throughout the AP workflow.

- Audit-ready documentation – Store all records digitally with timestamps and user logs for full traceability and compliance.

Manual processes rely heavily on emails, paper invoices, and spreadsheets, slowing down approvals and increasing the risk of duplicate payments, missed deadlines, or unauthorised charges. These systems are also complex to audit and scale.

By contrast, automated workflows consistently apply rules, route invoices instantly, flag issues in real time, and log every action automatically. This enables accurate records, fast payment authorisation, and real-time invoice status tracking.

Here’s an example: A recurring invoice from a software vendor is auto-captured, matched to an existing PO, routed for one-click approval, and queued for payment—all without a single email or piece of paper.

A structured workflow protects your company from financial errors and compliance risks, giving finance leaders better visibility into cash flow and liabilities.

The challenges of a manual accounts payable process

Manual AP might work for a small payable team processing a handful of invoices, but it doesn’t scale. As volume grows, so do the problems.

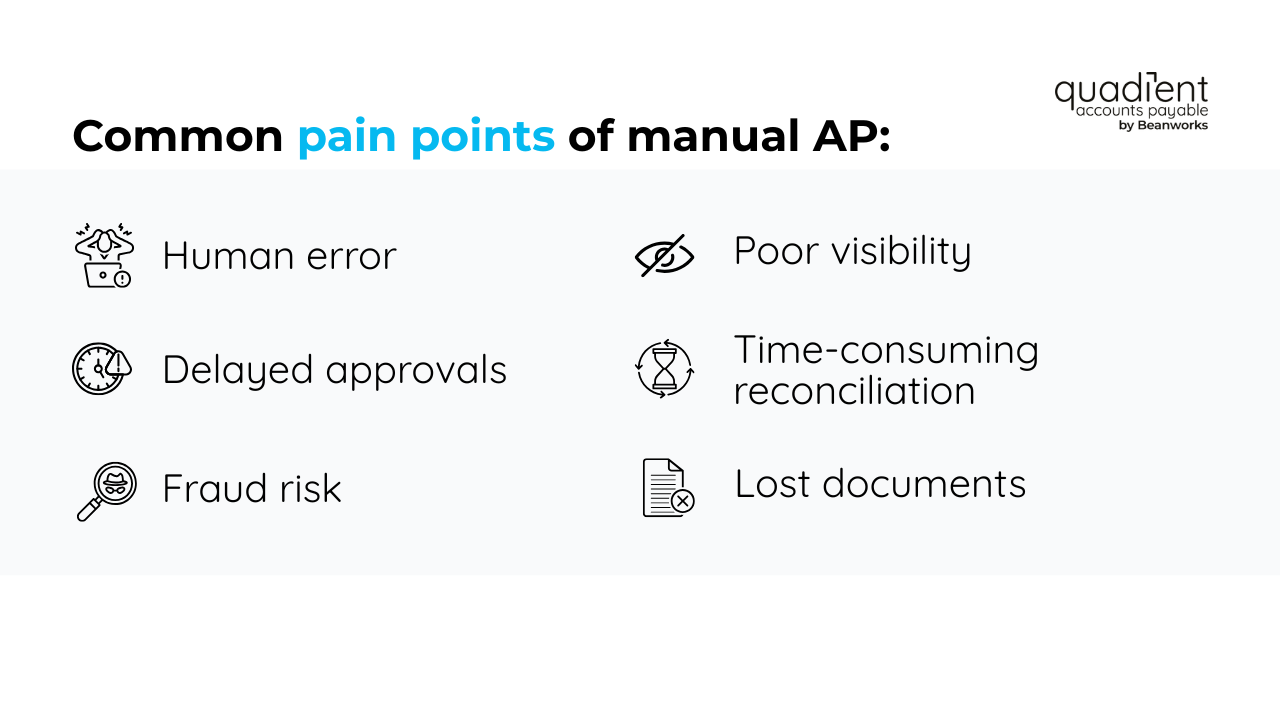

Common pain points in manual AP include:

- Human error: Mistyped amounts, missed invoices, and duplicate payments are inevitable when entering data by hand.

- Delayed approvals: Invoices sit in inboxes or on desks, waiting for sign-off, slowing everything down.

