Introduction

The accounts receivable (AR) process plays a direct role in a company’s financial health. A business might show a profit on paper, but if cash isn't coming in on time, it can still struggle to meet payroll, pay suppliers, or invest in growth. That’s why managing the full cycle of accounts receivable—from order to payment—is essential.

This article breaks down the full accounts receivable process cycle, highlights common challenges, and shows how automation tools like Quadient AR Automation can help improve cash flow and reduce friction.

What is the accounts receivable process cycle?

The accounts receivable (AR) process cycle is the set of steps a business follows to track and collect customer payments. It begins when a sale is made and ends when the payment is received and recorded.

AR is part of the larger order-to-cash process, covering the full lifecycle of a customer transaction. The goal of the AR cycle is clear: collect payments accurately and on time while minimising delays, errors, and bad debt.

A strong AR cycle helps stabilise cash flow, improves reporting accuracy, and supports better decision-making throughout the business.

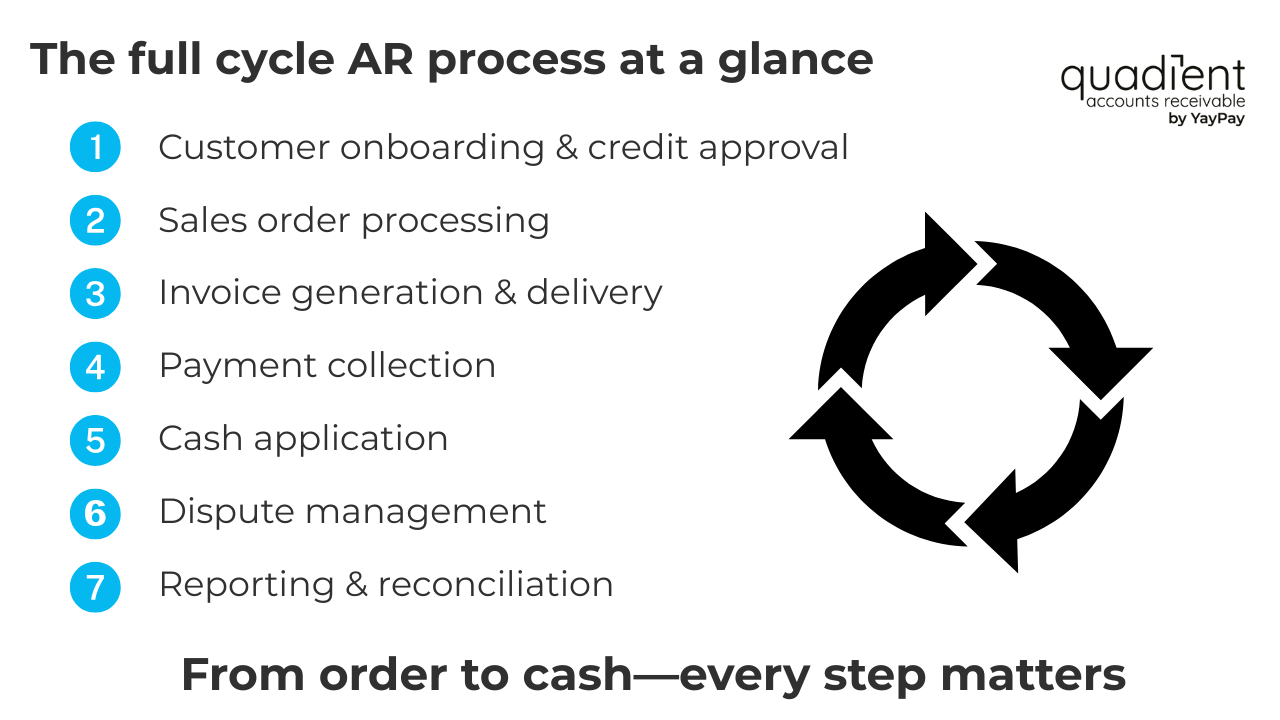

Components of the full cycle AR process

Managing accounts receivable means handling every stage of the cycle, from onboarding customers to closing the books.

Here's what the full process looks like.

1. Customer onboarding and credit approval

Set up customer profiles, evaluate credit risk, and agree on payment terms. This builds a risk-managed foundation.

2. Sales order processing

Ensure orders are accurate and passed to finance and fulfillment. Errors at this stage create downstream issues.

