Introduction

Finance teams today face significant pressure to streamline operations, reduce costs, and boost efficiency. One of the smartest ways to do this is through AP automation. However, before you invest, it is essential to understand the return on investment. That’s where knowing your AP automation ROI comes in.

In this guide, we’ll walk through how to calculate ROI for accounts payable automation, the cost and benefits involved, and how to get the most from your automation efforts.

Why AP automation ROI matters

Calculating the ROI of an AP automation solution isn’t just a finance exercise. It’s how you justify the investment to leadership, unlock better cash flow management, and build a more resilient operation.

The real value of automated invoice processing lies in eliminating manual processes, reducing human error, and streamlining your payment cycles. It’s about making smarter, faster financial decisions, backed by real data.

Understanding AP automation ROI

In simple terms, accounts payable automation ROI measures how much you gain financially from automating your invoice-to-pay process, relative to what it costs to implement and maintain the system.

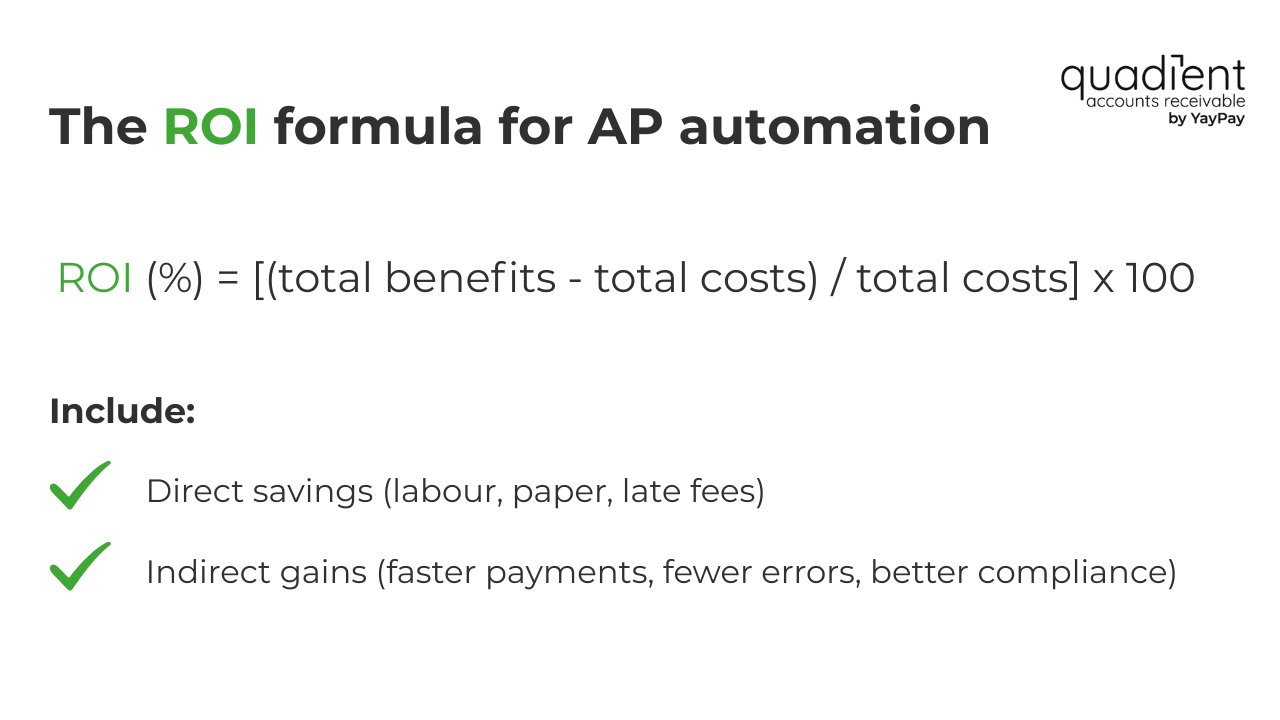

Here’s the basic formula:

ROI (%) = [(total benefits - total costs) / total costs] x 100

Total benefits encompass both direct cost savings and indirect gains, such as stronger vendor relationships, improved regulatory compliance, and a reduced risk of fraud.