- Fraud risk: Without strong internal controls, fake vendors or unauthorised payments can easily slip through.

- Poor visibility: Finance teams often can’t see where invoices stand or which payments are overdue.

- Time-consuming reconciliation: Month-end close becomes a scramble to track down paperwork, verify payments, and resolve discrepancies.

- Lost documents: Paper invoices and decentralised systems create version control issues and lost audit trails.

64% of AP professionals say they lack visibility into invoice or payment status.

According to industry data, processing a single invoice manually can take more than 10 days. That kind of inefficiency adds up. Multiply those 10 days across hundreds—or thousands—of invoices, and the cost in time, labour, and late fees becomes unsustainable.

Manual systems also block access to early-payment discounts, increase the risk of strained supplier relationships, and pull finance teams away from strategic work. And as your business grows, legacy processes simply can’t keep up, leading to bottlenecks, burnout, and mounting risk.

In contrast, best-in-class AP automation reduces invoice processing time to just a few days, boosts real-time visibility, and applies consistent rules that scale with your business.

AP automation as a solution for accounts payable needs

The solution to inefficient, error-prone AP? Automation.

Manual accounts payable systems create friction, delays, and risk. AP Automation replaces those pain points with speed, accuracy, and control, turning AP from a liability into a strategic asset.

What AP automation delivers:

- Intelligent data capture - Optical Character Recognition (OCR) technology reads and extracts invoice data, eliminating manual data entry and reducing human error.

- Automated matching and approvals – Invoices are automatically matched to POs and receipts; mismatches are flagged for review, and approval routing happens in real time.

- Exception handling – Outliers quickly surface, with clear audit trails and resolution paths.

- Real time visibility – Dashboards show what’s pending, approved, paid, or held—no more chasing down updates.

- ERP integration – Syncs with your existing accounting systems for end-to-end continuity and accurate records.

Teams using automation process up to 30 invoices per hour, compared to just five manually.

For example, Mission Construction implemented Quadient AP Automation and now processes 30 invoices in under 5 minutes, has eliminated duplicate payments, and refocused AP staff time on strategic work instead of paperwork.

What this looks like in practice:

| Before automation | After automation |

| Invoice printed and hand delivered | Invoice captured automatically via OCR |

| Manager out of office delays approval | Invoice routed digitally and approved remotely |

| Finance emails for status updates | Real-time dashboard shows invoice progress |

| Payment delayed | Payment scheduled and processed on time |

| Vendor frustrated | Vendor paid on time, relationship strengthened |

Automated AP also makes it easier to enforce three-way matching, ensuring supplier invoices match the purchase requisition and receipt of goods. This safeguards against payment errors and improves financial control across the accounting process.

The big picture: Beyond savings

AP automation isn’t just about saving money or speeding things up—it’s a foundational upgrade for your entire finance function.

- It supports strong vendor relationships and unlocks early-payment discounts

- It ensures compliance through digital audit trails and consistent approval processes

- It provides real-time insights into payable balances, improving cash flow management and financial forecasting

- It mitigates the risk of fraud, payment errors, and unauthorised payments

- It supports the connected finance ecosystem, making data accessible across departments

95% of finance leaders say automation reduced time spent on manual data entry.

When repetitive tasks don’t bog down your AP team, they can focus on strategy, compliance, and insights that drive smarter decisions.

Conclusion

Mastering full-cycle accounts payable is about building a better system for managing money in your business. A structured payable workflow reduces risk, saves time, and improves financial health.

Automating that structure with automation software like Quadient AP Automation gives you even more control, speed, and insight. Finance leaders can track payment approvals, spot unpaid invoices, and generate journal entries with minimal manual effort.

With Quadient AP Automation, finance teams shift from paper-pushers to strategic enablers—able to focus on cash flow planning, vendor relationships, and performance insights that drive growth.

Finance teams don’t have to be stuck chasing paper and tracking approvals. With the right tools, they can lead smarter, more strategic operations.

53% of finance leaders still rely on manual AP processes.

Ready to upgrade your AP process?

Explore Quadient’s AP Automation platform and discover how to work faster, more securely, and with more control.

With a payable automation solution, your finance department can build strong supplier relationships, ensure timely payments, reduce costly errors, and confidently support your business's financial growth.