3. Invoice generation and delivery

After product or service delivery:

- Invoices are generated based on order and delivery data

- Use of electronic invoices helps reduce delays, ensure delivery, and enable faster processing

- Electronic invoicing platforms automate invoice creation and distribute digital invoices efficiently

Timely and accurate invoices reduce the chance of disputes and late payments.

4. Payment collection

Offer flexible payment methods (ACH, credit card, wire, cheques), monitor due dates, and enforce payment terms.

Automated invoice reminders help ensure customers stay on track, improving collection rates and reducing days sales outstanding (DSO).

5. Cash application

Match payments to the correct invoices, handle credits or overpayments, and update financial records.

Manual cash application can introduce delays. Automation speeds this up and improves accuracy.

6. Dispute management

Invoice disputes are common when customers spot errors or inconsistencies. When this happens:

- AR teams must investigate and resolve the issue quickly

- Communication between AR, sales, and customers is critical

Automating parts of the invoice management process can streamline dispute tracking and reduce resolution times.

7. Reporting and reconciliation

Review aging reports, reconcile AR with the general ledger, and forecast cash inflows based on open receivables.

Real-time data supports better decisions and fewer financial surprises.

Challenges in the AR cycle process

The accounts receivable process often runs into trouble when it's managed manually. Data entry by hand is time-consuming and prone to mistakes, which can lead to incorrect invoices, missed payments, and reporting errors. Many teams still rely on spreadsheets or email to track AR activity, but these tools don’t offer the visibility or speed needed to manage receivables efficiently.

Disconnected systems make matters worse. When AR platforms, CRM systems, and ERP tools don’t sync, data gaps and blind spots emerge. This makes it harder to track payment status, follow up on overdue invoices, or resolve issues quickly. Poor communication between AR, sales, and customer support teams adds another layer of friction, especially when customer account details aren't shared across departments.

Manual invoicing processes also carry a higher risk of fraud. Without proper controls in place, businesses may struggle to catch duplicate payments, unauthorised changes, or fake invoices. Automated platforms offer stronger protection through role-based access, audit trails, and built-in verification checks.