Key factors in calculating AP automation ROI

To get a true picture of ROI, you need to consider everything from implementation costs to long-term performance.

Direct cost savings

Switching from manual data entry and paper invoices to automated systems leads to major labour cost reductions. You’ll also benefit from:

- Fewer late payments and penalties

- More frequent capture of early payment discounts

- Reduced spend on printing, mailing, and storage

- Lower risk of payment errors and duplicated invoice numbers

Indirect benefits

The hidden value of AP automation lies in its ripple effects across your financial operations:

- Stronger vendor relationships: On-time payments help build trust.

- Better compliance: AP automation improves audit trails and reduces fraud risk.

- Happier employees: Automation frees your team from repetitive, manual tasks.

Implementation and maintenance costs

Every AP automation software solution comes with startup and ongoing costs. Factor in:

- License and subscription fees

- System integration with your ERP system (e.g., Microsoft Dynamics)

- Training and change management

- Configuration of purchase order matching, invoice headers, and general ledger codes

Implementing AP automation isn’t without its challenges. Some teams face resistance to change, lack of training, or trouble integrating with legacy ERP systems. Engaging stakeholders early, providing hands-on training, and choosing a flexible, well-supported platform can help overcome these roadblocks.

Step-by-step guide to calculating AP automation ROI

Step 1: Assess current AP process costs

Start with the full cost of your current manual invoice processing:

- Staff time and labour costs

- Materials (paper, toner, envelopes)

- Delays in approval routing and invoice capture

- Missed payment discounts and fees from late payment scheduling

Step 2: Estimate post-automation costs

With an AP automation tool, your costs shift. Estimate:

- Software and platform fees

- Lower payroll due to reduced manual tasks

- Integration with your Enterprise Resource Planning (ERP) systems

- Use of technologies like Optical Character Recognition (OCR), Machine Learning (ML), and Robotic Process Automation (RPA) for invoice reader capabilities

Step 3: Determine net savings

Subtract your projected automation costs from your current AP expenses. Don’t forget to factor in improved data visibility, fewer disputes, and faster vendor management resolution.

Step 4: Apply the ROI formula

Plug your savings and investment into the formula to find your ROI.

For example: If you spend $180,000 on manual AP annually and automation brings that down to $70,000, with implementation costs of $50,000, your ROI is:

[(180,000 - 70,000) - 50,000] / 50,000 x 100 = 120%

That means the system pays for itself quickly, and then keeps generating value.

Benefits of AP automation

Beyond ROI, there are powerful benefits to adopting digital workflows for invoice management.

Increased operational efficiency

With automated workflows, you’ll:

- Speed up approval times

- Eliminate errors from manual entry

- Handle higher invoice volumes without increasing headcount

Greater cash flow control

Automation improves your ability to manage payment methods, wire transfers, and virtual cards. You’ll also get:

- Smarter payment origination

- Better alignment with procurement strategies

- Access to real-time data analysis for cash flow insights

Stronger risk and compliance posture

Automation bolsters your safeguards against:

- Invoice fraud through better 3-way checking and three-way PO matching

- Regulatory compliance via secure, auditable records

- Risky approvals with enforced approval workflows

How to maximise your AP automation ROI

Choose a scalable solution

Pick invoice automation software that integrates with your current stack, supports growth, and uses AI-powered solutions for smarter processing.

Engage stakeholders early

Include your finance teams, IT, and procurement leads in planning. Their input ensures alignment and boosts adoption.

Monitor and optimise

Track KPIs like approval cycle time, invoice capture rate, and payment accuracy. Make continuous improvements using real-time monitoring tools.

Leverage vendor support

Use your vendor’s training, onboarding, and support resources. A partner who understands your industry and workflows is key to maximising your results.

Conclusion

Investing in AP automation is more than just replacing manual processes with automation tools. It’s a strategic move that strengthens your entire accounts payable ecosystem. From reduced Total Cost of Ownership to improved supplier portal interactions, the gains are both immediate and long-term.

Looking to see your potential ROI in action? Try our ROI calculator.

Ready to take the next step?

Quadient’s AP automation solutions are designed to help you work smarter, not harder. Contact us for a personalised demo, or explore our library of resources to learn more.