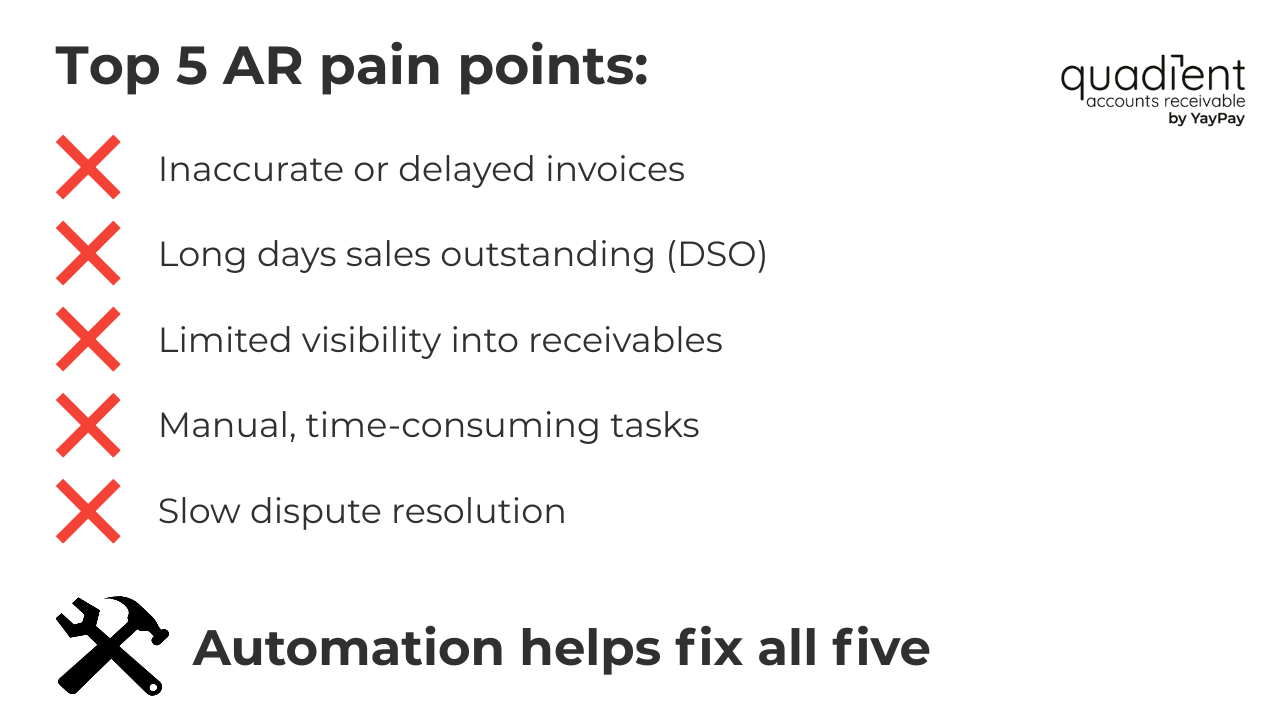

Common AR pain points include:

- Inaccurate or delayed invoicing that leads to payment delays

- Limited visibility into receivables, making it difficult to prioritise follow-ups

- Long DSO, which ties up working capital

- Slow dispute resolution, especially without centralised communication tools

- Resource-intensive processes that waste staff time on repetitive tasks

These challenges hurt cash flow, delay decision-making, and make it harder to scale finance operations as a business grows. Automation can help address these pain points by streamlining the process and providing real-time visibility.

How AR automation enhances the full cycle AR process

Modern AR automation software eliminates manual bottlenecks and increases visibility.

Benefits of automation:

- Automated invoice generation with fewer errors

- Centralised invoice-to-cash software for invoicing, tracking, and reporting

- Real-time dashboards and alerts

- Automated invoice reminders and follow-ups

- Streamlined dispute resolution workflows

- Greater accuracy in cash application

Manual vs automated AR

Feature | Manual AR | Automated AR |

|---|---|---|

Data entry | Manual, error-prone | Minimal, integrated |

Invoice creation | Manual | Automated and scheduled |

Payment matching | Manual reconciliation | Auto-application of payments |

Dispute handling | Email-based and slow | Workflow-driven and trackable |

Reporting | Static, outdated | Real-time dashboards and insights |

Fraud risk | Higher | Lower with controls and audit trails |

Quadient AR Automation supports the full cycle of accounts receivable, from invoice generation to reporting. It helps businesses streamline operations and reduce DSO by automating key tasks such as:

- Sending electronic invoices and automated payment reminders

- Tracking incoming payments across methods

- Managing invoice disputes and customer follow-ups

- Generating real-time AR dashboards and forecasts

What sets Quadient apart is how these capabilities translate into real-world impact.

Real results from leading organisations:

Jumio, a digital identity verification provider, reduced its days sales outstanding by 24 days—a 29% improvement—after adopting Quadient AR Automation. The team eliminated most manual outreach and empowered customers with self-service access to real-time account data. This improved both collection speed and customer experience.

CPL, a STEM staffing firm, increased its cash collection by 3.8% during the pandemic using Quadient’s invoice-to-cash software. With enhanced AR dashboards, customer portals, and automated communications, CPL shortened dispute cycles and improved collaboration across departments.

These are just two examples of how Quadient AR Automation turns a reactive AR process into a strategic business advantage. From invoice creation to reconciliation, it delivers speed, accuracy, and control at every stage of the cycle.

Explore how Quadient AR Automation can help your team work smarter, reduce DSO, and improve financial health: https://www.quadient.com/en-gb/ar-automation

Best practices to optimise the accounts receivable process

Whether you’re just tightening up your workflow or investing in automation, these practices can help:

- Establish clear credit policies and stick to them

- Use standardised invoice formats

- Adopt electronic invoicing wherever possible

- Offer flexible payment options

- Automate invoice creation and reminders

- Review AR aging reports regularly

- Train staff on fast, effective dispute resolution

- Use secure, centralised invoice management tools to reduce fraud

Conclusion

The accounts receivable process cycle is more than back-office busywork. It’s a core driver of business performance and financial health. When this process works smoothly, businesses get paid faster, reduce overhead, and make better financial decisions.

By understanding each stage of the accounts receivable process and using tools like Quadient AR Automation to reduce friction, businesses can transform AR from a reactive, manual task into a proactive, strategic advantage. From invoice creation to cash collection, automation helps finance teams work faster, smarter, and with greater control.

Learn how Quadient AR Automation can help streamline your full cycle accounts receivable process: https://www.quadient.com/en-gb/ar-automation